Rishi Sunak will deliver his Budget speech to the House of Common on Wednesday October 27.

Stefan Rousseau

Rishi Sunak will deliver his autumn Budget in the House of Commons from 12.30pm tomorrow - here's a look at what we know so far

Don't Miss

Most Read

Rishi Sunak is expected to deliver a jam-packed Budget on October 27, with reports suggesting it could total to around £30bn.

Here's a look at what we know so far and what to expect for the Chancellor.

National living wage boost

The UK's national living wage is set to go up from £8.91 to £9.50 an hour from next April, in a boost to millions of low-paid workers across the country.

For those aged 21 to 22, the minimum wage will rise from £8.36 to £9.18. Transport As part of the government's levelling up agenda, Sunak is set to pump billions into transport and give metro mayors the power, and responsibility, to improve key links.

The Treasury said nearly £7 billion would be given to areas such as Greater Manchester, the West Midlands and South Yorkshire for projects ranging from tram improvements to introducing London-style improvements in infrastructure, fares and services.

Workers at the Cuadrilla fracking site in Preston New Road, Little Plumpton, Lancashire where operations are expected to start next week.

Danny Lawson

The Treasury has confirmed Greater Manchester will be given £1.07 billion in next week’s Budget and spending review. The announcement is also being touted as a vote of confidence in the devolution agenda as all those awarded cash are areas with metro mayors.

Elsewhere, there will be £830 million given to West Yorkshire, £570 million in South Yorkshire, £1.05 billion in the West Midlands, £310 million in Tees Valley, £540 million in the West of England and £710 million for the Liverpool City Region.

Public sector pay rise

More than five million public sector workers are set for a rise, with the Chancellor set to scrap their year-long pay freeze. According to the latest available data from the Office for National Statistics, there were 5.68 million public sector workers registered June.

The Chancellor last November “paused” public sector pay increases for 2021/22, with the exception of the NHS and those earning less than £24,000, after heavy borrowing during the Covid-19 crisis.

But Mr Sunak on Monday said that, with the economy bouncing back following the lifting of virus restrictions, it was “right” that frontline workers would “see their wages rise”.

But critics questioned how much better off workers will be considering the Chancellor has already hiked National Insurance and cut Universal Credit as inflation rises, with the consumer price inflation rate currently standing at 3.1%.

Mr Sunak increased National Insurance Contributions for workers by 1.25% to help pay for the NHS and social care, while he ended the £20-a-week Universal Credit coronavirus uplift earlier this month.

Health workers in the accident and emergency (A&E) department at Whiston Hospital in Merseyside as they continue deal with the increasing number of coronavirus patients.

Peter Byrne

Funding boost for the NHS

A huge £6bn is being committed to clear the NHS backlog and help get the health service back on track.

Mr Sunak is expected to set out investment in NHS capital funding that will support the aim to deliver around 30% more elective activity by 2024-25 compared to pre-pandemic levels. This is equivalent to millions more checks, scans and procedures for non-emergency patients, the Treasury said.

In an effort to address the Covid backlog of people waiting for checks, tests and scans, and help get waiting lists down, £2.3 billion of the funding package will be used to try to transform diagnostic services.

While £2.1 billion of the £5.9 billion total will be invested in technology and data in a bid to improve efficiency and security within the NHS.

What about Wales?

Wales is expected to receive a new £130m fund to help small and medium sized businesses.

The Chancellor is expected to announce the fund to deliver loans through the British Business Bank to help firms invest and grow.

And Scotland?

Details of a new £150 million fund aimed at helping smaller businesses in Scotland will be revealed by Rishi Sunak in his Budget this week.

The fund, to be delivered through the British Business Bank, will be similar to existing schemes in England and Northern Ireland, which have provided investment and loans for small and medium-sized enterprises (SMEs). Details on how businesses in Scotland can access the fund will be outlined in due course.

A ‘skills revolution’

A cash injection of £3 billion will be given to both post-16 education but also to adults later in life. Mr Sunak will announce the number of skills boot camps in areas such as artificial intelligence, cybersecurity and nuclear will be quadrupled.

Some £1.6 billion will provide up to 100,000 16 to 19-year-olds studying for T-levels – technical-based qualifications – with additional classroom hours, while 24,000 traineeships will also be created. – Tripling of funding for special educational needs and disabilities New school places for children with disabilities and special educational needs will be created with a £2.6 billion pot.

Mr Sunak is expected to almost triple the amount of this year’s capital funding for the most disadvantaged young people through specialised educational support, with up to 30,000 new spots made available.

Housing

The Treasury said a £1.8 billion package of investment would help regenerate land and level up the country.

Mr Sunak will allocate £65 million to ramp up England’s planning system, including digitisation that will make local plans easier to access and £9 million to help local authorities create 100 new urban “pocket parks” across UK.

Houses under construction on a housing development in Basingstoke, Hampshire. PA Photo. Picture date: Tuesday January 7, 2020. Photo credit should read: Andrew Matthews/PA Wire

Andrew Matthews

Global Britain Investment Fund

The £1.4 billion fund will funnel money into key innovative sectors by handing out grants to encourage internationally mobile companies to invest in the UK’s critical industries, including life sciences and automotive.

The fund includes £354 million to support investment in life sciences manufacturing, increasing resilience for future pandemics, and more than £800 million investment in the production and supply chain of electric vehicles, including in the North East and Midlands.

A new talent network to attract high-skilled workers to the UK will also be set up in innovation hotspots, first in the Bay Area of San Francisco and Boston in the US in 2022, and also Bengaluru in India.

Boost for museums and galleries

Over three years, £850 million will “breathe life” back into cultural hotspots. The money will be used to restore and upgrade some of the country’s most popular institutions such as London’s V&A museum, Tate Liverpool and the Imperial War Museum in Duxford. A total of £125 million will go towards helping build a state-of-the-art scientific research centre in Oxfordshire, part of the Natural History Museum. In addition, more than £75 million will be spent to help 110 regional museums and libraries improve their buildings and level up their digital facilities, the Treasury said.

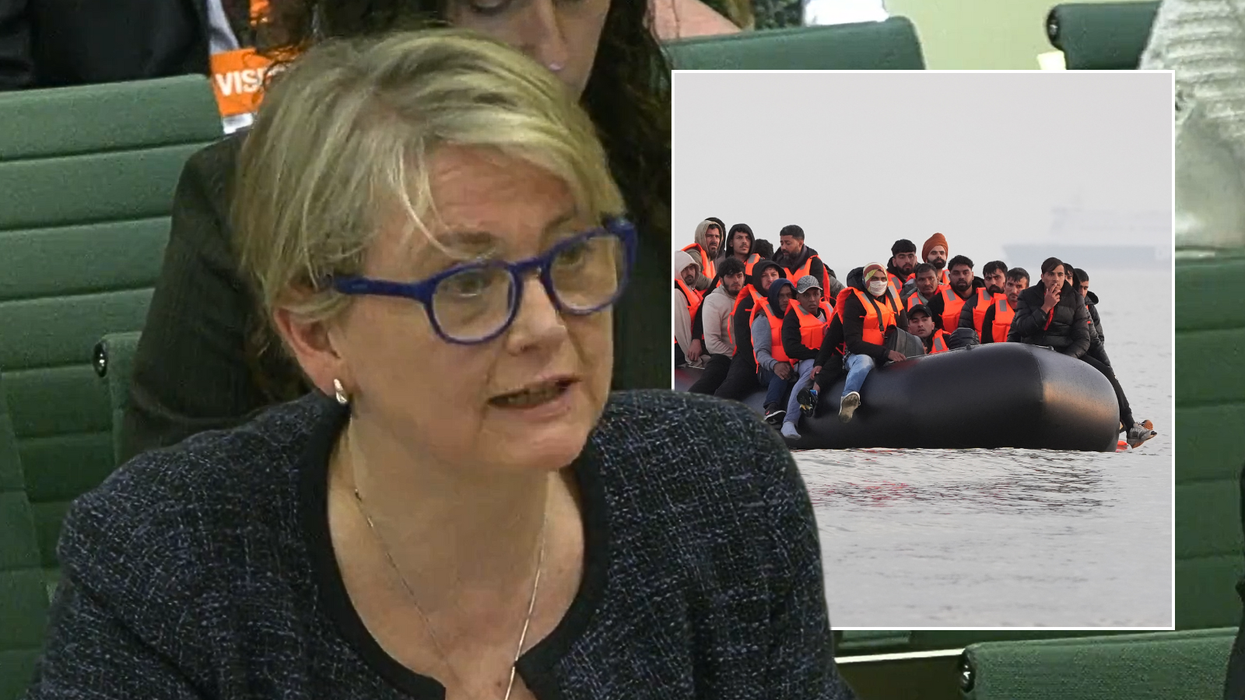

Protection at the border

Ageing Border Force vessels will be replaced by new cutters as part of a £700 million investment to improve the safety of Britain’s borders. The current fleet, which is 20 years old, will be retired and 11 new vessels will come into service to help tackle organised crime and illegal migration at a cost of £74 million.

The announcement also includes £628 million “to modernise and digitalise the border”, with proposals including a US-style Electronic Travel Authorisation for tourists wishing to come to the UK.

A group of people thought to be migrants are brought in to Ramsgate, Kent, by Border Force officers, following a small boat incident in the Channel. Picture date: Sunday September 26, 2021.

Gareth Fuller

Investing in the next sports stars

Football pitches, tennis courts and youth facilities will see £700 million of funding to help foster the next generation of young talent.

Maths coaching

Up to 500,000 adults will be able to access a £560 million scheme to improve their maths skills, as it was revealed more than eight million people in England have numeracy skills lower than those expected of a nine-year-old, with the North East, West Midlands and Yorkshire and the Humber worst affected.

Mr Sunak will say that through the Multiply programme, people can access free personal tutoring, digital training and flexible courses.

Post-Brexit tax rule changes

Tax changes will be introduced to try to tempt more of the world’s largest shipping companies to UK shores.

Ships that fly the Union Jack and those which help the UK reach net zero will both be more likely to be accepted if applying to the UK’s tonnage tax regime. Mr Sunak will deliver his Budget and spending review to the Commons on Wednesday.