HMRC launches new road charges for petrol, diesel and electric car drivers today - are you impacted?

Advisory fuel rates will change twice more this year

Don't Miss

Most Read

Petrol, diesel and electric vehicle drivers are being warned of new changes being introduced today, in a move that could alter how much they pay to stay on the road.

HM Revenue and Customs changes advisory fuel rates (AFRs) four times per year, which impacts how company car users pay to drive.

The rates apply to employees being reimbursed for business travel in their company cars, or if employees need to repay the cost of fuel used for private travel.

If the mileage rate is not higher than the AFR for the engine size and fuel type of their company car, there will be no taxable profit.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The new HMRC advisory fuel rates will be introduced today

|GETTY

They will also avoid the need to pay Class 1A National Insurance when operating their company car.

The latest AFR update from the HMRC, which is being introduced today, will see owners of petrol cars benefit, with prices dropping per mile.

Drivers using company cars powered by electric or Liquefied Petroleum Gas will remain on the standard rates they were on previously.

To help drivers adjust to the new HMRC changes, GB News has rounded up the latest advisory fuel rates being introduced today.

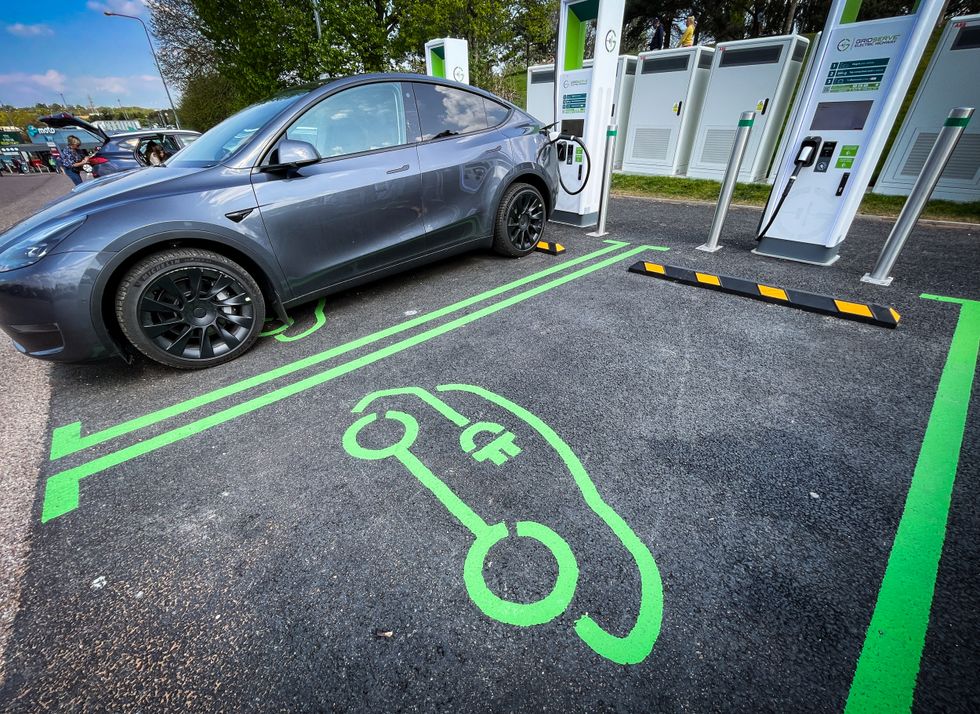

Many drivers are now opting for electric vehicles as their company cars

| GETTYAdvisory fuel rates from June 1, 2025

Petrol

Engines up to 1,400cc - Remains at 12p

Between 1,401cc and 2,000cc - Reduced to 14p

Over 2,000cc - Reduced to 22p

Diesel

Engines up to 1,600cc - Reduced to 11p

Between 1,601cc and 2,000cc - Remains at 13p

Over 2,000cc - Remains at 17p

Liquefied Petroleum Gas (LPG)

Engines up to 1,400cc - Remains at 11p

Between 1,401cc and 2,000cc - Remains at 13p

Over 2,000cc - Remains at 21p

Electric

All electric vehicles - Remains at 7p

LATEST DEVELOPMENTS:

While there are fewer LPG vehicles on UK roads, the MPG used to calculate the rate is 20 per cent lower than for petrol, due to its lower volumetric energy density.

Petrol and diesel rates are calculated by taking forecourt prices from the Department for Energy Security and Net Zero (DESNZ).

EV rates are calculated using price data from DESNZ, the Office for National Statistics (ONS), consumption rates from the Department for Transport (DfT) and annual car sales volumes to businesses.

Advisory fuel rates will be updated again on September 1, before the final review this year on December 1. In 2026, changes will be made again on March 1 and June 1.