Millions of pensioners to lose £300 energy bill support - how to protect your Winter Fuel Payment

New Winter Fuel Payment rules are coming into effect

|GETTY

Pensioners will now need to be on means-tested benefits to claim the Winter Fuel Payment but what benefits does this include?

Don't Miss

Most Read

Latest

Some 10 million pensioners are expected to lose access to the Winter Fuel Payments after the news it will be means-tested going forward.

Chancellor Rachel Reeves confirmed that the energy bill support will be reserved for those on benefits, such as Pension Credit.

What is the Winter Fuel Payment?

Currently, Britons born before September 22, 1958, are eligible to get help with their energy bills during the winter months.

As it stands, the Winter Fuel Payment is worth between £100 and £300, and was delivered to 11.3 million people in the 2022-23 tax year.

How much someone gets from the payment is dependent on their age and their individual circumstances.

Households where the claimants are under 80 will claim £200 in Winter Fuel Payment, while those over 80 will get a hiked sum of £300 which should be paid automatically.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

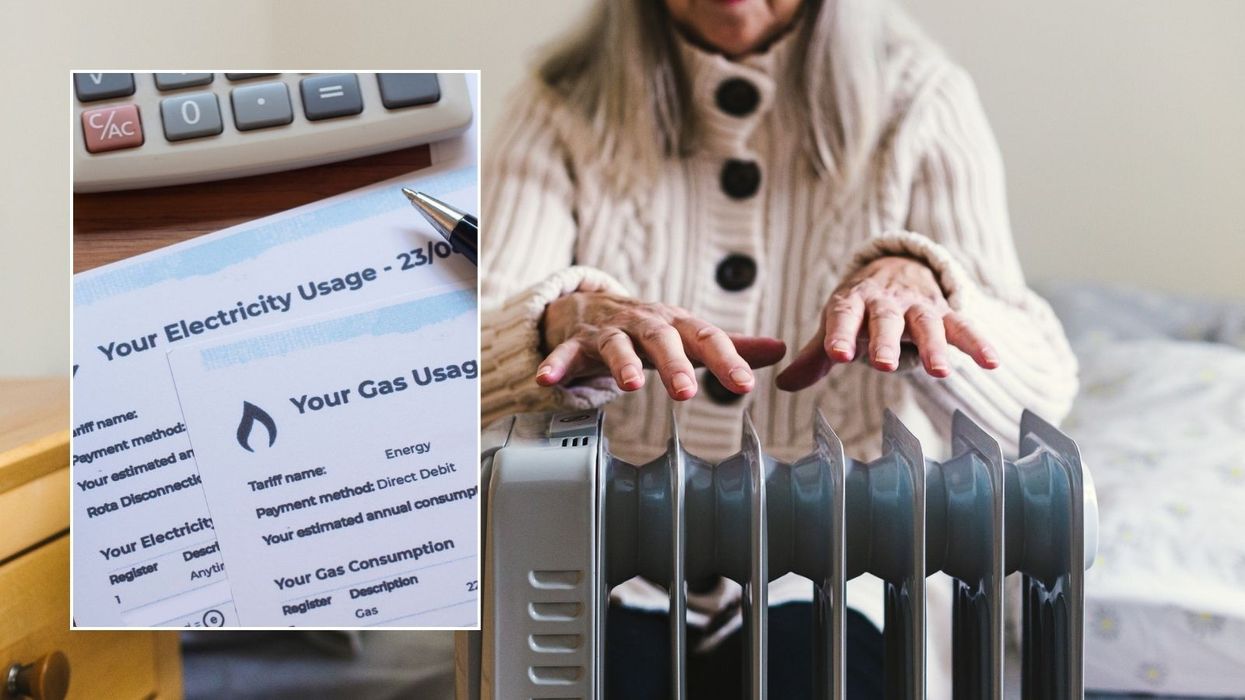

The cost of living crisis has pushed energy bills to new heights in recent years | GETTY

The cost of living crisis has pushed energy bills to new heights in recent years | GETTY Who will be eligible for the Winter Fuel Payment?

From this year, those living in England or Wales will face stricter eligibility criteria in order to claim the energy bill assistance.

Those who are not receiving Pension Credit or other means-tested DWP benefits will no longer receive the Winter Fuel Payment.

To be entitled to this support, Britons will need to be on state pension age and be on one of the following benefits:

- Pension Credit

- Income support

- Income-based jobseeker's allowance,

- Income-related employment and support allowance

- Universal Credit.

To get Pension Credit, pensioners need to be on low incomes with around 1.4 million people being in receipt of it as of August 2023.

How to protect your Winter Fuel Payment?

Anyone already claiming Pension Credit will automatically get Winter Fuel Payments sent to them every month, however, those not receiving this DWP support will need to apply. This also applies if someone has deferred their state pension since their last Winter Fuel Payment.

According to the charity Independent Age, around one in three pensioners do not receive energy bill support despite otherwise being entitled to it. This is the equivalent of 880,000 people.

Under new criteria outlined by Reeves, those over the state pension age who claim Housing Benefit will be able to get the support as they will be entitled to Pension Credit.

Through the means-tested pensioner benefit, households Pension get a top-up to their weekly income of up to £218.15 if they are single, or a joint weekly income of £332.95 if they have a partner.

To get Pension Credit, someone's income has to be under the DWP's thresholds. Determining a claimant's weekly income, the Government takes into account the state pension, pensions, earnings from employment and self-employed income.

Britons should be aware that savings is included in their income. If a claimant has more than £10,000 every £500 is counted as £1 of income a week.

LATEST DEVELOPMENTS:

The Winter Fuel Payment will be worth between £250 and £600 this year | PA

The Winter Fuel Payment will be worth between £250 and £600 this year | PAPensioners can start their application for Pension Credit at any time after they hit the state pension age, which is currently 66, with applications being backdated by three months.

This can be completed by visiting the Government's website or calling the Pension Credit claim line on 0800 99 1234.

During the application process, people will need to share their National Insurance number, as well as their partner's number.

Furthermore, they will need to divulge any information about income and pension details, including savings and investments.