‘I’m preparing for my state pension age to rise to 70 - anything younger will be a bonus’

The mum of three currently doesn’t earn enough to be auto enrolled into her workplace pension

|PENSIONBEE

The full new state pension is below the amount needed for a “minimum” standard of living in retirement, analysis shows

Don't Miss

Most Read

Latest

With state pension age rises on the horizon, many Britons are worried they will be left working for years longer than expected before they can afford to retire.

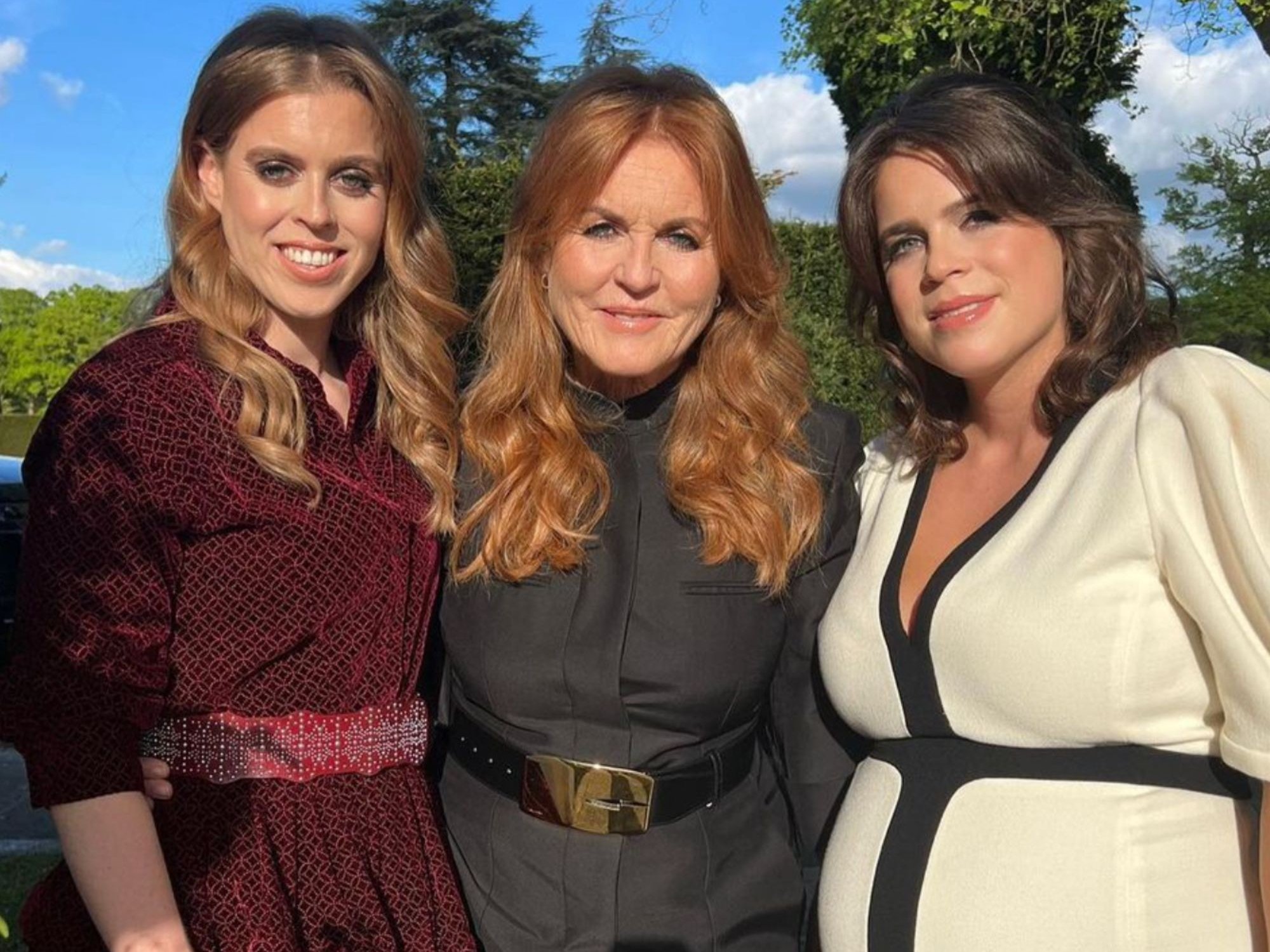

Mum-of-three Joanna Tinker, 42, is taking action now in case she is affected by state pension age changes in the future.

She currently doesn’t earn enough to be auto-enrolled into her workplace pension, so the state pension will boost her retirement income.

Ms Tinker, from Somerset, told GB News: “We know lots of people, women especially, have been left stranded by the rise, and we didn't want to be caught unaware.”

The UK pension age is currently 66, but it is set to rise to 67 between May 2026 and March 2028. From 2044, it is expected to rise to 68.

However, research into the impact of growing life expectancy and falling birthrates on the state pension suggests that anyone born after April 1970 may have to work until they are 71 before claiming their pension.

The UK pension age is currently 66, but it is set to rise to 67 between May 2026 and March 2028

|GETTY

Ms Tinker is hoping the state pension age won’t rise again, but is preparing her finances in case it does.

Currently her state pension age is 68, however she is trying to budget for retirement at 70 just in case things change.

She said: “Once it started to rise a few years ago, my husband and I had a conversation and said we ought to expect it may rise to 70 by the time we get there and try to plan for that to be the case.

“If we expect 70, then anything younger will be a bonus. Our PensionBee forecasts are therefore set to us retiring at 70.”

In order to prepare for her retirement age, Ms Tinker explained she can’t rely on a workplace pension scheme.

Working as a part-time administrator means she does not earn enough to be opted in, so she makes it a priority to make her own contributions as and when she can.

She says online pension provider PensionBee has been “invaluable”. She added: “I've been able to transfer in my various pension pots and consolidate it all into a figure that I can build with little contributions when I get paid from a project.”

From April 6, 2024, the full weekly state pension entitlement will increase by 8.5 per cent in line with earnings growth under the ‘triple lock’ commitment.

Taking into effect payments starting on Monday April 8, the new full state pension will rise by £905.30 a year to £11,542, with payments of £221.20 a week.

A basic state pension recipient who gets the full rates will receive an annual amount of £8,844, or £169.50 a week.

When Ms Tinker plans her retirement, she factors in the state pension as a means to pay for her lifestyle.

She said: “Although [the state pension] it isn't a huge amount, it will be crucial to our retirement income.

“We've been married 20 years and always just got by on a low income because of my husband's work and me taking time off to look after the children.

“I've also got a long-term health condition which means I can't work more than a few hours per week.

LATEST DEVELOPMENTS:

“The state pension amount is factored into our projections on PensionBee and we're planning/hoping with that in mind.”

Becky O’Connor, Director of Public Affairs at PensionBee, commented: “The 8.5 per cent state pension rise this week will come as a huge relief to the millions of retiree’s dependent on it to support them in retirement.

“While lower than last year’s increase, which saw the state pension increase by 10.1 per cent in line with inflation, many pensioners receiving a full state pension will now only require a small amount of extra income - from a personal or workplace pension, or from part-time earnings being dragged into the tax net.”