State pension means-testing would 'dramatically alter' retirement savings in Britain, economists warn

Rachel Reeves tells Christopher Hope whether she will apologise to pensioners after humiliating winter fuel U-turn |

GB NEWS

All Britons are entitled to the state pension once they reach the official retirement age

Don't Miss

Most Read

Means-testing state pension payments would "dramatically alter" saving for retirement in Britain, according to a report from the Institute of Fiscal Studies (IFS).

Economists from the think tank outlined the "challenges and trade-off" that come with public sector pension reform in a recent journal article in the Oxford Review of Economic Policy.

Jonathan Cribb, Carl Emmerson and Heidi Karjalainen warned that such a policy "would dramatically alter people's saving incentives during working life".

They explained that means-testing would effectively tax private pension income by reducing state pension entitlements for those with higher retirement savings.

Economists are breaking down the "challenges and pitfalls" of state pension means-testing

|GETTY

"Means-testing of the state pension would likely reduce the number of people participating in and the amounts saved into private pension schemes," the IFS economists wrote.

The experts also noted it "would make automatic enrolment into workplace pensions a harder policy to justify", as some savers could end up worse off.

Labour has firmly ruled out introducing means-testing for the state pension, with Pensions Minister Torsten Bell telling MPs the government is "not interested" in such reforms.

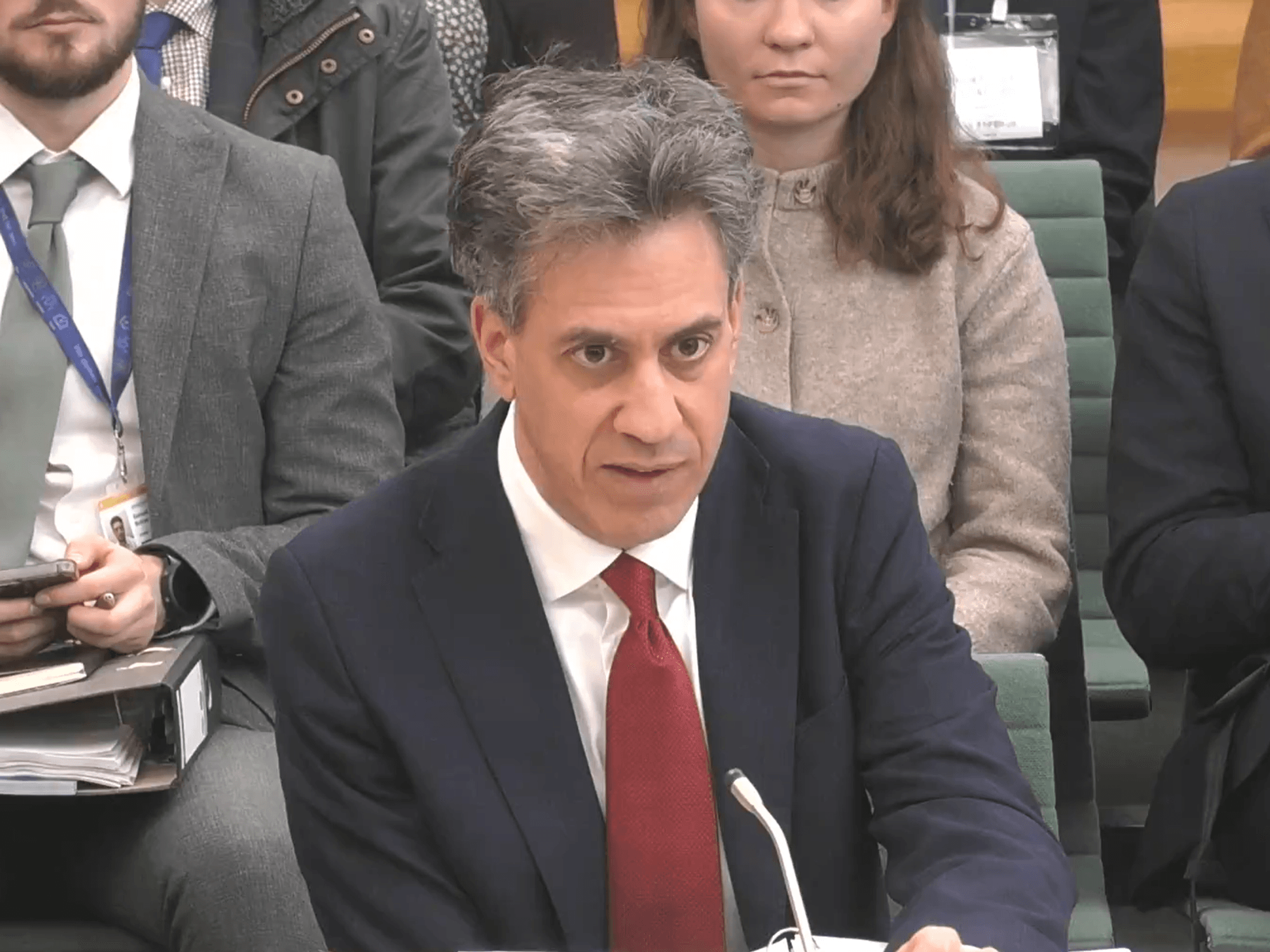

Speaking before the Work and Pensions Committee on June 4, Bell addressed calls from some quarters to restrict pension payments based on recipients' wealth or income.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The state pension triple lock will remain in place throughout Parliament, a senior minister has confirmed | GETTY

The state pension triple lock will remain in place throughout Parliament, a senior minister has confirmed | GETTY "I know some people call for means testing of the state pension. I believe the Opposition accidentally did a few months back. I do occasionally hear those calls," Bell told the committee.

He emphasised that whilst "some other countries do have more of that", the UK would not be following suit.

The current system bases state pension payments on National Insurance contributions, with recipients typically needing 35 years of full contributions to receive the full new state pension of £230.25 per week.

Bell appeared before the committee to discuss pension policy, where he defended the existing contribution-based approach. "The consensus is that a higher, less unequal new state pension is the right approach to be taking," he stated.

The basic state pension for those on the older system pays £176.45 weekly at the full rate, requiring 30 years of contributions, though some receive additional payments beyond this amount.

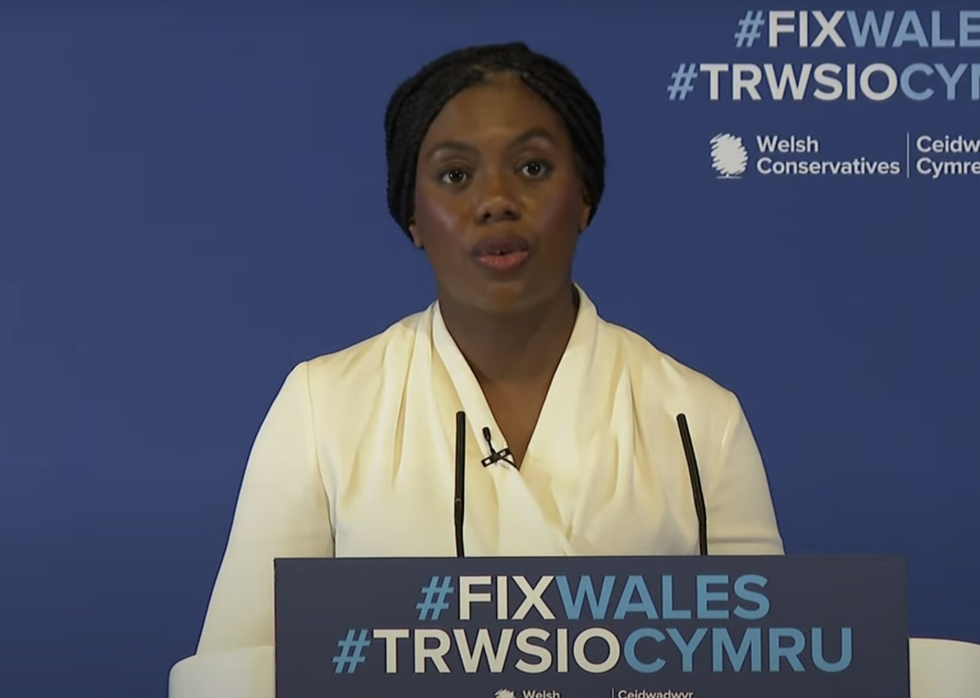

Bell's remarks came in response to Conservative leader Kemi Badenoch's comments earlier this year.

LATEST DEVELOPMENTS:

Kemi Badenoch has hinted means-testing could be on the agenda

| PAIn January, during an LBC radio call-in, Badenoch said "we are going to look at means-testing" when questioned about the triple lock mechanism that determines annual state pension increases.

The minister noted that other nations have adopted different approaches.

"Some other countries do have more of that. They have less focus on the baseline state pension and more means testing," Bell explained to MPs.

He cited Australia as "the classic example" of a country with greater means-testing, but reiterated that Britain would maintain its current system.

More From GB News