Savers urged to grab 'inflation-busting' high interest accounts as Britons losing £641 to low rates

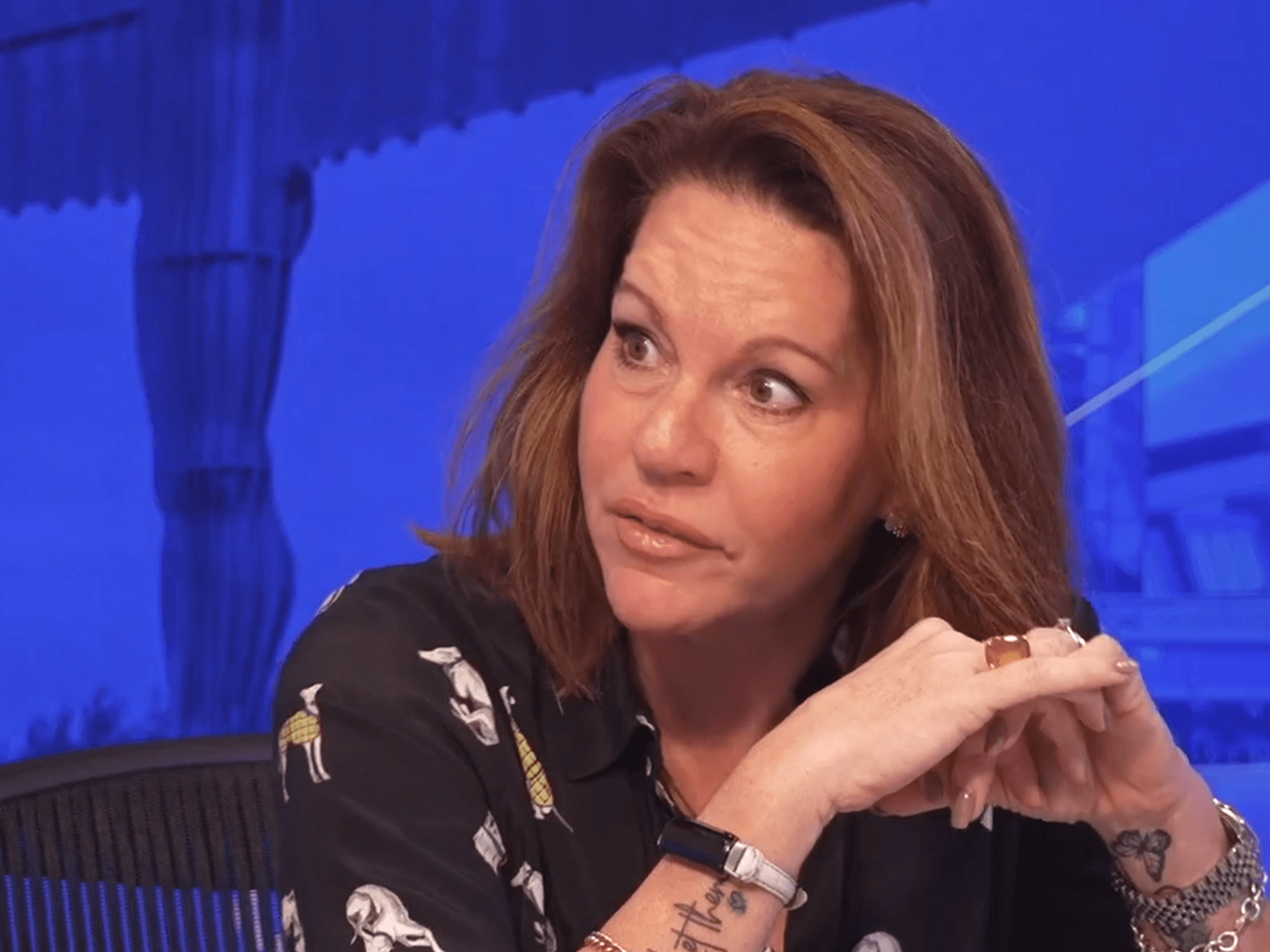

Savers are not taking advantage of high interest accounts

|GETTY

Savings interest rates have been at a historic high but some people are not taking advantage of it

Don't Miss

Most Read

Latest

Savers are missing out on up to £641 in extra interest by not taking advantage of "inflation-busting" accounts with high interest rates, according to new research.

Analysis carried out by TotallyMoney is shining a light on the savings millions of Britons are missing out and are calling out the worst performing accounts from high street banks and building societies.

If someone were to deposit the average savings balance of £17,365 in the market-leading easy-access savings account with a 4.96 per cent rate, they would earn £861 per year in interest.

In comparison, if they placed this money in a low-interest account offering 1.27 per cent, they would get just £220 which is a difference of £641.

With the Consumer Price Index (CPI) rate of inflation for the 12 months to April 2024 easing to 2.3 per cent, savers on a lower interest rate are at risk of losing a lot of money.

As it stands, the 20 worst easy savings accounts are providing an average rate of just 1.27 per cent, which is considerably lower than the Bank of England’s 5.25 per cent base rate.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England has raised interest rates to 5.25 per cent

| PAHere is a full list of the worst savings accounts currently being offered by banks and building societies, according to TotallyMoney research conducted by Moneycomms.co.uk:

- TSB - Easy Savings - 1.60 per cent

- Melton Building Society - Easy save - 1.51 per cent

- Halifax - Everyday Saver - 1.50 per cent

- Bank of Scotland - Access saver - 1.50 per cent

- Paragon Bank - Triple Access (14) - 1.50 per cent

- Paragon Bank - Double Access (8) - 1.50 per cent

- Aldermore - Double Access - 1.50 per cent

- Lloyds Bank - Easy Saver - 1.45 per cent

- Halifax - Reward Saver - 1.35 per cent

- Halifax - Bonus Saver -1.35 per cent

- Co-Op Bank - Select Access - 1.31 per cent

- Sainsbury's Bank - Extra Saver - 1.30 - per cent

- Sainsbury's Bank - Defined Access Saver - 1.30 per cent

- Santander - Limited Access - 1.20 per cent

- Barclays - Everyday Saver - 1.16 per cent

- Bank of Scotland - Advantage Saver - 1.05 per cent

- Union Bank of India - Savings A/C - one per cent

- NS&I - Investment Account - one per cent

- Punjab National Bank - Savings A/C - 0.75 per cent

- TSB - Save Well - 0.50 per cent.

Alastair Douglas, the CEO of TotallyMoney, is calling on savers to ditch their low-interest accounts and swap to a greater rate.

He explained: “The average saver could be missing out on more than £600 per year — which is a considerable amount, given how much the cost of living has increased. The extra income could be used to cover bills and expenses, left in savings so it continues to grow, or be put towards a special purchase.

“Double check your rate and make sure your money’s working for you. Loyalty doesn’t pay, and if your bank isn't paying you, then they’re making money from you.

“Don’t be worried about moving your balance to a smaller bank either, as long as they’re registered with the Financial Services Compensation Scheme, £85,000 of your money should be covered.

“If you’re struggling to save, then consider downloading a personal finance app which can let you connect an account via open banking.

“It should give you better insights into your finances, so you can avoid missing payments, dipping into your overdraft, or impacting your credit score. That way you can cut back on costly mistakes, and start moving forward.”

LATEST DEVELOPMENTS:

Savers are losing money to low interest accounts

| GETTYAndrew Hagger, a personal finance expert, at Moneycomms.co.uk, reminded Britons how easy getting a new savings account is at the moment.

Hagger said: “Opening a new savings rate is simple these days, so there's no excuse to leave your savings pot with a provider paying a substandard return.

“Go online and check your current interest rate on your savings, you may be in for a shock, just because your chosen account was a best buy at the time, it doesn't mean it is still a good deal now.

“The last couple of years have been much better for those lucky enough to have a decent savings balance - make the most of it and don't be afraid to move providers to secure a good rate on your cash.”GB News has contacted TSB, NS&I and Punjab National Bank for comment.