Recession odds rise as Donald Trump slammed over 'devastating' impact of tariffs on US economy

The US economy's GDP slipped by 0.3 per cent in the first quarter of 2025, signalling a recession could be on the horizon

Don't Miss

Most Read

The US economy unexpectedly contracted by 0.3 percent in the first quarter of 2025, marking the first decline in three years, according to data released today by the Bureau of Economic Analysis (BEA).

Economists had anticipated a growth rate of 0.4 per cent, which would have been the slowest gross domestic growth (gdp) in years.

Instead, the economy slipped into negative territory, weighed down by escalating trade tensions, policy uncertainty, and recession fears.

A recession is defined as happening when a country's economy experiences two consecutive quarters of negative GDP.

The odds of a recession happening have increased following Trump's tariffs, economists have warned

|GETTY

This represents a sharp reversal from the 2.4 percent growth recorded in the final quarter of 2024. The BEA attributed the decrease primarily to an increase in imports and a decrease in government spending.

Markets reacted negatively to the economic contraction, with all major indices trading in the red. The tech-heavy Nasdaq was hardest hit, trading down two percent following the announcement.

S&P 500 and Dow Jones futures also fell as investors processed the unexpected decline. "Imports were an enormous drag on Q1 GDP," said Ryan Sweet, chief US economist at Oxford Economics.

The surge in imports - up 50.9 percent in the quarter - doesn't boost GDP calculations, as Americans rushed to purchase foreign goods ahead of tariff implementation.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

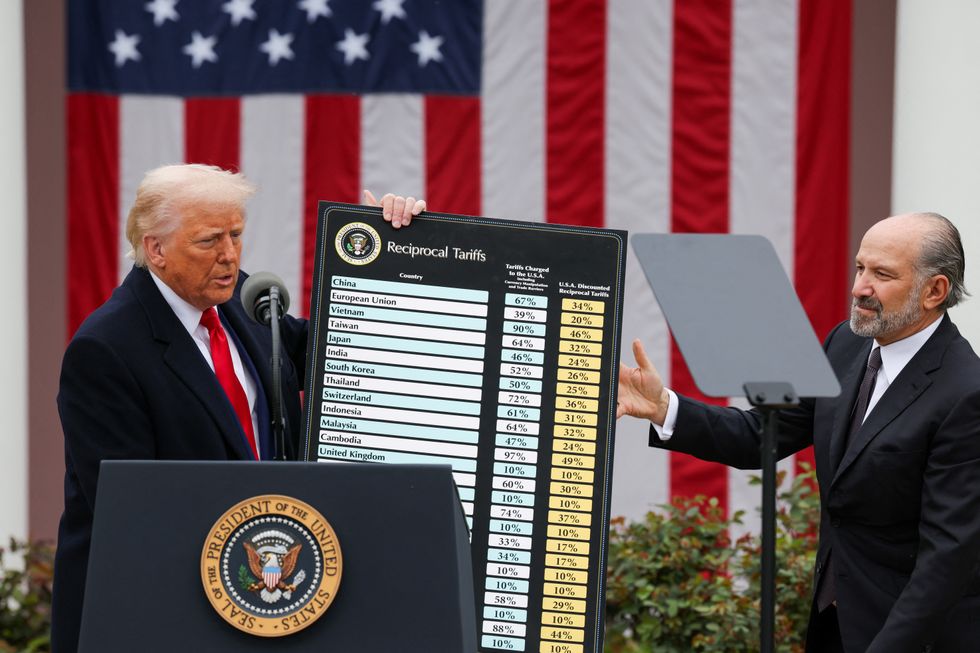

President Donald Trump has shaken global markets with a raft of new tariffs | REUTERS

President Donald Trump has shaken global markets with a raft of new tariffs | REUTERSBusiness investment in equipment jumped 22.5 per cent, suggesting companies were stockpiling ahead of Trump's trade policies.

The GDP contraction doesn't fully reflect the impact of President Trump's sweeping "Liberation Day" tariffs, which were rolled out in early April and partially reversed a week later.

Consumers have been racing to purchase foreign-made goods before the 10 per cent tariffs take effect, flooding car dealerships, tech stores, and furniture retailers.

"GDP is backward-looking but there was some good news as real final sales to private domestic purchasers, the engine of the economy, posted a decent gain," Sweet noted.

Recession fears have intensified following the GDP report, with several financial institutions raising their recession probability forecasts.

JPMorgan Chase recently increased its recession likelihood to 60 per cent, up from previous estimates. Deutsche Bank put the chance of a recession at 43 per cent in March.

LATEST DEVELOPMENTS:

Goldman Sachs has increased its odds of a recession happening

| GETTYSteve Dunne, PhD Researcher at The University of Warwick, offered a stark assessment of the impact Trump's tariffs are having on the world's largest economy.

He shared: "Across the opening 100 days of his second term, Trump has devastated perhaps irreparably economic confidence in the US."

The GDP contraction puts Federal Reserve Chair Jerome Powell in a difficult position as he navigates competing economic pressures.

Powell has been steadily increasing interest rates to combat inflation, aiming to bring price increases down to 2 per cent from the nine percent spike seen in 2022.

President Trump took to Truth Social to distance himself from the economic downturn, placing blame squarely on the previous administration.

"This is Biden's Stock Market, not Trump's," he posted. "I didn't take over until January 20. This will take a while, has nothing to do with tariffs, only that he left us with bad numbers."