Interest rate cut from Bank of England 'nailed in' after inflation drop

Economists believe an interest rate cut is "nailed in"

|PA

Economists are calling for interest rates to be slashed by 0.5 per cent in response to today's inflation figures

Don't Miss

Most Read

Latest

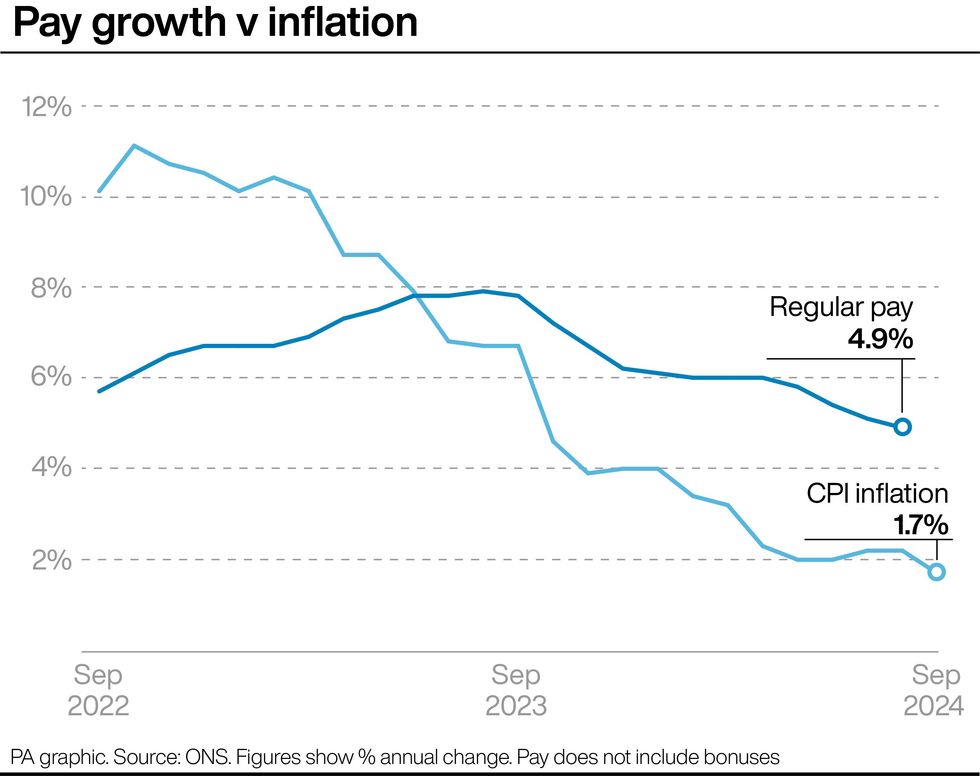

UK inflation has fallen below the Bank of England's two per cent target for the first time since April 2021, sparking expectations of an imminent interest rate cut.

The Office for National Statistics reported that Consumer Prices Index (CPI) inflation dropped to 1.7 per cent in September, down from 2.2 per cent in August.

In recent years, the central bank's Monetary Policy Committee (MPC) voted to raise rates to a 16-year high of 5.25 per cent.

This was in response to the CPI inflation rate skyrocketing during the cost of living crisis, reaching 11.1 per cent in October 2022.

With inflation falling below the Bank's target, another rate cut is expected to take place this year, following August's reduction to five per cent.

Economists have reacted strongly to the inflation data, with many predicting a cut to the base rate is "nailed in".

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Inflation has fallen to 1.7 per cent

|PA

Independent economist Julian Jessop wrote on X: "In my humble opinion, today's UK inflation data may be flattered by swings in transport costs, but they still add to the evidence that interest rates are much higher than they need to be.

"A 0.25 per cent cut is surely nailed on for November. Indeed, I'd vote for 0.50 per cent- especially after a tight Budget."

Thomas Pugh of RSM UK added: "The sharp drop in inflation to just 1.7 per cent, the first sub two per cent reading since April 2021, effectively nails on a 0.25 percentage point rate cut next month."

This sentiment was echoed by Matt Swannell of the EY Item Club, who suggested the data "removes another potential obstacle" to a rate cut in November.

The pound responded to these expectations, dropping 0.7 PER CENT against the US dollar to 1.298, its lowest level in almost two months.

Sanjay Raja, chief UK economist at Deutsche Bank Research, explained: "All told, today's inflation data should be music to the MPC's ears. Inflation momentum is slowing.

"Services prices - once deemed too sticky in the UK - are coming off faster than expected. The case for sequential rate cuts is rising."

Despite the CPI rate dipping below the target, economists expect it to rebound above two per cent in October due to Ofgem's latest energy price cap increase.

LATEST DEVELOPMENTS:

The Bank of England is likely to cut interest rates once again this year | GETTY

The Bank of England is likely to cut interest rates once again this year | GETTY However, the overall trend suggests a gradual easing of interest rates over the coming year, according to analysts.

George Buckley, chief European economist at Nomura, cautioned: "I think the bank will be cautious when it cuts interest rates, so we don't expect them to cut back-to-back.

"We think they'll do it every quarter by just a quarter point every quarter unless of course, we see much weaker economic news."

The Bank of England's MPC will next meet on November 7, 2024.