'Child Benefit stealth tax is unfair and single income families are worst hit. Hunt must change the rules'

Jeremy Hunt will deliver the Spring Budget in the House of Commons tomorrow

|PA | GETTY

Child Benefit tax rules need changing in tomorrow’s Spring Budget, writes Digital Finance Editor Jessica Sheldon

Don't Miss

Most Read

Latest

He’s promised to deliver a “plan for growth” tomorrow, but Jeremy Hunt remains relatively tight-lipped over what we can expect.

National Insurance and income tax rate cuts have been floated, but don’t be fooled into thinking that these announcements will stop your tax burden from increasing over the coming years.

Unless the Chancellor scraps his and Mr Sunak’s income tax threshold freeze, low income earners and pensioners face being dragged into the basic rate tax band over the coming years.

Then there is the Child Benefit tax, which is stinging hundreds of thousands of families amid seemingly never-ending price rises.

There have been problems with the High Income Child Benefit tax Charge since it was introduced by George Osborne in 2013.

For more than a decade, the High Income Child Benefit Charge (HICBC) has clawed back part or all of Child Benefit payments from families where one parent earns more than £50,000.

The threshold means single-income families are particularly punished, as the rules mean dual-income households earning £49,999 each – making a combined income of £99,998 - are unaffected.

Meanwhile, families where one person earns over £50,000 begin to lose Child Benefit through the tax, and the payment will be lost entirely if they earn £60,000.

More and more households have been affected, too, as the Conservatives have failed to increase the tax threshold amid wage growth and inflation, in a tax-raising measure known as fiscal drag.

The £50,000 threshold hasn’t ever been changed, despite estimates by Blick Rothenberg suggesting it would be worth close to £65,000 now if it had risen in line with inflation.

Often dubbed a stealth tax, this form of fiscal drag means the Treasury has boosted its coffers without having to hike the tax rate, and the Chancellor has dodged the headlines to go with it.

Mr Hunt was asked about the unfair Child Benefit tax rules earlier this year during an interview with money saving expert Martin Lewis.

"We look at those thresholds every year in Budgets and we will continue to do that,” the Chancellor replied, conceding there is a “very big distortion” in the marginal rate of tax via the HICBC.

Mr Hunt accepted “there is an unfairness” in how the rules affect families, so will 2024 finally be the year the Government changes the threshold?

The financial broadcaster said it was by far the “biggest single topic” the public asked him to raise, so it will be hard for the Chancellor to ignore.

But even if he does change the threshold, we need action quickly, as the new tax year begins next month.

A tax expert told me yesterday: “I think if he wants to get an easy vote winner that Martin Lewis will make the masses understand for him, he will say something about it.

LATEST DEVELOPMENTS:

WATCH NOW: How Britons are being hit with 'stealth' tax on incomes

“I’m highly confident that anything he says, or a lot of what he says, will never actually come to fruition because this time next year, we could have already had two more Budgets if not more.

“So, he might say, ‘Well, it’s too late for us to do it now for the 2024/25 tax year, but we’ll look at how we’re going to do it in a more fair way to ensure the middle incomes aren’t squeezed starting April 6, 2025 And then it may not be his problem how it’s dealt with.”

I sincerely hope that’s not the case.

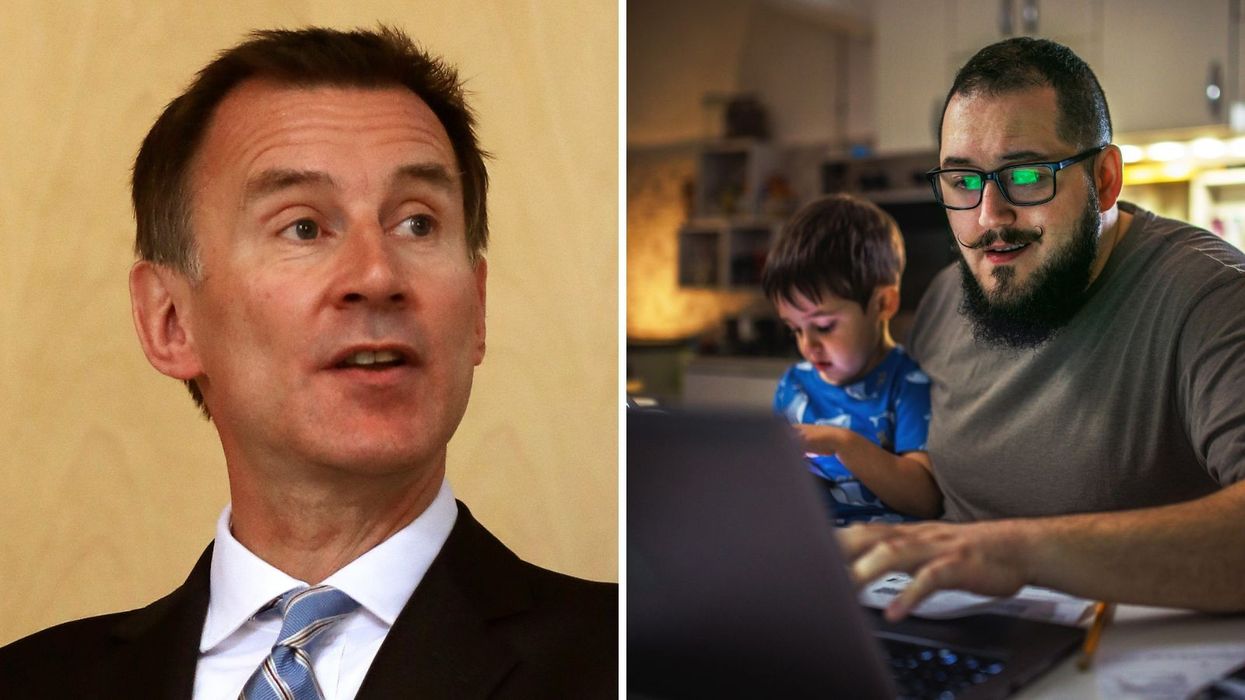

In a letter to Mr Hunt, Mr Lewis highlighted the unfairness of the current rules. A father whose partner tragically died 34 days after giving birth to twins has been left struggling with the cost of living and mortgage repayments after the loss of a second income.

Having taken on a new job which pays £60,000 to provide for his young children, he’s now having to repay Child Benefit, while couples can earn tens of thousands of pounds more without being affected.

This father needs help now.

So come on, Mr Hunt, change these unfair tax rules in tomorrow’s Budget, and make sure it’s implemented in time for the new tax year.