Martin Lewis highlights 'grossly unfair' Child Benefit tax rule that hits more and more families each year

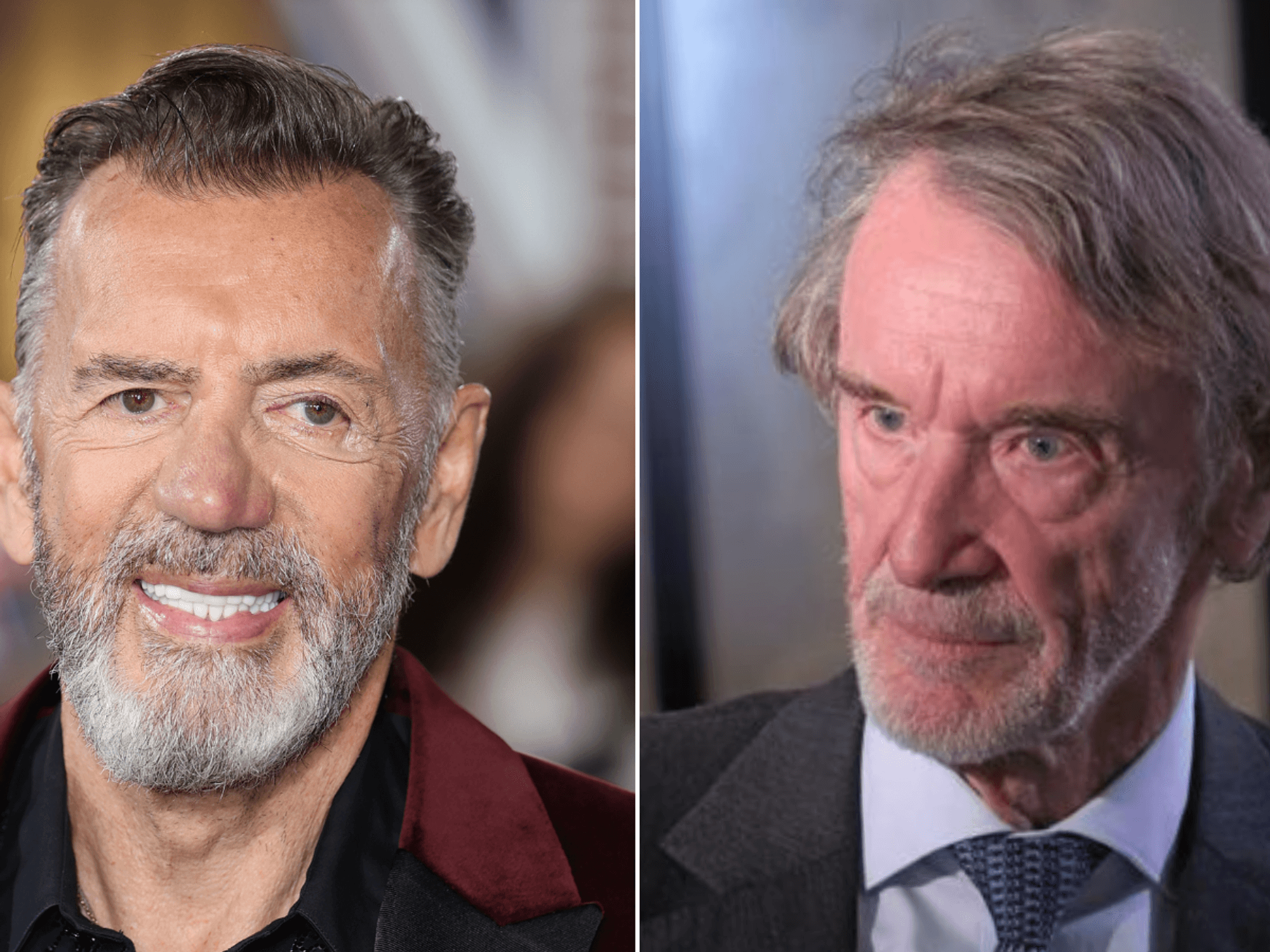

Martin Lewis interviewed Chancellor Jeremy Hunt on Monday

Don't Miss

Most Read

Latest

Chancellor Jeremy Hunt has acknowledged the "unfairness" hitting families who are being taxed on their Child Benefit, while other households with higher incomes are not affected.

In an interview with the Chancellor which aired during The Martin Lewis Money Show Live this evening, money saving expert Martin Lewis explained a lot of households had been in touch about the "grossly unfair" rules for the High Income Child Benefit tax Charge (HICBC).

The broadcaster told the story of a father who was struggling to get by on one income after the loss of his partner.

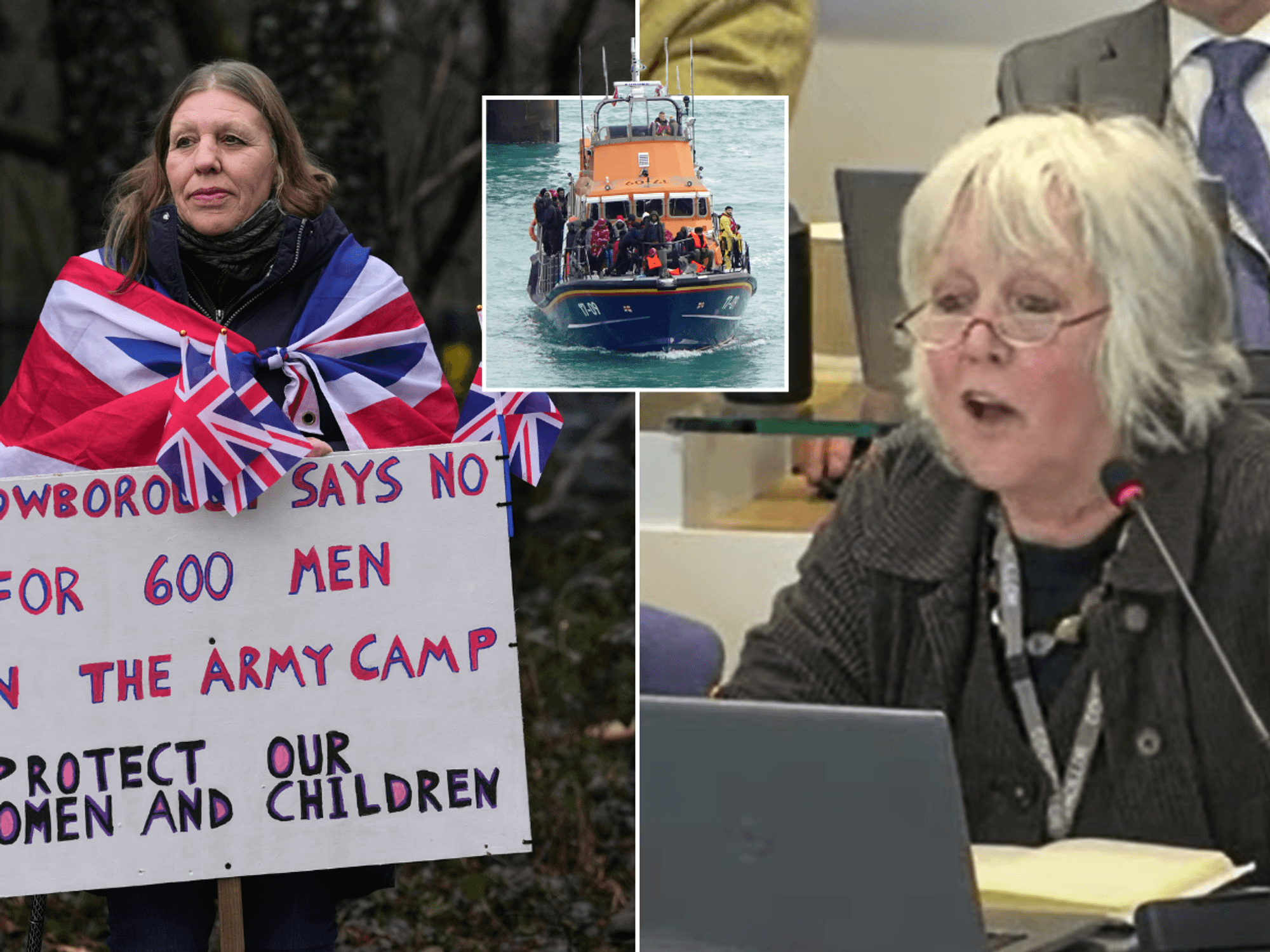

Mr Lewis was reading out a message from a member of the public, which said: "It seems grossly unfair that a couple can bring in nearly £100,000 - because it's about the individual income - but a single breadwinner loses out once they've earned more than half of this."

Martin Lewis asked Jeremy Hunt about topics including Child Benefit, fiscal drag and Carer's Allowance

|PA

Mr Lewis said he was among those who thought it was "the most unfair structure possible" as it hits people who have a single income while couples can "earn so much more" without being affected.

The financial journalist also pointed out that more and more people are being affected as the threshold has been frozen since it was introduced in 2013 by the then-Chancellor George Osborne.

Mr Hunt said: "We look at those thresholds every year in Budgets and we will continue to do that."

The Chancellor conceded there is a "very big distortion" in the marginal rate of tax via the HICBC.

He said: "I fully accept there is an unfairness with what happens with dual-income families..."

Pressed on the matter, Mr Hunt said: "All I will say is this is one of many distortions in our overcomplicated tax system that I look at when it comes to every Budget.

"There are lots of things I'd like to change. If it's affordable to do so, then I will do so, but it's too early for me to know at this stage..."

What is the High Income Child Benefit tax Charge?

The High Income Child Benefit Charge kicks in if a person or their partner has an individual income of more than £50,000. If the individual income exceeds £60,000, the Child Benefit is lost entirely through the tax.

It means households will begin to lose Child Benefit through the tax if there is one breadwinner who is earning more than £50,000.

However, dual-income families who earn below the threshold are not taxed, meaning they could earn just shy of £100,000 in total without losing Child Benefit.

LATEST DEVELOPMENTS:

WATCH NOW: Tory MP Greg Smith addresses Child Benefit stealth tax

Elsewhere in the interview, Mr Hunt said that the Carer’s Allowance of £76.75 a week was never meant to replace income.

He said: “We keep all the benefits under review. What I would say is the Carer’s Allowance was never meant to be income replacement.

"It’s meant to be support for people doing caring duties. But lots of people do caring duties for members of their family and people they know well.

“But I don’t think it’s possible for the state to fully replace income. But we have increased the Carer’s Allowance and we will continue to keep it under review.”

The Martin Lewis Money Show Live is available to watch now on ITVX.