Savers hit with 'unexpected' tax bill after rising interest rates - how to protect your money

ISAs are being recommended as a tax saving option by experts

Don't Miss

Most Read

Savers are being warned not to fall foul of “unexpected tax bills” following interest rate rises over the past year

The number of adult non-ISA savings accounts with balances large enough to incur tax on savings interest has tripled in the past year, according to research by Paragon Bank.

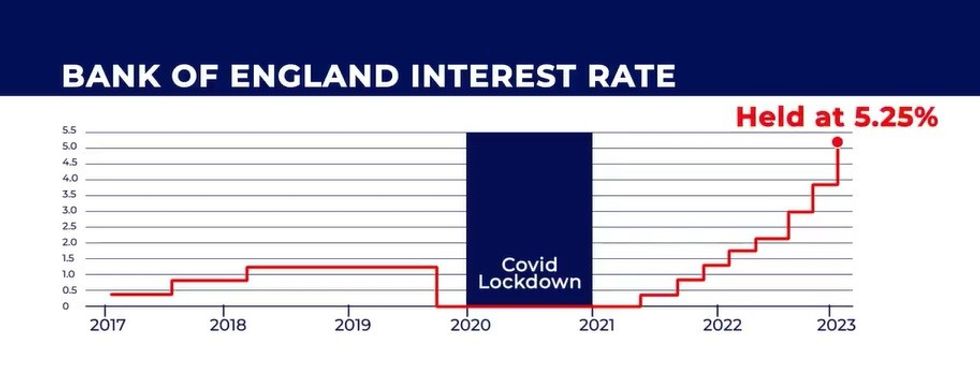

High street banks and building societies have passed on interest rate rises as the Bank of England hiked the base rate to try ease the UK’s inflation rate.

Basic-rate taxpayers can earn £1,000 in interest before getting hit with a tax charge on any savings interest under the Personal Savings Allowance.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers are at risk of getting 'unexpected tax bills'

|GETTY

For higher-rate taxpayers, this allowance is slashed to only £500. Rate hikes have inadvertently dragged savers across these thresholds and face levies on their savings.

Derek Sprawling, Paragon Savings Director, said cash ISAs are a “valuable shield” against a rising tax burden on savings, pointing out savers can put up to £20,000 into ISAs per tax year.

He explained: "These rising balances, fuelled by savings rate increases last year, leave some of the most proactive savers exposed to unexpected tax bills.

"By maximising ISA utilisation, savers can ensure their hard-earned interest stays in their pockets.”

Analysis of the latest Consolidated Analysis Center, Incorporated (CACI) data revealed a 246 per cent rise in active adult non-ISA accounts earning over £1,000 in savings interest.

Some 5.5 million of these accounts existed in November 2023 compared to just 1.6 million the same time the year before.

Furthermore, the amount of accounts surpassing the higher-rate tax threshold rose from 3.5 million to 8.7 million over this period.

Every tax year, savers can put money into one of each kind of ISA available: cash, stocks and shares, innovative and a Lifetime ISA (LISA).

LATEST DEVELOPMENTS:

Interest rates have increased over the past couple of years after 14 consecutive base rate hikes | GB NEWS

Interest rates have increased over the past couple of years after 14 consecutive base rate hikes | GB NEWSIt is possible to deposit savings of up to £20,000 in one type of account or split the allowance across some or all of the other types.

However, it is only possible for taxpayers to pay £4,000 into their Lifetime ISA during the tax year which runs from April 6 to April 5.

ISAs will not close once the tax year comes to an end, with customers keeping their savings on a tax-free basis for as long as they keep money in the accounts.