British workers ‘required’ to take 'lower pay deals' in fight against inflation, claims Bank of England official

Rising wages are contributing to inflation, according to senior officials from the Bank of England

Don't Miss

Most Read

Latest

British workers will likely need to take lower pay deals to bring inflation in the UK down further, a senior Bank of England policymaker has claimed. She warned the public would need to accept lower pay rises to combat inflation which can be considered a real-terms pay cut. If wages rise below the rate of inflation, this is referred to as a real-terms pay cut.

Sarah Breeden, one of the central bank’s deputy governors, confirmed there was still “some way to go” to get the Consumer Price Index (CPI) rate down to the two per cent target.

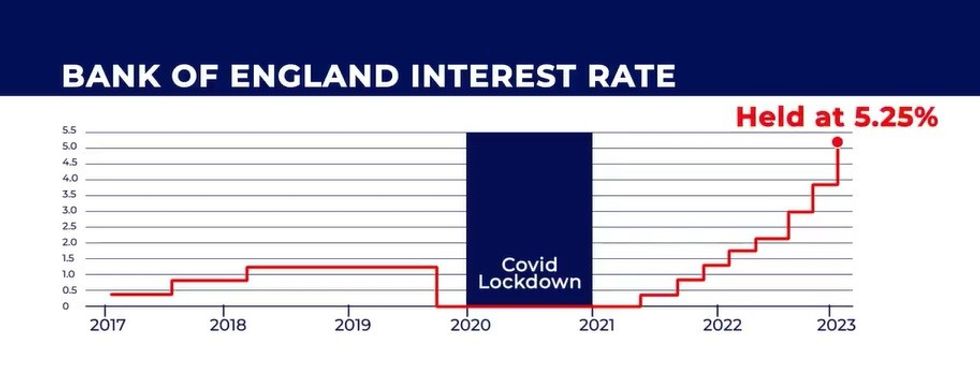

Last week, the Bank of England’s Monetary Policy Committee (MPC) voted to keep interest rates at 5.25 per cent with the base rate having previously been raised to ease inflation.

The central bank has stated it will need to see further evidence of inflation falling before announcing any cuts to rates.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Wage growth is contributing to inflation, according to experts

|GETTY

Despite the CPI rate easing in recent months, inflation for the 12 months to December 2023 jumped slightly to four per cent.

This reignited concerns over the UK economy with an interest rate reduction now not on the cards until later in the year.

While speaking at a UK Women in Economics Network event, Ms Breeden shared what needs to be done hit the desired target for inflation.

She explained: “Some combination of moderation in pay pressures and firms’ margins will be required for services inflation to return to more normal rate.”

According to the deputy governor, indicators of annual pay growth is still at a range of between six and seven per cent.

Ms Breeden cited that this is “still elevated” and needs to be addressed as soon as possible to ease the country’s inflation level.

“Given the current weakness in productivity growth, several percentage points higher than what is consistent with the inflation target, were they to persist,” she said.

In the three months to November 2023, annual growth in average workers’ earnings outside of bonuses fell to 6.6 per cent.

LATEST DEVELOPMENTS:

Interest rates have increased over the past couple of years after 14 consecutive base rate hikes | GB NEWS

Interest rates have increased over the past couple of years after 14 consecutive base rate hikes | GB NEWSThis was down from a record height of eight percent in July, the highest rate since comparable records started 23 years ago.

However, these statistics were published during a noticeable showdown in the labour market with a steady drop in vacancies and increase in unemployment figures.

The hesitancy of the Bank of England to slash interest rates has been met with ire from leading figures in the business community.

Neil Carberry, the Recruitment and Employment Confederation’s (REC) chief executive, said: “The labour market’s resilience is a great strength of the British economy – but it can’t last for ever without sustained economic growth.

“Pay has normalised, inflation is dropping, and the hiring market has been cooling for a year now – it’s high time that the Bank of England starts releasing the brake pedal on our economy.”