ISA alert: Major shake-up expected in July as Rachel Reeves under fire over 'damaging and outdated' tax

Scrapping stamp duty on UK shares could boost investment and restore confidence in Britain’s struggling markets, experts claim

Don't Miss

Most Read

Chancellor Rachel Reeves is under mounting pressure to deliver bold reform as calls grow to overhaul Britain’s savings system.

A sweeping shake-up of ISAs is expected within weeks, in what could be the biggest changes since the scheme launched in 1999.

The Treasury is preparing to review how ISAs operate, with the Chancellor tipped to unveil fresh plans during her Mansion House speech in July.

Industry leaders are pushing for decisive action to boost UK investment and restore confidence in London’s financial markets.

At the centre of the row is stamp duty on shares, a 0.5 per cent charge that experts say is discouraging people from backing British companies.

Experts have branded the levy an "outdated and damaging tax from a bygone era" that weakens the UK’s global competitiveness.

Interactive investor, the UK’s second-largest DIY investment platform, is leading the calls for change. Its research shows that 72 per cent of retail investors would invest more in the UK if the charge on shares and investment trusts were scrapped.

With market liquidity under pressure and capital flowing abroad, campaigners say scrapping stamp duty is essential if Labour is serious about unlocking economic growth through greater public investment.

Richard Wilson, Chief Executive of interactive investor, has launched a scathing attack on the current system. "Stamp duty on UK shares and investment trusts is an outdated and damaging tax from a bygone era that serves only to undermine the competitiveness of the UK stock market," he said.

Wilson argued that the tax "penalises investors for backing British businesses, making the UK a less attractive place to invest compared to global peers".

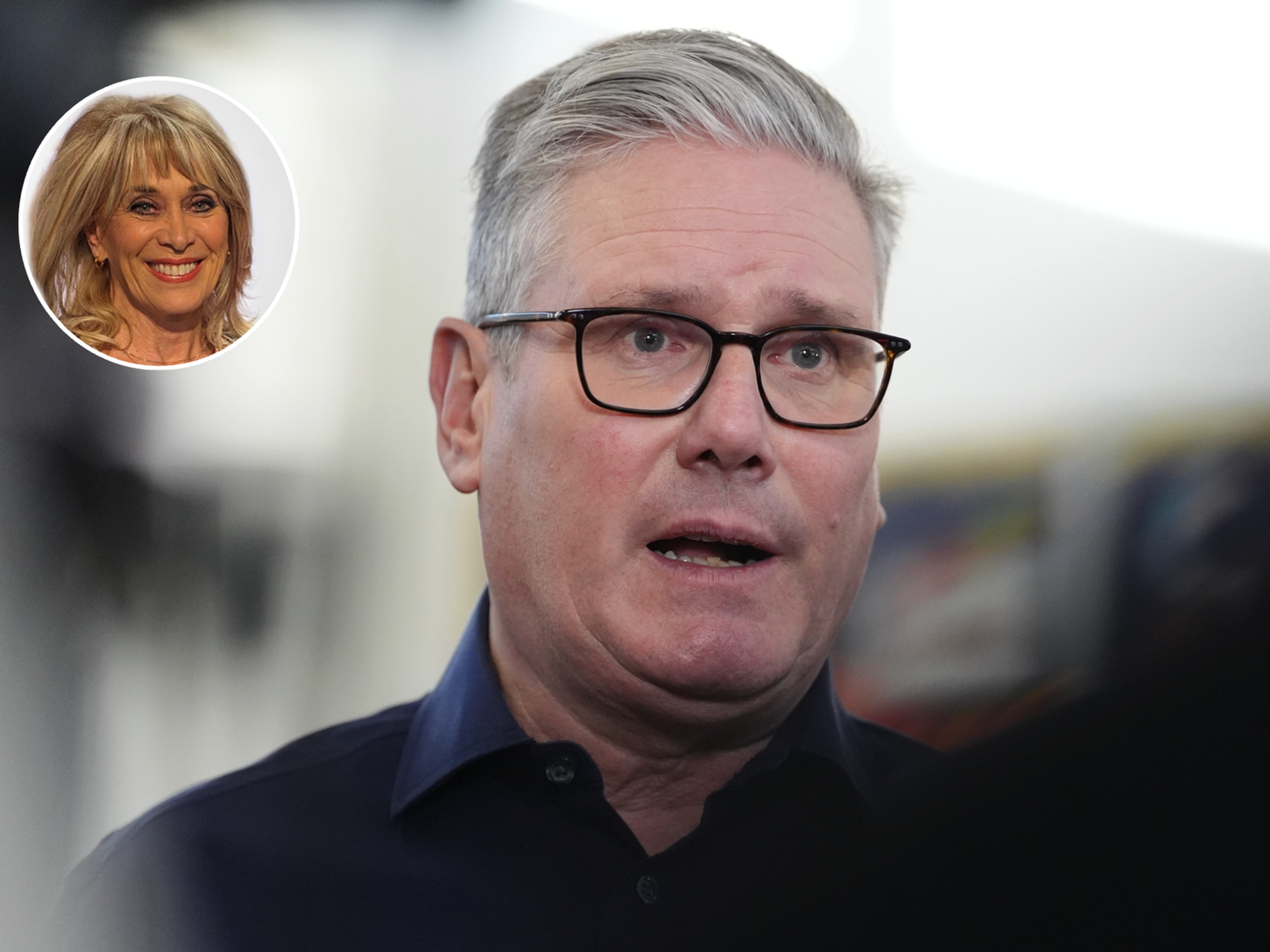

Rachel Reeves is preparing significant reform to ISA reform | GETTY

Rachel Reeves is preparing significant reform to ISA reform | GETTY He warned it was "driving capital elsewhere and draining liquidity from the market" at a crucial time for the economy.

"We believe removing stamp duty on UK shares will help encourage retail investors to back the best of British businesses," Wilson added, calling for ministers to seize this opportunity to revitalise London's markets.

The Treasury is preparing to launch a consultation seeking views from across the City on reforming ISAs, with speculation mounting that cash ISA allowances could be slashed from the current £20,000 to as little as £4,000.

The Government wants to encourage savers to channel more money into stocks and shares ISAs rather than holding large sums in cash accounts.

ISAs are useful tools for those looking save and avoid paying tax | GETTY

ISAs are useful tools for those looking save and avoid paying tax | GETTYFinancial Conduct Authority figures show three in five people with more than £10,000 in investible assets hold at least 75 per cent of these assets in cash rather than investments.

In the Spring Statement, ministers said they wanted to "get the balance right between cash and equities to earn better returns for savers" and "boost the culture of retail investment".

Industry experts are warning against adding further complexity to the ISA system. Michael Summersgill, chief executive of stockbroker AJ Bell, said simplification was "key to unlocking that investment".

He criticised "gimmicks like the ill-fated UK Isa, rightly kiboshed by the chancellor" as political soundbites "destined to fail".

Summersgill warned that "trying to corral consumers into UK investments by introducing new products, restricting cash Isa limits or introducing mandatory investment quotas will only add complexity".

Instead, he advocated merging cash and stocks and shares ISAs into a single account. "The current Isa framework labels people either as a cash saver or an investor.

In reality, however, most people need a bit of both cash savings for a rainy day and long-term investments for future growth," he said.

Andrew Hagger, founder of personal finance website Money Comms, predicted "a big shake-up in the Isa market, far more than just tinkering around the edges".

Research found restricting cash ISAs alone would not achieve the Treasury's objectives without broader reforms

| GETTYHe noted that investment firms were "pushing hard to increase the amount UK consumers put into equity products rather than cash".

Hagger highlighted the complexity of the current system, particularly for stocks and shares ISAs "where performance and charges can vary widely from provider to provider".

He called for simplification and potentially new products, suggesting "perhaps where you could invest cash and equities in a single Isa product".

Interactive investor's polling found that only seven per cent of investors would increase stock market investments if the Government lowered cash ISA allowances, suggesting that restricting cash ISAs alone would not achieve the Treasury's objectives without broader reforms.

More From GB News