State pension triple lock future plunged into uncertainty as minister makes statement

Nick Thomas-Symonds hails Anglo-French efforts to curb Channel crossings |

Recently, analysts have questioned the long-term viability of the state pension triple lock amid funding concerns

Don't Miss

Most Read

The state pension triple lock's future has been plunged into further uncertainty after the latest comments from a senior Labour Government minister.

Payment General Nick Thomas-Symonds confirmed that his party remains committed to the mechanism used for the retirement benefit payment rate hikes but only "for this parliament".

Labour has just completed its first year back in power, out of a potential five-year term, since winning last year's General Election, which means the triple lock could be after this period.

Thanks to the triple lock, state pension payment rates increase every year in line with either the rate of inflation, average wages or 2.5 per cent; whichever is highest.

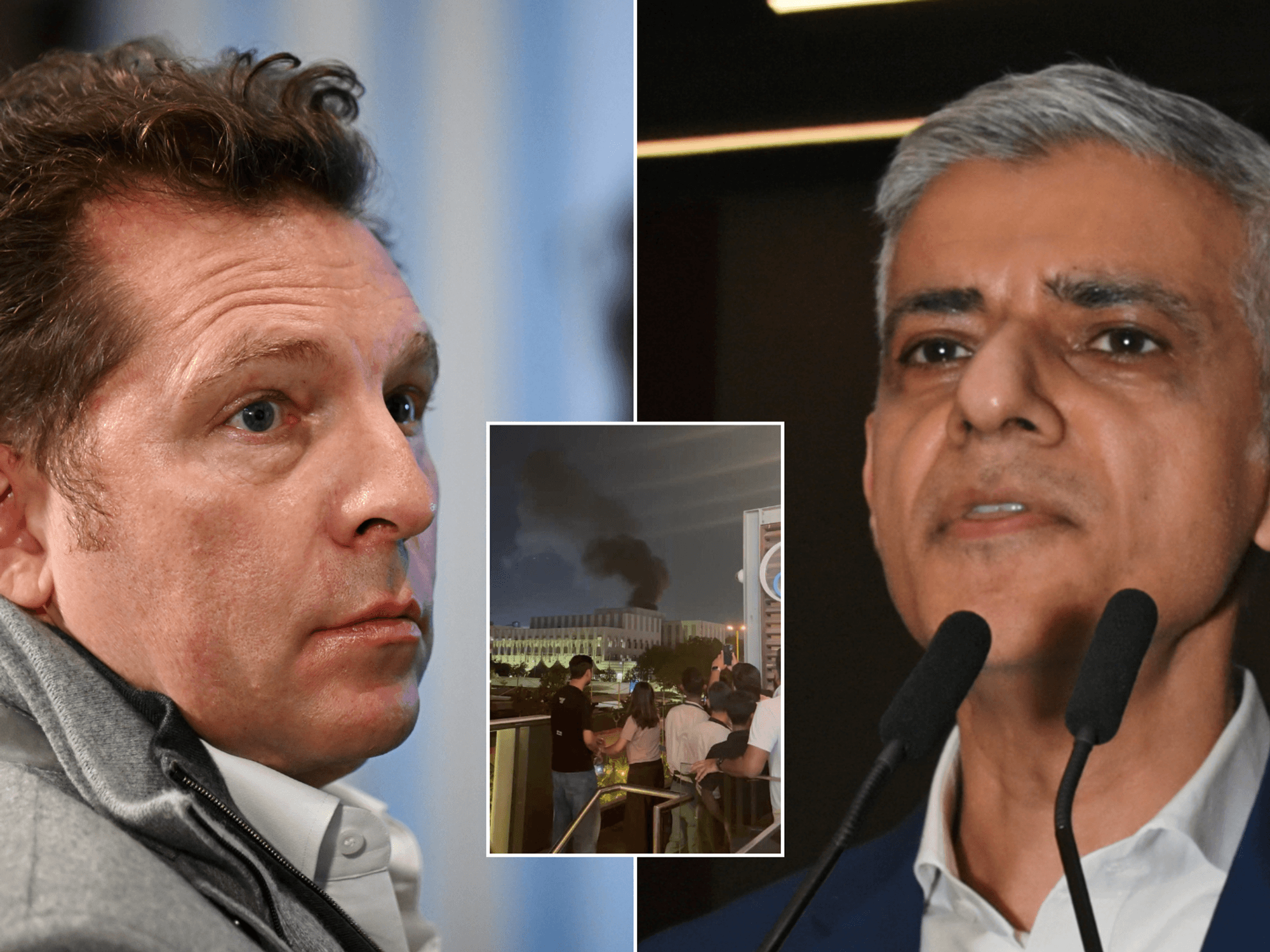

Labour has issued an update amid growing concerns over the state pension triple lock

|GETTY / GB NEWS

However, figures cited by the Office for Budget Responsibility (OBR) have signaled that reform to the retirement benefit is needed in order to balance the public finances.

A report from the watchdog, published yesterday (July 8), is now estimated to cost the Treasury £15.5billion per year by 2029-30, which is around 46 per cent of the overall benefits budget.

Notably, this is three times greater than the initial cost estimate for the triple lock with the OBR warning that the UK is not prepared to deal with financial shocks akin to the Covid-19 pandemic.

While appearing on Sky News, Thomas-Symonds was asked if the state pension triple lock needs to be reviewed again in light of this growing expense on the taxpayer.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Older Britons are worried about the future of the state pension triple lock | PA

Older Britons are worried about the future of the state pension triple lock | PAHe replied: "No, we've promised that we will maintain the triple lock for this parliament. That is what we will do. People do deserve dignity in retirement.

"But it's also about the fact that pensioners who've contributed so much to our society are then in retirement - they are not in the position, as other people in the population are, to be able to add to their income.

"They tend to be people who are on fixed incomes. So we will absolutely be sticking to that pledge."

Thomas-Symonds also promised Labour would not link eligibility to the state pension through income or savings by means testing payments.

According to the OBR, the UK's public finances are in a "relatively vulnerable position" due to successive economist shocks, as well as U-turns on spending cuts.

Labour's Paymaster General blamed the previous Conservative Government for the watchdog's findings, claiming the report "speaks to the structural weaknesses that we've inherited in our economy".

LATEST DEVELOPMENTS:

A recent report from the OBR found the triple lock is costing the Treasury treble than initial estimates in a blow to Rachel Reeves

| GBNEWSOn the triple lock's future, Jon Greer, head of retirement policy at Quilter, said: "It is evident that many retirees heavily depend on their state pension to get by, especially to maintain their standard of living in the face of rising inflation and high interest rates.

"However, we are equally cognisant of the fact that the triple lock pledge will become a material burden on the public purse, and is without a target for the level of the state pension, putting a strain on both the UK’s finances and its taxpayers.

"This was noted by the IFS in its recent Pensions Review, and highlighted by the Adam Smith Institute which said the state pension could become fiscally unsustainable by as early as 2036.

"Therefore, acknowledging the importance of both components, we advocate that the government brings forward a consultation to determine the most appropriate uprating mechanism, and a full appraisal of state pension income levels should be conducted in order to set it at an appropriate level."

More From GB News