State pension set to rise by hundreds of pounds in just months

The state pension could rise up to £230 a week

| Pexels

State pensioners are set to receive over £400 extra each year, new data shows

Don't Miss

Most Read

Latest

The state pension is on track to rise by four per cent under the triple lock due to wage increases released today.

Total pay including bonuses rose by four per cent in the May - July quarter, the latest UK labour market statistics showed.

Under the triple lock formula, and barring an unexpected surge in inflation in the next few months, this increase in wage growth will determine the rise in the state pension in April 2025.

The triple lock ensures that state pension payments increase by the highest of total average weekly earnings, inflation for September or 2.5 per cent.

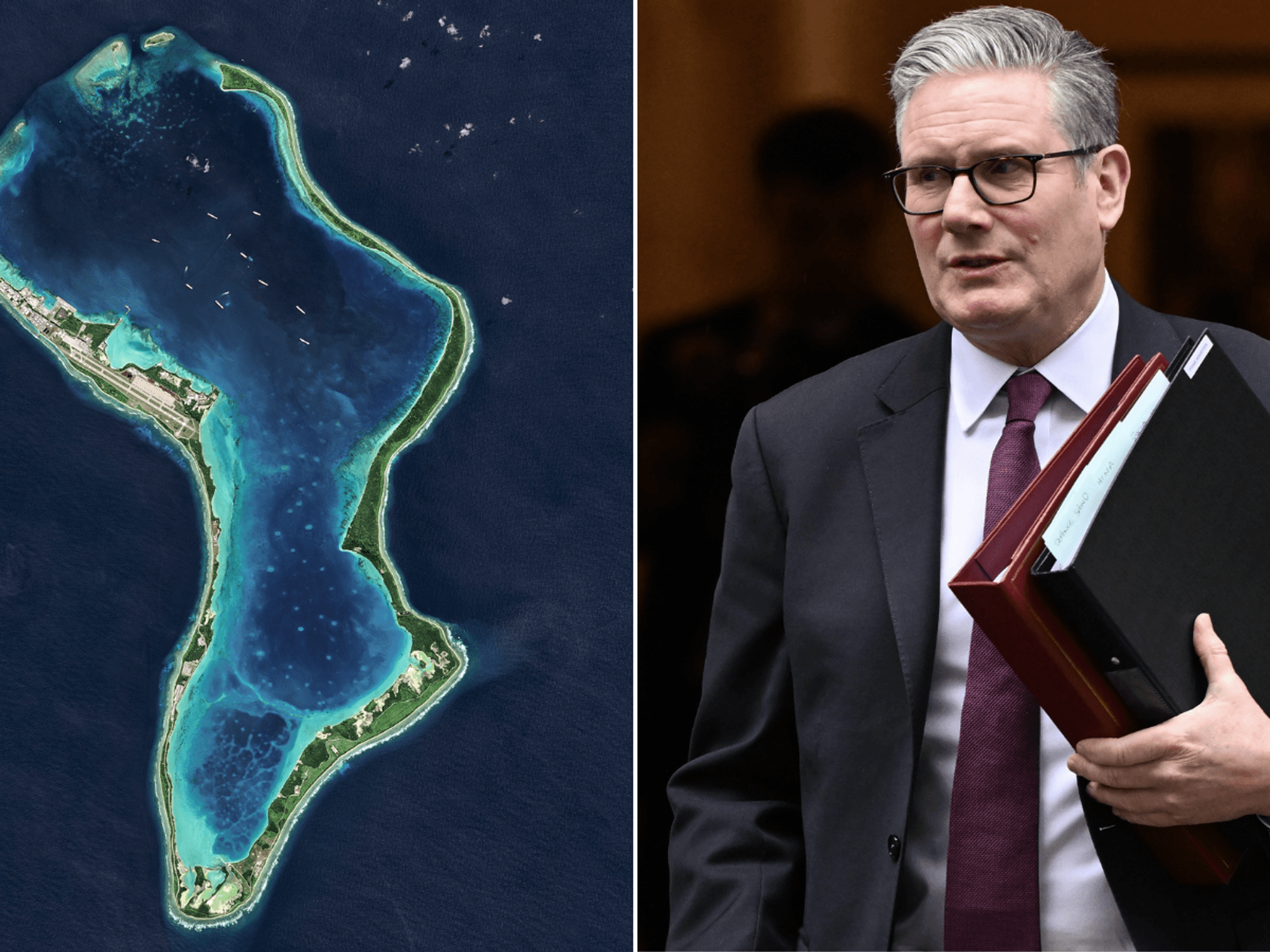

As wage growth sits at four per cent, the new state pension – currently £221.20 per week – should rise to around £230 per week, an increase of almost £9 a week.

The four per cent rise in April would give an extra £460 a year to recipients.

Average weekly earnings rose by 4 per cent in the three months to July

| PAThe new state pension will increase from £11,502.40 per year to £11,962 per year, an increase of £460 a year.

Liz Kendall, the secretary of state for work and pensions, will make the final decision on the state pension before October’s budget.

However, chancellor Rachel Reeves has already pledged the Government’s backing of the triple lock until the end of this parliament.

Inflation data for September has not yet been published but stood at 2.2 per cent for July, according to the Office for National Statistics (ONS).

While the pensions triple lock seems safe under Labour, Jon Greer, head of retirement policy at Quilter, fears that the sustainability of the triple lock in the long term is questionable.

He said: "While the anticipated uplift in the state pension is positive news for pensioners, it is essential to consider the broader implications and sustainability of the triple lock policy.

"The Government’s pension review will latterly look at pensions adequacy which must consider both state and private provision. Perhaps the review will be the mechanism to start the journey for change that removes the politics from the triple lock.”

With tax thresholds frozen in April 2025, this increase will bring around 340,000 pensioners into tax for the first time.

Around 12.9million people receive state pensions and of these around 1.1million are paid outside the UK, leaving around 11.8million UK pensioners.

Of these, HMRC estimates that there are currently 8.5 million pensioners paying income tax, or just under three-quarters of all pensioners. This will mean that most recently retired pensioners receive an after-tax increase of £368 rather than £460.

Commenting, Steve Webb, partner at pension consultants LCP said: "Part of next April’s increase is simply to keep pace with rising prices.

"Based on the current inflation figure of 2.2 per cent, the new state pension would need to rise by just over £250 simply for pensioners to stand still.

LATEST DEVELOPMENTS:

"Whilst an above-inflation increase of £460 will be welcomed, only the further £210 represents a real increase. And this is before allowing for the income tax which most pensioners will pay on their state pension rise.

"Those who lose £200 or £300 in Winter Fuel Payments will therefore still be worse off in real terms next April."

Today’s UK jobs report also shows that the unemployment rate has fallen to 4.1 per cent for the May to July quarter - down from 4.2 per cent in April-June.

During the quarter, unemployment fell by 74,000 people to 1.437 million and employment rose in the quarter.

It is up by 265,000 to 33.232 million, to 74.8 per cent of the population.