State pension triple lock future in doubt as UK 'on track to face retirement crisis by 2040'

Keir Starmer quizzed by Christopher Hope on whether pensioners will receive an apology for his winter fuel allowance cuts. |

GB NEWS

The triple lock guarantees the state pension payment rate increases every year by at least 2.5 per cent, but for how much longer remains to be seen

Don't Miss

Most Read

The state pension triple lock is at risk with Britain "on track to face a retirement crisis by 2040", analysts are warning.

Yesterday (July 8), the Office for Budget Responsibility (OBR) sounded the alarm about the UK's fiscal trajectory, describing the nation's finances as being on an "unsustainable" track. The watchdog's latest report predicts that Britain's national debt could surge from 94 per cent of GDP to 270 per cent by the early 2070s.

The projected debt explosion is largely driven by an ageing population and the resulting increases in healthcare and pension spending, placing Britain in what the OBR termed a "vulnerable position" amongst advanced economies.

Under the triple lock mechanism, which ensures state pensions rise in line with whichever is highest of inflation, wage increases or 2.5 per cent, is proving far more costly than originally anticipated.

The state pension triple lock's future is in doubt

|GETTY

The OBR calculates that the policy will cost £15.5billion by 2030, representing a threefold increase from projections made when it was introduced in 2011.he economic think tank's latest analysis reveals the Treasury is set to spend more on welfare than it collects through National Insurance contributions.

Despite the Government's current commitment to maintaining the triple lock "for the entirety of this parliament," there is growing expectation among MPs and economists that reform has become inevitable. A Downing Street spokesman's carefully worded statement leaves the door open for changes after the next election.

A Labour MP revealed there was "active thinking" in government about the growing cost of the triple lock and "whether you can deliver it."

Paul Dales, the chief UK economist at Capital Economics argued: "Getting rid of the triple lock makes sense - as the OBR report today showed it plays a big role in the projected increase in the cost of the state pension."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

People preparing for retirement are concerned over what their savings will eventually look like | PA

People preparing for retirement are concerned over what their savings will eventually look like | PAJon Greer. the head of retirement specialists at wealth management firm Quilter acknowledged: "While the triple lock remains a safeguard for pensioners, its escalating cost poses a serious challenge to fiscal sustainability."

Retirement experts are warning of a broader crisis beyond the triple lock's fiscal pressures, with the UK facing potential retirement inadequacy by 2040.

Catherine Foot, the director at the Standard Life Centre for the Future of Retirement, highlighted that whilst longer life expectancies are "a remarkable fact of modern life," they create new challenges as "rates of individual retirement saving are falling far behind what our longer lifespans now require."

Foot explained: "In all but its least optimistic life expectancy scenarios, the OBR projects significant increases in public spending.

"A sizeable portion of this increase will be driven by more people receiving the state pension for longer, as well as the triple lock driving up the State Pension amount people receive. At the same time, rates of individual retirement saving are falling far behind what our longer lifespans now require.

“This poses serious questions about the UK’s future retirement adequacy. Our research shows the UK is on track to face a retirement crisis by 2040 if current trends persist, with the majority of retirees expected to have insufficient savings. That isn’t a reality the Government or pensioners want to face.

LATEST DEVELOPMENTS:

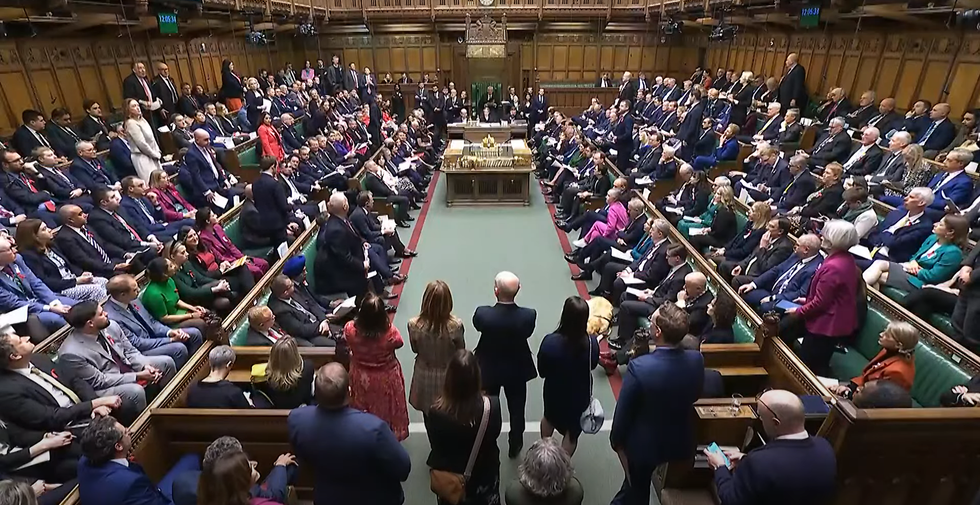

MPs are expected to scurtinise the future of the state pension triple lock

| HOUSE OF COMMONS“We urge Government to commit to begin the adequacy review at the earliest opportunity and set out a roadmap to improving retirement adequacy. The review has the potential to deliver real change that will improve the retirement prospects of millions of people, especially when combined with the government’s broader pension reform agenda.”

Research indicates the majority of retirees are expected to have insufficient savings if current trends persist. Foot urged the Government to "commit to begin the adequacy review at the earliest opportunity and set out a roadmap to improving retirement adequacy."

Political tensions are emerging within Labour ranks as the fiscal reality clashes with spending demands from backbench MPs. Over 40 MPs have backed an amendment by Richard Burgon to scrap the remaining cut to benefits in the welfare reform bill, with Burgon stating: "MPs should back my amendment and vote down this brutal and unnecessary cut."

However, a Labour MP loyal to the Government dismissed the rebels as "deluded about the state of the public finances." They warned: "There is no magic money tree. You just can't give everyone lots of money all the time, we're not in an age of plenty."

More From GB News