Savings crisis as Britons 'rush to tax-free accounts' ahead of Rachel Reeves's ISA raid

Britons are able to save up to £20,000 a year in ISA products without paying tax, but this allowance could be slashed as Rachel Reeves attempts to generate revenue from the Treasury

Don't Miss

Most Read

Savers poured a staggering £4.2billion into cash ISAs in March, up 31 per cent compared to the same period last year, according to the latest Bank of England data.

The surge comes amid widespread rumours that the Labour Government might slash the £20,000 cash ISA allowance in the upcoming Autumn Budget.

"Rumours that the Government was poised to slash cash ISA allowances in the Spring Statement sparked a rush to the tax-free accounts," said Laura Suter, director of personal finance at AJ Bell.

This represents an extra £1billion paid into the tax-free savings vehicles by the Britons compared to March 2024. Data suggests April could see higher figures, as it records the biggest inflows to cash ISAs with the tax year deadline approaching.

Rachel Reeves is reportedly understood to be considering changes to ISA allowances | GETTY

Rachel Reeves is reportedly understood to be considering changes to ISA allowances | GETTY Last year saw £11.5billion paid into these accounts in April alone. If the same 31 per cent increase were applied, April 2025 could see inflows reach approximately £15billion.

However, as the Spring Statement did not deliver the anticipated changes to cash ISA allowances, this may have dampened some of the expected flows.

The rush to ISAs comes ahead of any potential reforms being implemented by Chancellor Rachel Reeves, with reports suggesting the tax-free limit could be cut to £4,000.

Earlier in the year, a Treasury document stated that the Government is reviewing ISA options to "get the balance right between cash and equities to earn better returns for savers".

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Rachel Reeves has hinted at potential ISA reform

| GETTYThe Chancellor told the Treasury Select Committee on April 2 that she thinks reforming the cash ISA would be "worthwhile" for the Government.

While Reeves said she does "recognise the importance of cash for a lot of people," she justified possible reform because "already, you can save in a savings account and some of that is tax-free".

She added that the Government is interested in "boosting the culture of retail investment". No specific changes have been confirmed yet.

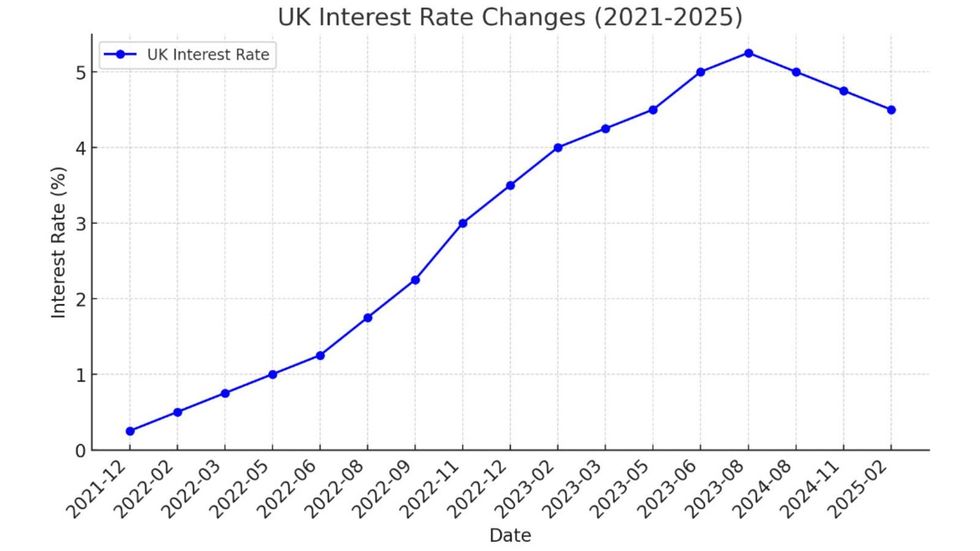

Interest rates on Cash ISAs have seen mixed movements, with top rates rising despite expectations of a falling Bank of England base rate.

"Fortunately for the savers paying into their Cash ISAs, interest rates on the accounts rose around tax year end," noted Suter. Data from Moneyfacts showed that easy-access ISA rates were higher at the end of March than in April last year.

However, fixed rate ISA accounts were paying less. The average Cash ISA rate has been dropping according to Bank of England data, falling from a peak of 3.4 per cent in October 2023 to two per cent in March 2025.

LATEST DEVELOPMENTS:

The Bank of England has made multiple changes to the base rate over the years | CHAT GPT

The Bank of England has made multiple changes to the base rate over the years | CHAT GPT "If savers don't shop around they may well be losing out by plumping for an ISA rather than a standard taxable savings account, despite the free ride on tax," Suter warned.

Cash ISAs have historically underperformed compared to investments, with the latter delivering more than twice the returns since 1999.

Reeves told the Treasury Select Committee: "We know there are many people putting cash aside who could consider investing in stocks and shares but perhaps lack the confidence."

While rumours of a £4,000 Cash ISA limit have circulated, no specific measures have been confirmed by the Treasury.