Shops could be forced to accept cash as MPs issue 'wake up call' warning over 'two-tier' Britain

Britons are warned not to 'sleepwalk into a situation where cash is no longer widely accepted'

Don't Miss

Most Read

Latest

Businesses may need to be forced to accept cash payments in the future to protect vulnerable people who rely on it, MPs have warned.

A Treasury Committee report has raised concerns that declining cash acceptance could create a "two-tier society" where certain groups face exclusion.

The committee stopped short of recommending immediate legal changes but said the Government must improve its monitoring of the issue.

It also warns that as fewer businesses accept cash, prices could rise for essential goods and services in the remaining outlets that do.

This would create a poverty premium for those who use cash to budget, the committee found.

Dame Meg Hillier, who chairs the committee, said: "We are at risk of a two-tier society where the most vulnerable bear the brunt and this needs to be a wake-up call."

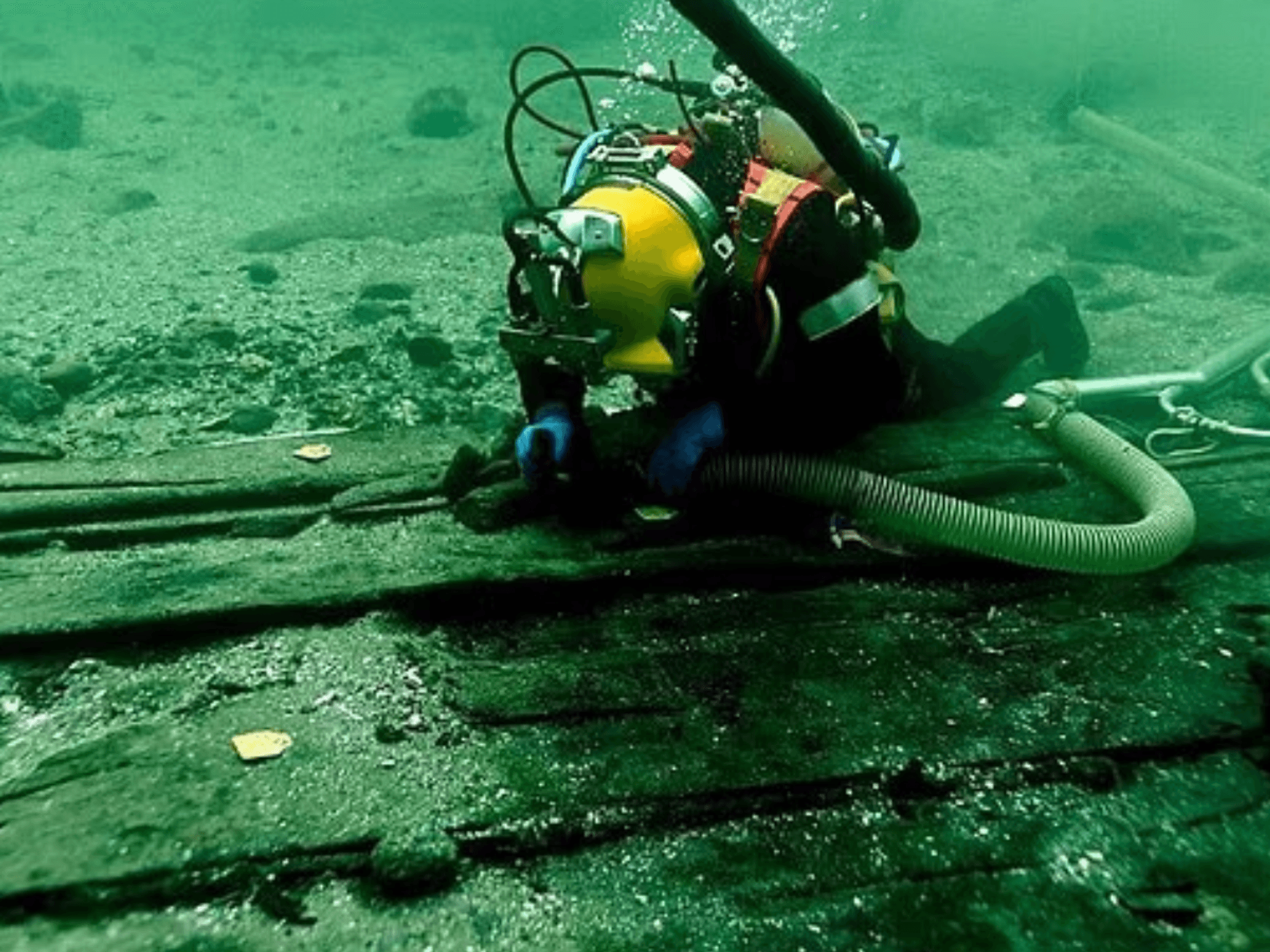

The committee heard evidence from groups representing the elderly, domestic abuse victims and people with learning disabilities

| GETTYThe committee heard evidence from groups representing the elderly, domestic abuse victims and people with learning disabilities.

Currently, UK businesses can accept whichever form of payment they want, with no legal duty to accommodate customers' varying needs.

Cash usage has plummeted over the past decade. According to UK Finance, cash was used for 51 per cent of all payments in 2013, but by 2023 this had fallen to just 12 per cent. For people without bank accounts, being able to spend physical cash remains vital.

CLICK HERE TO VOTE IN OUR POLL - SHOULD SHOPS BE FORCED TO ACCEPT CASH?

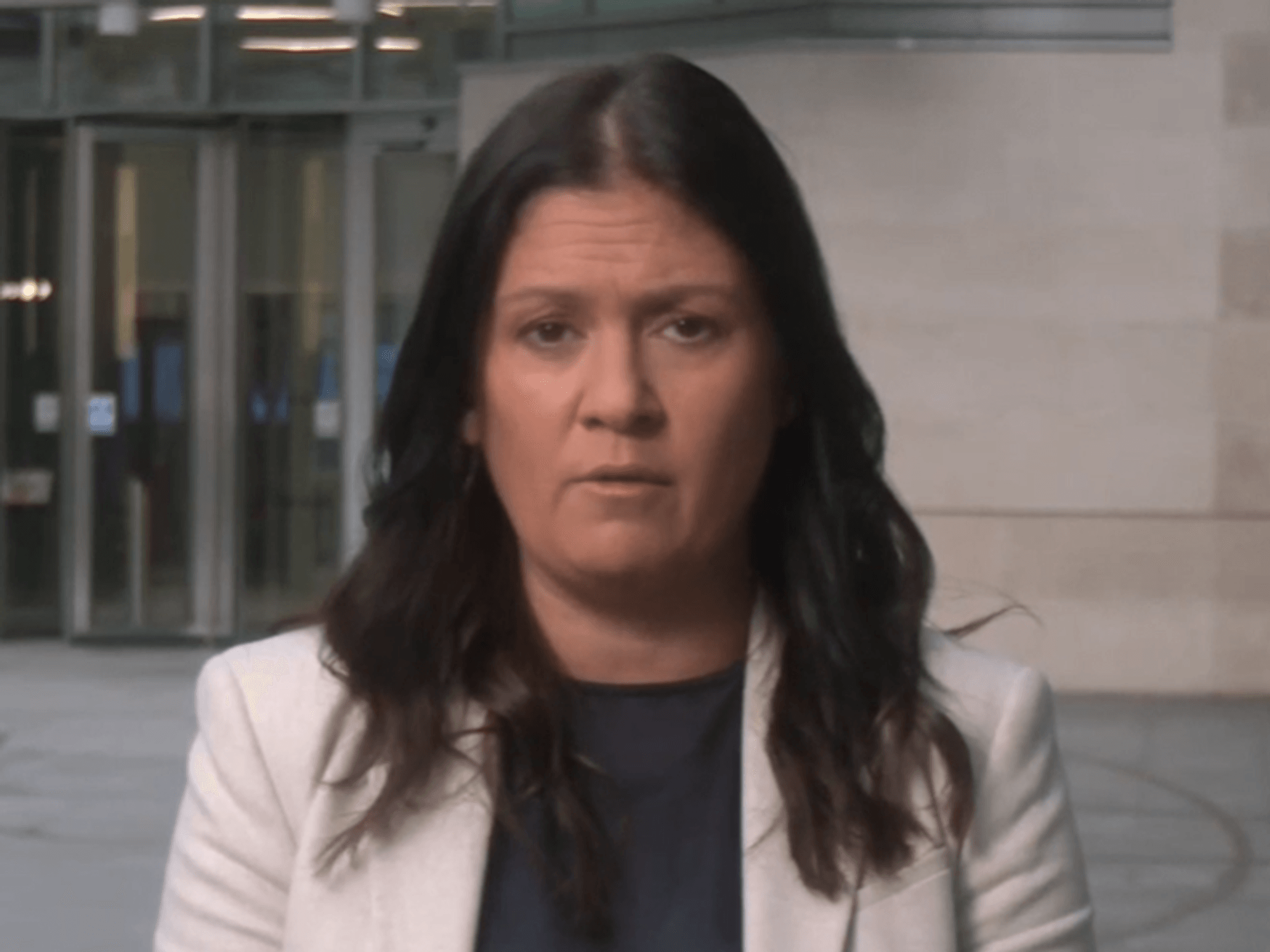

Dame Meg Hillier said: "The Government is in the dark on how widely cash is being accepted"

| Google Street ViewDame Meg Hillier said: "The Government is in the dark on how widely cash is being accepted and that is completely unsustainable. We must avoid sleepwalking into a situation where cash is no longer widely accepted.

"A sizeable minority depend on being able to use cash and they must not be forgotten by Whitehall." She said the report should be a "wake-up call" about the risks of ignoring those affected by the falling use of banknotes and coins.

Witnesses highlighted public transport and infrastructure for motorists as areas where cash acceptance has declined significantly. Many reported car parks are removing the ability to pay with physical cash.

Councils and local Government-funded services are increasingly cashless, according to charities and consumers. The Committee warned this trend risks excluding vulnerable people from leisure centres, theatres and public transport.

LATEST DEVELOPMENTS:

The report stated: "There may come a time in the future where it becomes necessary for HM Treasury to mandate cash acceptance if appropriate safeguards have not been implemented."

In a bid to ensure the Government can make informed decisions, the committee called for annual reporting on cash acceptance levels.

Some campaigners expressed disappointment at this approach, with Ron Delnevo from the Payments Choice Alliance describing it as "procrastinating".

Some countries are already taking steps to protect cash usage. Australia and parts of the EU are planning requirements to accept cash for essential services in certain circumstances.

Cash access has become a growing concern in recent years | GETTY

Cash access has become a growing concern in recent years | GETTYThe report also highlighted the national resilience benefits of maintaining cash, particularly during bank outages.

Letters from banks indicated at least 158 banking IT failures between January 2023 and February 2025.

Caroline Abrahams of Age UK emphasised: "It's vitally important that older people have free access to cash within their local communities, especially in rural areas and towns where there are no local banks or ATMs."

Shadow Chancellor Mel Stride added: "If the Government doesn't act, we risk shutting vulnerable people out of everyday life. Cash still matters to millions - and ministers must ensure it's protected."