Santander cuts interest rates on mortgages – full list of products

High street lenders, including Santander, are continuing to cut mortgage rates

Don't Miss

Most Read

Latest

Santander has announced a further reduction to interest rates across its line of mortgage products.

As of today, the lender has slashed fixed rates on select purchase mortgages amid a wave of mortgage rate cuts from high street banks and building societies.

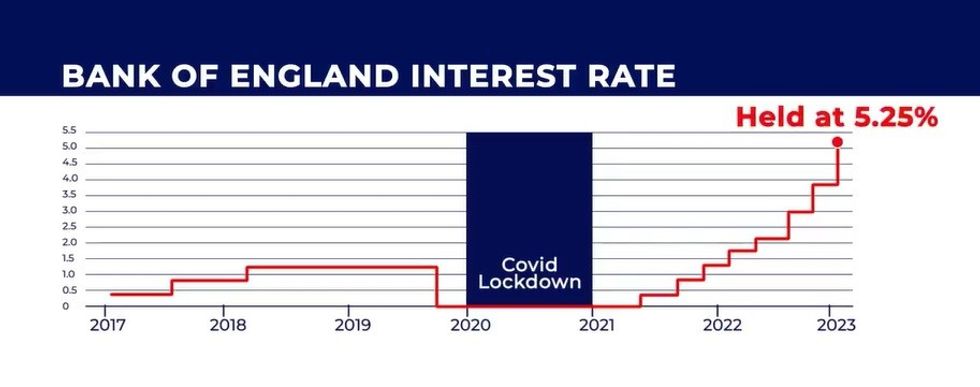

Homeowners and first-time homebuyers have struggled with rising rates following recent decisions from the Bank of England.

However, analysts are betting on the central bank cutting the base rate from its 15-year-high of 5.25 per cent which could bring mortgage rates down even further.

The lender is slashing rates once again

|GETTY

Here is a full list of the new mortgage rates for two-year fixed rate products from Santander following today’s reduction:

- 60 per cent LTV two-year fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.10 per cent, down from 4.55 per cent.

- 75 per cent LTV two-year fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.15 per cent, down from 4.60 per cent.

- 85 per cent LTV two-year fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.52 per cent, down from 4.79 per cent.

As well as this, here is a full list of the new mortgage rates for five-year fixed rate products from Santander’s following today’s reduction:

- 60 per cent LTV five year fixed rate residential purchase mortgage with no product fee is now priced at 4.14 per cent, down from 4.34 per cent.

- 75 per cent LTV five year fixed rate residential purchase mortgage with no product fee is now priced at 4.19 per cent, down from 4.45 per cent.

- 85 per cent LTV five year fixed rate residential purchase mortgage with no product fee is now priced at 4.24 per cent, down from 4.54 per cent.

LATEST DEVELOPMENTS:

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWSInflation easing has been one of the reasons mortgage rates have dropped in recent weeks but the Consumer Price Index (CPI) rate for the 12 months to December 2023 to four percent, the Office for National Statistics (ONS) confirmed.

Jonathan Veers, owner and operational director at The Buy to Let, warned that interest rates could fluctuate throughout the year, which prospective homebuyers must factor in.

He explained: “A fall in inflation has been one reason why some mortgage rates have dropped to 3.9 per cent, but inflation may increase once again in the coming months, leading to slightly higher mortgage rates compared to now.

“Nevertheless, it is expected that mortgage rates will continue to fall in the second half of this year as the Bank of England is predicted to reduce its base rate.”