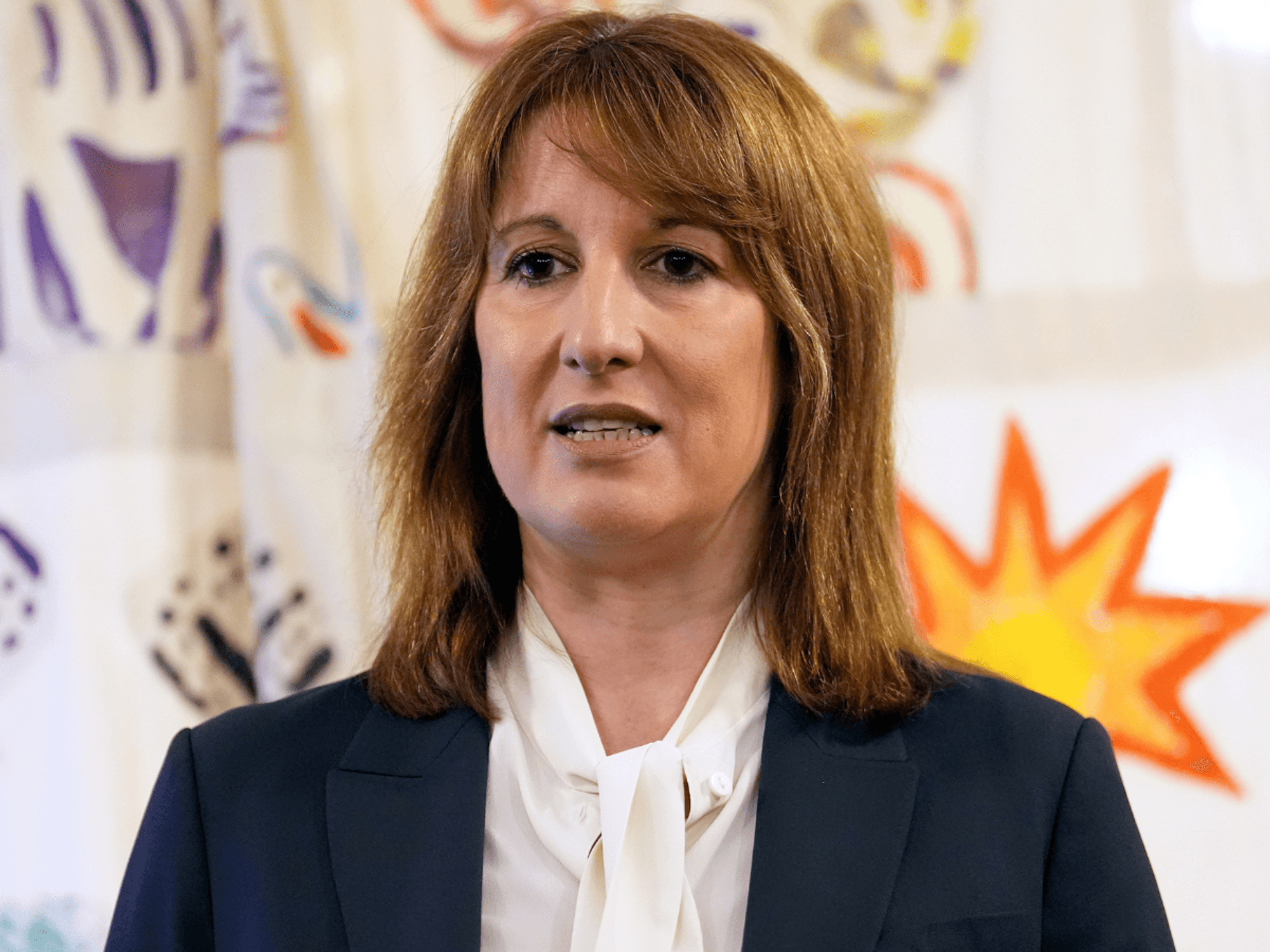

UK unemployment hits highest level since 2021 in fresh blow to Rachel Reeves

Labour's history of economic woes and recessions |

GBNEWS

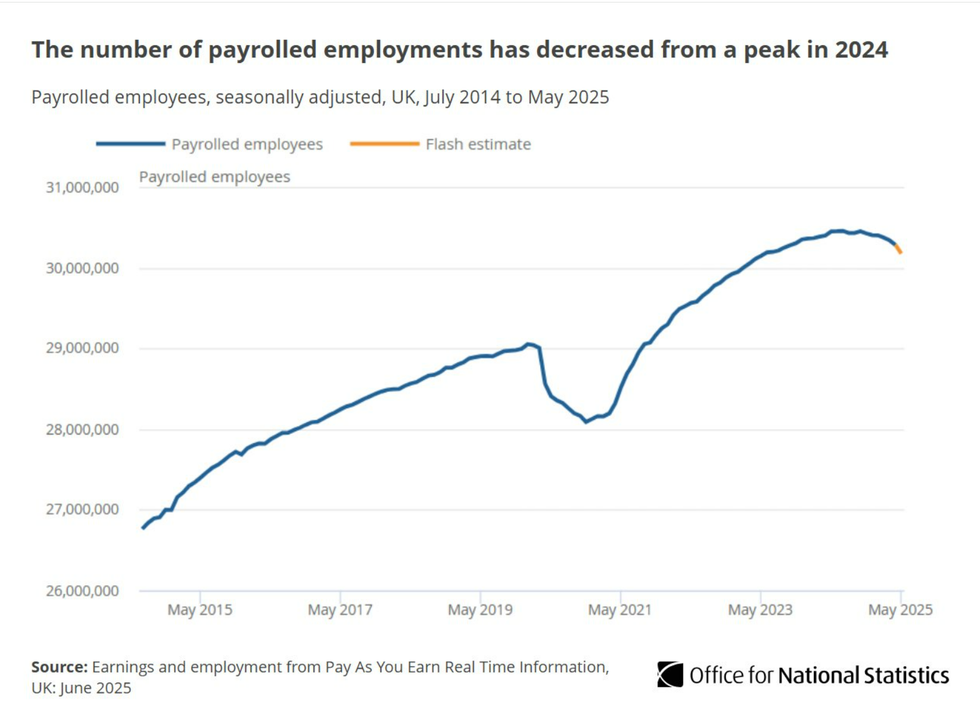

UK payrolls shrink by 164,000 across April and May, deepening fears that job losses are accelerating as the labour market cools

Don't Miss

Most Read

UK unemployment has risen to 4.6 per cent in the three months to April, the highest rate recorded since summer 2021, according to new data from the Office for National Statistics.

The increase, up from 4.5 per cent in the previous quarter, adds fresh pressure on Chancellor Rachel Reeves as concerns grow over a weakening labour market.

While regular pay continued to grow, rising by 5.2 per cent year-on-year, this marked a slowdown compared to previous months.

After adjusting for inflation using the Consumer Prices Index, real wages were up by 2.1 per cent, suggesting that workers are starting to recover some of the spending power lost during the cost of living crisis. Including bonuses, total pay grew slightly faster, with real total earnings up by 2.3 per cent.

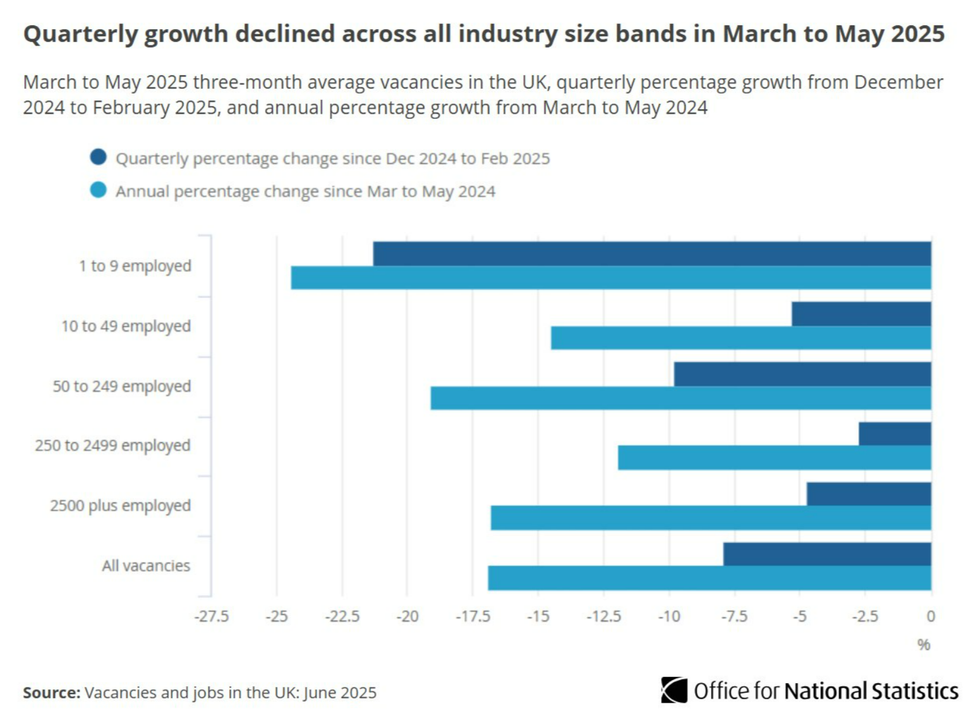

However, the broader economic picture is less encouraging. The number of job vacancies fell by 63,000 in the latest quarter, marking the fifteenth consecutive drop and leaving vacancies nearly 60,000 below pre-pandemic levels.

Liz McKeown, ONS director of economic statistics, said: "There continues to be weakening in the labour market, with the number of people on payroll falling notably.

"Feedback from our vacancies survey suggests some firms may be holding back from recruiting new workers or replacing people when they move on."

Employers have reported delaying recruitment or failing to replace staff, reflecting ongoing uncertainty about the UK’s economic outlook. It coincided with firms facing a hike in national insurance contributions in April, which had been announced in October’s budget.

Economists have warned that while falling inflation and wage growth may open the door to interest rate cuts later in the year, the labour market's slowdown could weigh on tax revenues and household confidence.

With unemployment now at its highest point in nearly four years, the Government faces a difficult balancing act of trying to claim progress on living standards while tackling a rise in joblessness that risks eroding that same progress.

Despite a strong start to the year — economic growth of 0.7 per cent in the first quarter was a welcome surprise — this has not been reflected in the labour market.

Professor Joe Nellis is economic adviser to MHA, the accountancy and advisory firm said: "Driven by one-off economic stimuli such as a surge in exports in anticipation of potential tariffs, this was not sustainable growth that will have a positive impact on job creation.

"When the Chancellor outlines her spending review on Wednesday, she has the opportunity to kickstart job creation by committing to investment in infrastructure and public services, but with the Government's finances thinly spread, other areas of public expenditure may come under pressure.

The number of job vacancies fell by 63,000 in the latest quarter

|GETTY/ONS

"Nonetheless, a significant acceleration in unemployment remains highly unlikely due to a persistently tight labour market, with unemployment remaining at comparatively low levels historically."

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, the wealth manager said: "Easing wage growth isn’t the best news for consumers still struggling with high living costs.

"Inflation is creeping up once again though workers can take some comfort that wages are still rising faster than inflation, with real terms growth of 2.1 per cent on regular salaries and 2.3 per cent on total pay, which includes bonuses, once CPI inflation is accounted for.

“While pre-tax headline incomes are stretching further than they did 12 months ago, households would be wise to tread carefully when it comes to their personal finances.

"Pay growth could slow further in the coming months if the Chancellor’s new tax measures on businesses and US President Donald Trump’s tariff policies dampen economic growth as expected.

The number of employees on UK payrolls fell by 55,000 in April 2025, according to revised figures.

|ONS

"Many may already be feeling the squeeze as frozen income tax thresholds – set to remain in place until at least 2028 – drag more people into higher rates tax as their income increases.

"Add in the effects of ‘Awful April’ when a raft of bill hikes hit consumer budgets and for many it may feel like disposable incomes are running on the spot rather than improving in real terms."

Ben Harrison, Director of the Work Foundation at Lancaster University, a leading think tank for improving working lives in the UK said: "Today’s data underscores the importance of Government committing the investment and funding required to support more people into the labour market in the Spending Review.

It's vital that alongside an extra £1 billion for additional employment support programmes, the Government reverses plans to cut nearly £5 billion of welfare spending.

"These cuts stand to make it much more difficult for those with long-term health conditions to access sustainable employment in the future."

There were 736,000 job vacancies in March to May 2025, down 63,000 on the quarter

|ONS

Haine continued: "With inflation expected to tick up in the coming months – a result of the Chancellor’s employment tax hikes as companies pass on rising costs to consumers, along with any impact from Trump’s tariff war – the outlook for household budgets remains uncertain.

"Interest rates are easing but the pace of those reductions may not be as fast as some might like with any future decisions ‘shrouded by uncertainty’ according to Bank of England Governor Andrew Bailey.

"The Bank of England lowered the headline interest rate for the fourth time since last August in April but easing wage growth and the prospect of weaker economic growth data in the second quarter may not be enough to trigger a fifth rate cut this month in the face of sticky inflation.

UK unemployment has risen to 4.6 per cent in the three months to April adding fresh pressure on Chancellor Rachel Reeves as concerns grow over a weakening labour market | Parliament TV

UK unemployment has risen to 4.6 per cent in the three months to April adding fresh pressure on Chancellor Rachel Reeves as concerns grow over a weakening labour market | Parliament TV"Rising employment costs and global uncertainty have already prompted some businesses to scale back hiring plans this year or not replace staff who leave.

"When uncertainty reigns, keeping personal finances on a steady footing is imperative. Losing a job can cause havoc for households that don’t have an emergency fund that can cover the regular bills during a sustained period without earned income.

"For households that don’t have a fallback fund in place, now is the time to start building one up. Cutting expenditure where possible, paying down expensive debts and signing up for income protection are other strategies that can help to ease financial ease, particularly for households where job security may already be a worry."

More From GB News