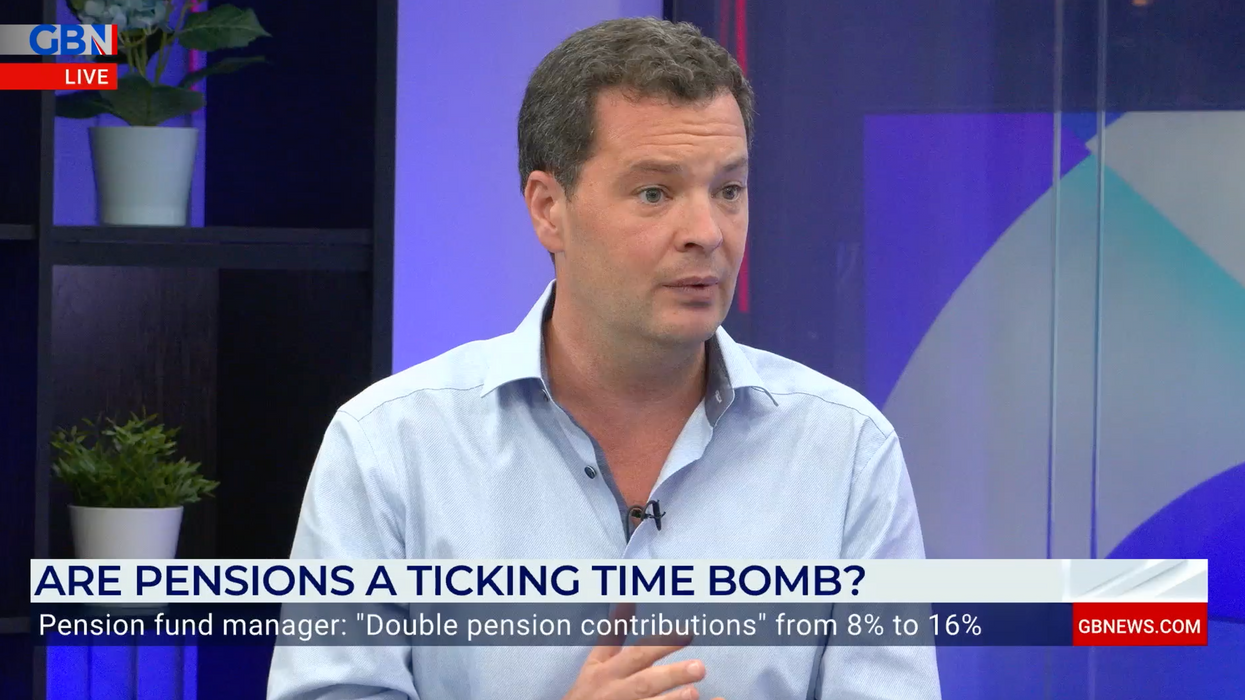

Alex Deane offers advice on pensions

GB NEWS

An expert has called for minimum pension contributions to double

Don't Miss

Most Read

Britons should double their minimum pension contributions from eight per cent to 16 per cent, according to the boss of one of Britain’s biggest fund managers.

The radical idea would amount to a huge revamp of the current retirement saving rules, and the sentiment has been backed by political commentator Alex Deane on GB News, who says “the sooner, the better”.

Deane, however, claims that doubling the minimum amount is simply a “conversation starter” as a means to opening a dialogue for raising contributions.

According to Abrdn Chief Executive Stephen Bird, millions of people are heading for an inadequate income in retirement as a result of the current minimum three per cent contribution from employers and five per cent from employees not being nearly enough.

WATCH THE FULL DISCUSSION BELOW

Speaking on GB News, Alex Deane said Britons should heed the advice as most are “clearly” not saving enough for their retirement.

“You can’t in one go double the income required from people. You can do it incrementally in time.

“I certainly think we should move from the current eight per cent minimum.

“There’s a Private Members’ Bill in the House at the moment that brings the age of contributions down from 22 to 18 - that brings another 900,000 into the savings net, which is great, and another four years.

Pension contributions should double, an expert has claimed

PEXELS“I know there’s people who are 18 who are thinking they don’t care about their pensions, I’ve got news for you, you do need to care.

“The sooner we put it in and the more interest you have, the better.”

Minimum contributions were initially set at one per cent for employers and one per cent for employees in 2012 when the auto-enrolment pensions regime was first phased in.

Both categories were raised in 2018 and 2019.

Writing in The Times, Bird said: “To have any chance of achieving decent retirement outcomes, the contribution rate needs to double — taking it closer to the levels seen in other developed economies, or indeed, the Abrdn employee scheme.”

Craig Beaumont from the Federation of Small Businesses said should a move would be “extreme and unaffordable”.

He added that it would be an “unreasonable squeeze” on both employees and employers.

A gradual rise to 12 per cent would be a sensible way forward, according to the Pensions and Lifetime Savings Association.

Nigel Peaple, its director of policy, said: “We believe the right thing is for most of the increase to come from employers so that, by the early 2030s, pension contributions are split 50-50 between the employer and employee.”