Good news for homeowners as mortgage rate increases begin to ease: ‘Encouraging sign!’

Interest rates continue to be relatively high but current hikes to mortgage products remain “modest”

Don't Miss

Most Read

Mortgage rate rises in the UK are easing in an “encouraging sign” for homeowners, according to experts.

The average interest rates on overall two and five-year fixed deals rose from March to April but more modestly than the month before, according to research by Moneyfactscompare.

Despite this slight hike, this mortgage rate rise remains lower compared to the average reported for January 2024.

Between the beginning of March to early April, overall average two and five year fixed rate mortgages jumped to 5.80 per cent 5.39 per cent, respectively.

Currently, the average two-year rate deal is higher 0.41 per cent than the five-year equivalent, Moneyfacts found.

As well as this, the average standard variable rate (SVR) remained at 8.18 per cent which is just below the highest recorded between November and December 2023.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

There are "encouraging signs" for homeowners, experts claim

|GETTY

Furthermore, the average two-year tracker or variable rate mortgage in the UK dropped to 6.14 per cent over the period.

On top of this, overall product choice increased month-on-month to 6,307 deals which is the highest level since February 2028.

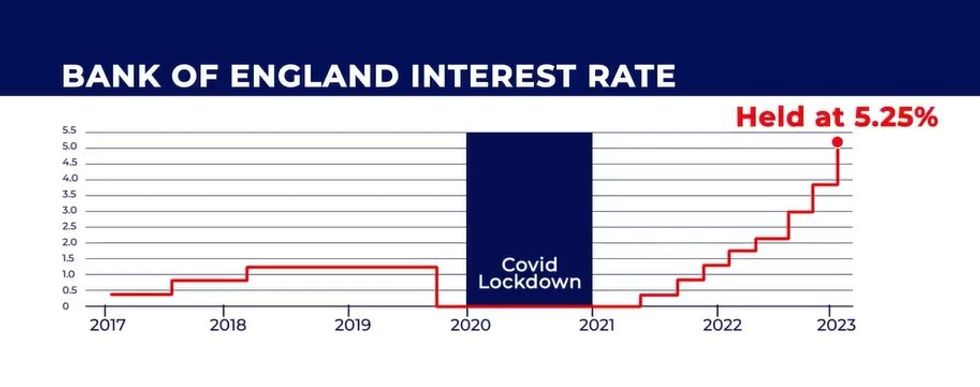

Over the last two years, homeowners have been saddled with high mortgage repayments due to interest rates being raised.

This has been a consequence of the Bank of England’s decision to hike the base rate which has remained at 5.25 per cent since August 2023.

The central bank has opted to raise rates as part of its efforts to ease the Consumer Price Index (CPI) rate of inflation.

For the 12 months to February 2024, inflation eased to 3.4 per cent after a period of remaining at around four per cent.

As such, analysts are pricing in on potential interest rate cuts from the Bank of England in the later of 2024.

This will be a boon for mortgage holders and likely see monthly repayments drop with experts noting that rate increases.

Rachel Springall, a finance expert at Moneyfacts, highlighted how much of the issues impacting the property market has “subsided” which will benefit homeowners long-term.

She explained: “Fixed mortgage rates have continued on an upward trajectory, but the rises to the overall average two- and five-year fixed mortgage rates were much more modest.

LATEST DEVELOPMENTS:

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS“The volatility surrounding the shelf-life of mortgage products also stabilised.

"These are encouraging signs for borrowers concerned about rising interest rates and the short window of opportunity to secure a new deal.

“It is worth noting that both the average two- and five-year fixed rates are lower than they were back at the start of 2024.

“Borrowers will find rates are significantly lower compared to six months ago, when the average two- and five-year fixed rates were 0.67 per cent and 0.58 per cent higher respectively.”