Millions of Britons ‘missing’ mortgage payments as interest rates remain too high

Interest rate rises have impacted peoples’ ability to make their mortgage payments on time

Don't Miss

Most Read

Latest

Millions of households are “missing” mortgage payments in order to pay bills amid the cost of living crisis, according to new statistics.

Research carried out by Which? found that 2.4 million households missed at least one payment in the month to March 8 as families struggle with hiked interest rates.

This the equivalent of 8.6 per cent of mortgage holders and is a significant increase from the 1.9 million households which did the same in the previous month.

Experts are warning the cost of living crisis, which had led to sharp hikes to interest rates, is having an impact on people’s ability to pay essential bills.

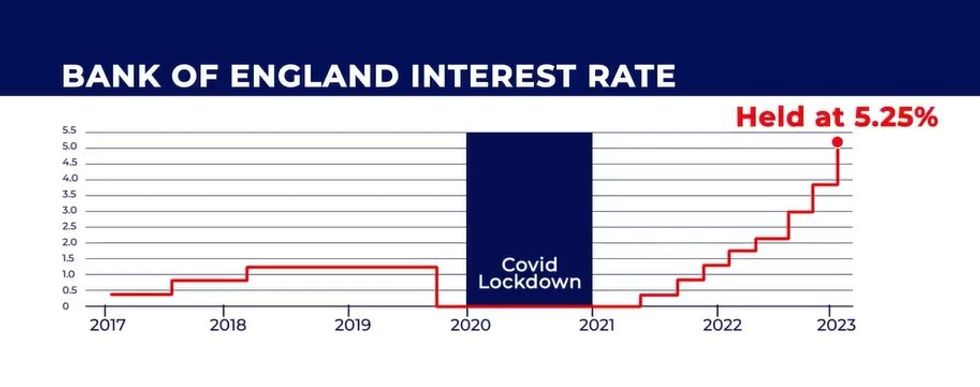

The Bank of England raised the base rats to 5.25 per cent to ease inflation, and has keep rates there since August 2023.

While the Consumer Price Index (CPI) rate has dropped, the central bank is unlikely to slash rates until later in the year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mortgage holders are struggling to make ends meet, according to Which?

|GETTY

Mortgage holders have been among the groups to be affected by this decision and are paying more every month.

Some 8.1 per cent of mortgage holders missed essential payments such as housing, utility bill, credit card or loan payments, Which? revealed.

This is the third highest level the group has recorded for mortgage holders since it started tracking it in April 2020.

Furthermore, the consumer captions found that missed payment rates were also high among renters.

Around one in seven renters did not make essential payments in the month to March 8.

Notably, Britons who own their home outright reported a decrease in missed payments to 1.6 per cent, down from 2.8 per cent from the month before.

Overall, an increase in missed utility bills and credit card or loan payments drove the overall rise in missed payments for mortgage holders and renters.

According to Which?, this indicates both groups may be prioritising housing costs over other essential bills.

LATEST DEVELOPMENTS:

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWSRocio Concha, Which?’s director of Policy and Advocacy, urged homeowners to seek financial advice if they are struggling.

She said: “It’s very worrying that missed payment levels are still so high - with almost one in 10 mortgage holders missing a household payment in a single month.

“We’d encourage anyone who’s struggling to seek free debt advice and reach out to their mortgage provider or landlord for help.

“As so many people face financial hardship, Which? is calling on businesses in essential sectors like food, energy and telecoms providers to do more to help customers get a good deal and avoid unnecessary or unfair costs and charges during this crisis.”