Revealed: Why you should always pay in CASH if you want to build wealth

A study found that people experience 20 per cent more psychological pain when they pay with notes and coins

Don't Miss

Most Read

People should pay with cash if they want to make smarter economic decisions and save money, new research suggests.

A study involving over 3,000 people determined that when someone pays with physical money, they will experience 20 per cent more psychological pain as opposed to when they use their card.

“When you pay contactless, you can pay in a blink of an eye,” said the study authors, whose research was published in the Journal of Economic Behaviour and Organisation.

“We find that when people pay using contactless it hurts less, but they spend more.

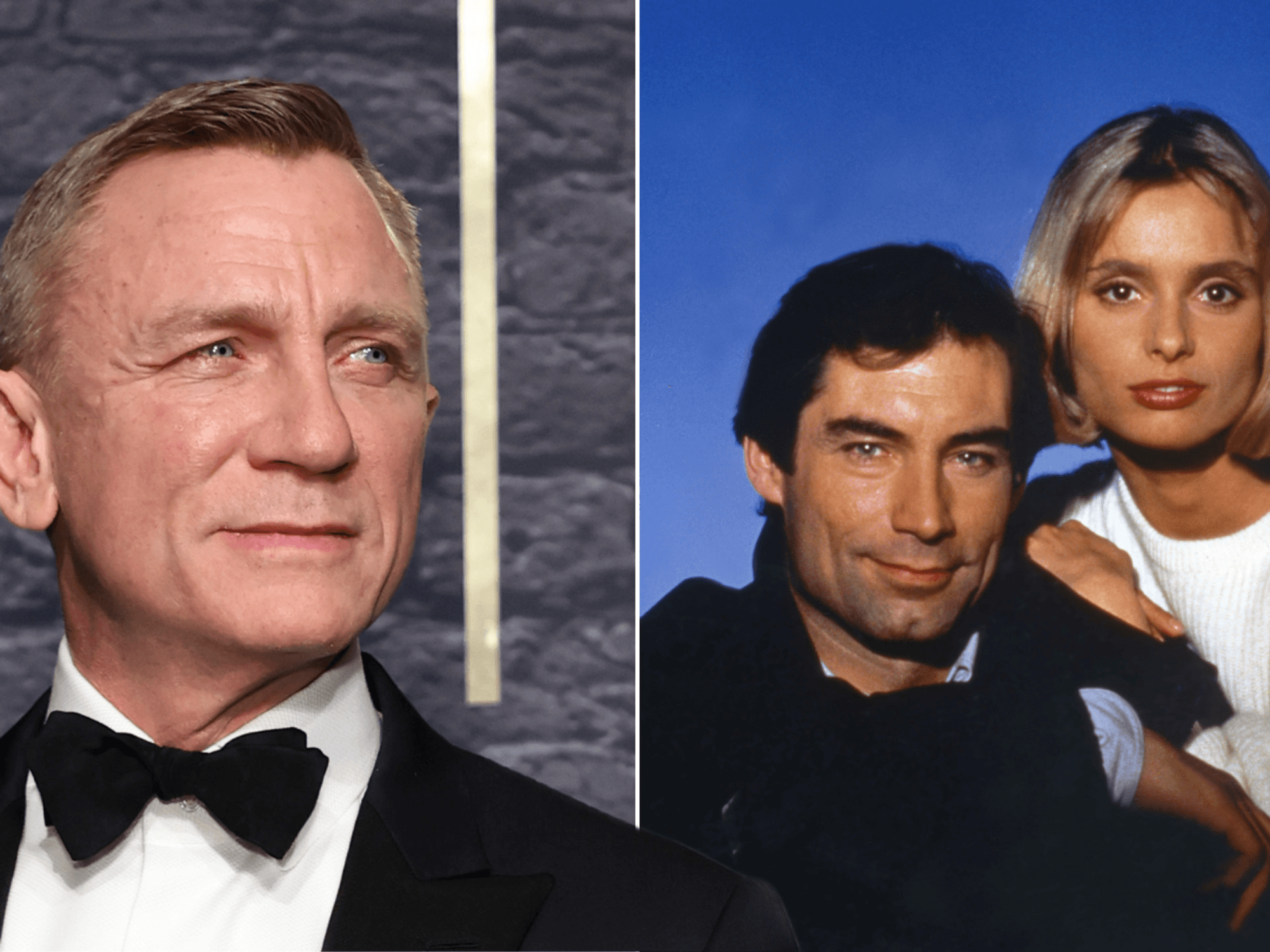

Research shows why you should always pay in cash if you want to save money

|Getty

“With cash payments, people experience the pain of loss intensely as they need to check the amount, select the right bills and coins, hand these over, receive their change and check whether the amount they have received is correct.”

The researchers from the University of Groningen, The Netherlands, investigated different types of payments and their impact on overspending, as well as the psychological pain produced with each method.

They added: “Given the declining use of cash, it is crucial for policymakers to devise tools that aid consumers in averting overspending when using electronic payment methods, particularly contactless ones.”

On a scale of one to seven, spenders rated the mental pain caused by using notes or coins a 4.1.

LATEST DEVELOPMENTS:

Meanwhile, using a contactless payment card resulted in a pain rating of 3.4.

The research concluded that spenders experienced less suffering when they used their cards, thus prompting them to use their cashless methods more.

It also found that people with less money find paying more painful than those with higher earnings.

Last month, experts from MoneyZine, said that the UK could be left without free-to-use cash machines within the next 12 years.

From 2018 to 2023, some 14,783 free-to-use cash machines were shut down

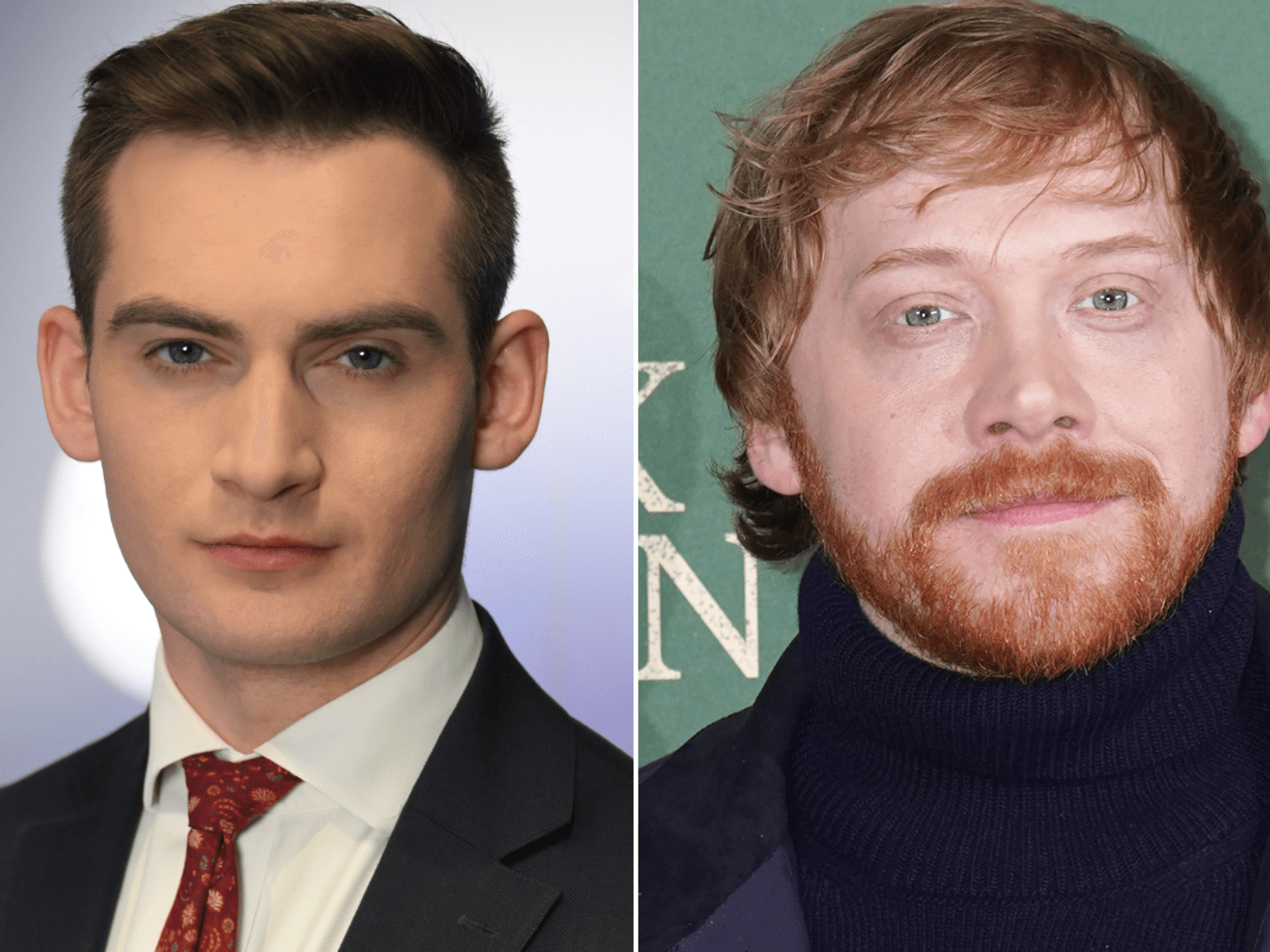

| GETTYBank customers are currently able to withdraw money from their accounts at the majority of cash machines for free, however, this is expected to change.

Following GB News’ Don’t Kill Cash campaign, the Government told banks to provide cash services for the public within a three mile radius of customers or risk being fined.

From 2018 to 2023, some 14,783 free-to-use cash machines were shut down, MoneyZine found. This issue is set to be compounded by the scrapping of free-to-use ATMs with experts warning this will likely impact vulnerable people the most.

Luke Eales, the CEO of Moneyzine, urged the Government and regulators to make sure people will still have sufficient access to cash in the years to come.