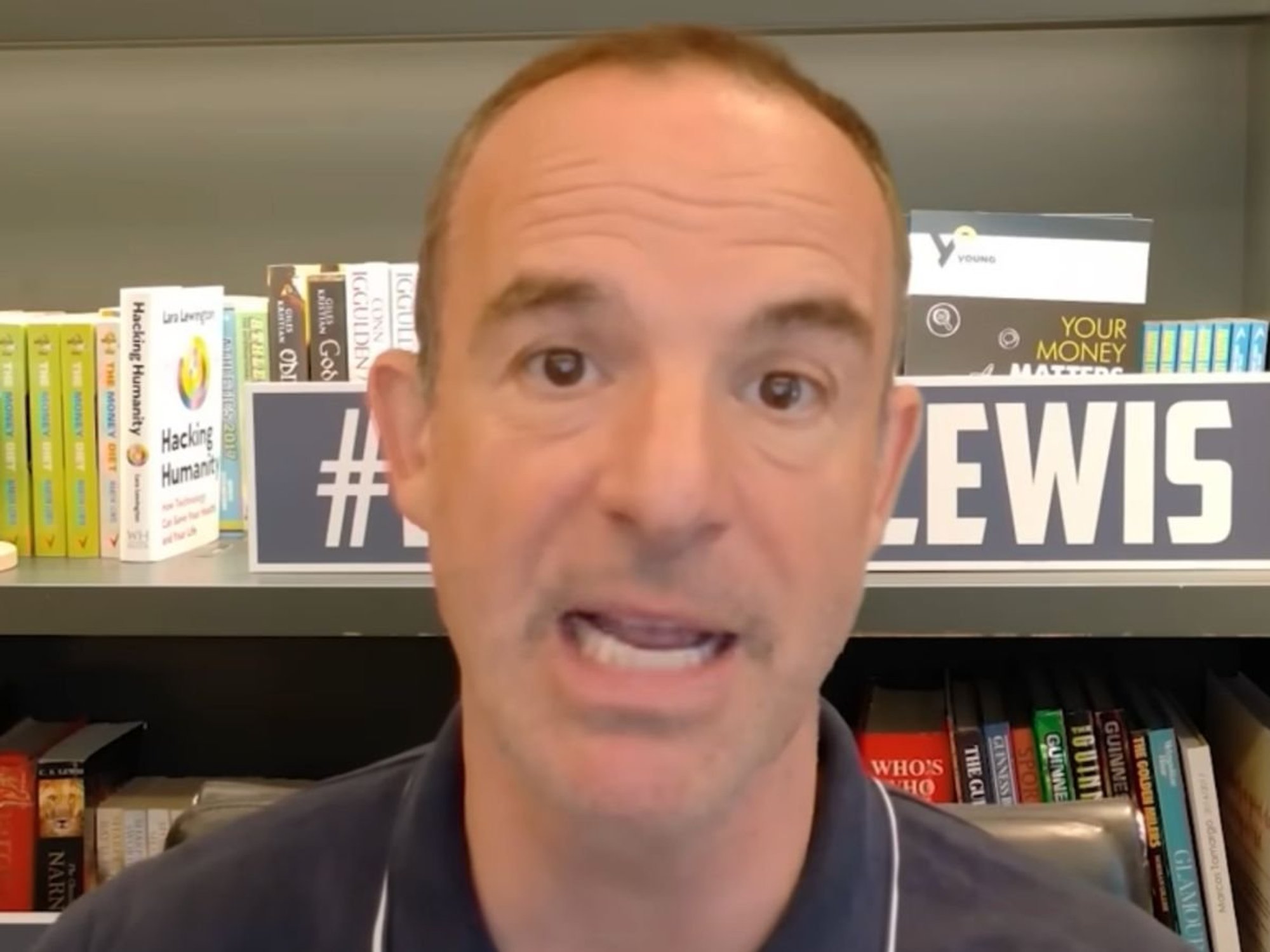

Drivers urged to make crucial change as insurers unlikely to ‘take foot off the gas’ and reduce premiums

WATCH: ‘They just do it!’ Stephen Dixon gives top tip for slashing car insurance

|GB NEWS

Drivers should switch providers at least 27 days before renewal

Don't Miss

Most Read

Drivers have been urged to buy car insurance policies at least 27 days before it is due to renew to help save costs as premiums reach an all-time high.

Experts have explained that drivers can fetch a better price on their car insurance premiums by shopping around at least 27 days before its due to renew instead of automatically going with the same provider which could be more costly.

One of the biggest cost hikes for drivers has been through automatically renewing policies which are subject to increases to fall in line with inflation and more people claiming, but by switching to somewhere else, motorist could get cheaper rates.

The latest data by the Association of British Insurers found that car insurance premiums now sits at £635, a one per cent increase from the previous quarter.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

ABI to help tackle costs of insurance

|GETTY

Tom Banks, motoring expert at Go.Compare, said: “These latest figures from the ABI will no doubt be welcomed by motorists, who have been feeling the impact of premiums increasing for some time now.

“The escalating cost of car insurance premiums in the past couple of years has been widely attributed to the rising costs of replacements and repairs, as well as inflation.

“It’s good news to see this is now stabilising and we will see this reduction in premiums being passed onto the policyholder.

“However, it also shows that the industry is working hard to keep the costs down for consumers so only time will tell if this can continue or whether we will see premiums increase again.”

Mervyn Skeet, director of general insurance policy at the ABI said that the group understands car insurance costs are putting pressure on household finances.

The figures showed how “competitive” the motor market is, with insurers reportedly absorbing cost rises but keeping prices relatively stable, Skeet continued.

While prices in the stats have recorded a slowdown in price increases, “we won’t be taking our foot off the gas when it comes to our work on tackling the cost of cover,” she added.

Although the ABI are working on reducing prices, Banks warned that as drivers there is very little they can do to change the insurance landscape externally, “but there are some things that you can do to help keep your own insurance costs down”.

The main cost barrier includes staying with the same insurance provider out of convenience instead of shopping around.

Last week the ABI said it would be stepping up its progress and support for drivers to help manage the costs of paying for insurance on a monthly basis.

Through the launch of the Premium Finance Principles, the organisation outlined how drivers should clearly be told what they will be paying every month to boost transparency in the sector.

The scheme also called for insurers to provide a clear comparison of the total cost of paying annually and the total cost of paying monthly before drivers agree to the terms.

LATEST DEVELOPMENTS:

- Drivers warned private parking changes are ‘confusing’ for motorists who continue to get fined 'unfairly'

- Millions of drivers at risk of Dartford Crossing fines as ‘several’ payment issues cause concern

- DVSA unveils huge MOT change affecting drivers across the country amid 'easily manipulated' documents

Car insurance went up £157 since January

|GETY

Prices for drivers went up by £157 since January with costs expected to continue rising this year.