Tax warning issued as ‘stealthy’ ploy to hammer income exposed

The new tax year starts today

Don't Miss

Most Read

Britons have been warned over a “stealthy” ploy by the Government to hammer personal income.

It comes as the new tax year comes into effect, meaning several changes have come into play that people will need to make a note of.

GB News Economics and Business Editor has issued a warning over the new changes, saying they are likely to have more of an impact on the individual as opposed to businesses.

He says this is mostly evidenced by the lack of change in personal tax allowance, creating a “fiscal drag” effect.

Liam Halligan has issued a warning over the Government's 'stealthy' tax move

|PA / GB News

Explaining the trend, he said: “Everybody gets a personal tax allowance. For the first £12,570 you earn, you pay no tax. But that tax allowance is frozen until 2028.

“Usually this would go up with inflation but because the allowance is frozen, as your wage goes up, more and more of your wage is dragged into a tax bracket.

“We can see, from £12,571 to £50,270, the vast majority of earners, you pay 20 per cent, but again that threshold will be frozen.

“If you get a pay rise, more and more of it will go to the higher rate of tax than the basic rate.”

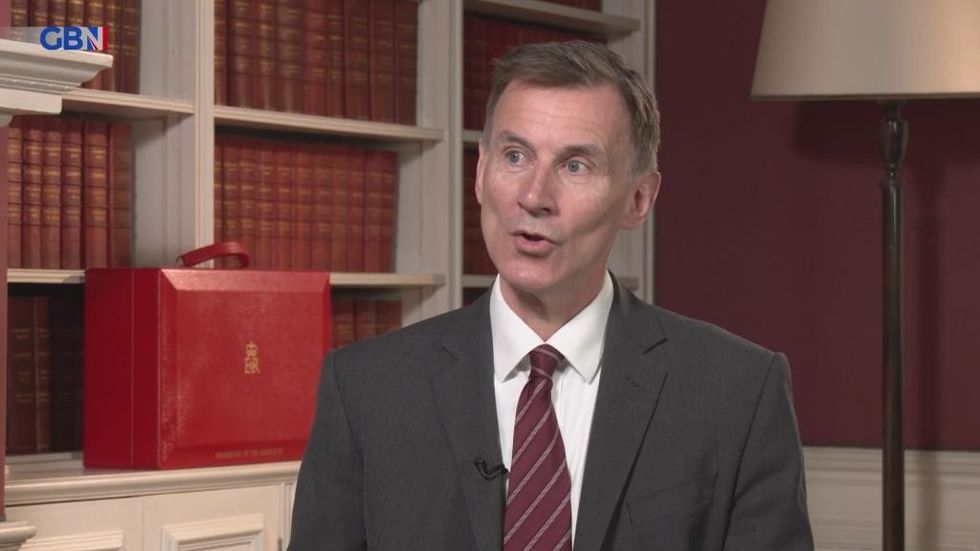

Jeremy Hunt announced new tax measures in his latest budget

|GB News

Liam Halligan says the threshold changes will have a significant impact on workers, with 2.6 million people being forced into paying a higher rate of tax.

The GB News Business and Economics Editor has criticised the Government over the trend, saying the changes have been imposed discreetly, leaving many Britons unprepared.

He told Mark Longhurst: “These changes will sit unhappily with a lot of Tory backbenchers.

“We’re starting from a point where the tax burden was already at the highest point since Clement Attlee.

“It’s a 70-year high and this is going to push us up more. If you look briefly at the budget measures it would seem income tax is staying where it is, but he’s hammering business.

“But actually, personal taxation is being hammered more than business taxation in my view, and it’s being done in a stealthy way.

“That’s why I think it’s important to take time to explain what is happening.”

It comes as some savers max out their new 2023-24 Isa allowances within minutes of the new tax year beginning.

The first customer to maximise their new Isa allowance of £20,000 did so at six minutes past midnight on Thursday April 6 according to Fidelity International Personal Investing.

Savers were also keen to use up their 2022-23 Isa allowances before the end of the old tax year on April 5.

DIY investment platform Bestinvest said its final Isa investment of the 2022-23 tax year came in at five minutes to midnight on April 5.

Its first contribution to an Isa in the new 2023-24 tax year was at 5.32am.