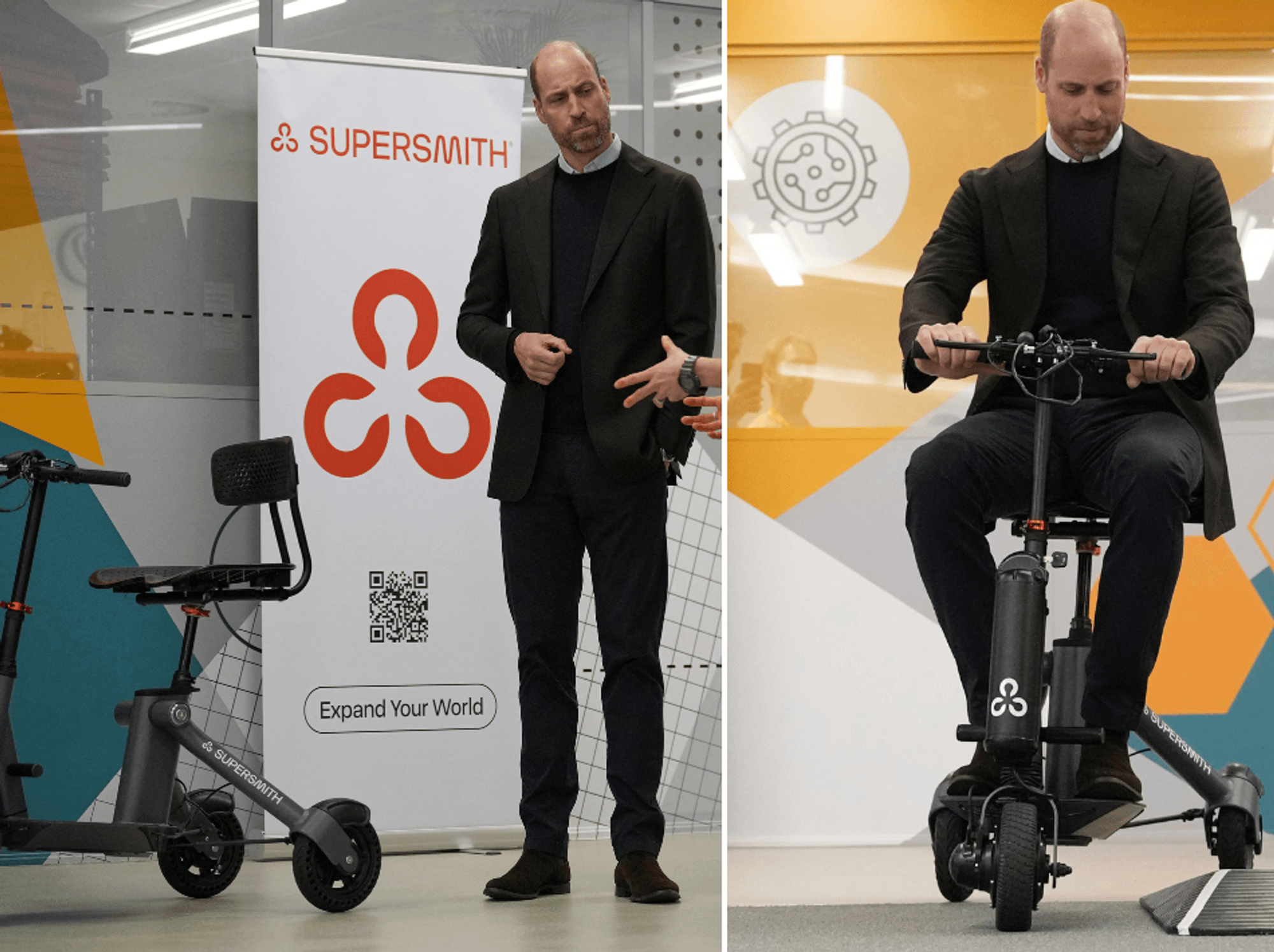

'Stealth tax must be scrapped. Taxpayers should get the relief they richly deserve' - John O'Connell

Rishi Sunak froze the income tax thresholds in 2021 and Jeremy Hunt extended it to 2028

|PA | GETTY

John O’Connell, chief executive of the TaxPayers’ Alliance, calls for politicians to end the ongoing tax threshold freeze which is dragging people into higher tax brackets

Don't Miss

Most Read

Latest

With inflation now within touching distance of the Bank of England’s two per cent target, the era of pernicious and continuous price hikes will finally be at an end. It’s been a brutal period.

There have been eye-watering price rises across a whole panoply of products. But the worst of it is over, and during the past year, some products have even fallen in price, such as butter, milk and petrol.

But the damaging effects of inflation will largely remain. Prices won’t go down across the board; they’ll only grow less quickly. And just as significantly, the impact of inflation on tax thresholds shows no sign of abating.

Ever since inflation first spiked, workers have understandably been demanding pay rises to help their pay packets keep pace with prices. Hence, from June to August 2023, the annual growth for regular pay was 7.8 per cent.

Tax thresholds will not increase until 2028

|GETTY

But as pay plays catch-up, tax rates have remained stubbornly frozen.

In 2021, then-Chancellor Rishi Sunak froze the personal allowance and higher rate income tax thresholds at £12,570 and £50,270, respectively.

Normally, they would rise with inflation, protecting people’s incomes.

The consequences are not just numbers on a page; they are deeply felt in our households.

Research by the TaxPayers’ Alliance found that 2.5 million more people are now paying income tax compared to 2021-22, with 1.1 million more people paying the basic rate and one million more paying the higher rate.

In another way of looking at it, in 2020/21 the personal allowance shielded 43 per cent of an average worker’s full-time earnings from taxation, providing a significant buffer.

Today, that figure has dropped to 36 per cent, meaning much more of someone’s hard-earned income is now taxable.

While ministers tout the two successive national insurance cuts as evidence of their tax-cutting efforts, the reality is more nuanced.

It’s certainly true that the cut from 12p to 8p is a positive move that has slowed the growth in the tax burden.

But for those on low and average incomes, it’s only a drop in the bucket compared to the far bigger impact of frozen thresholds.

Only for those earning around £50,000 does the National Insurance cut outweigh the impact of frozen thresholds.

This disparity underscores the need for a simpler approach to tax policy.

What cannot be forgotten is that this is a political choice.

Inflation has hit household incomes hard.

Many of the consequences cannot be remedied by the government.

They cannot dictate prices to businesses.

Nor can they force the Bank of England to cut interest rates, which have gone up in an attempt to bring inflation down but which have caused havoc with peoples’ mortgages.

READ MORE:

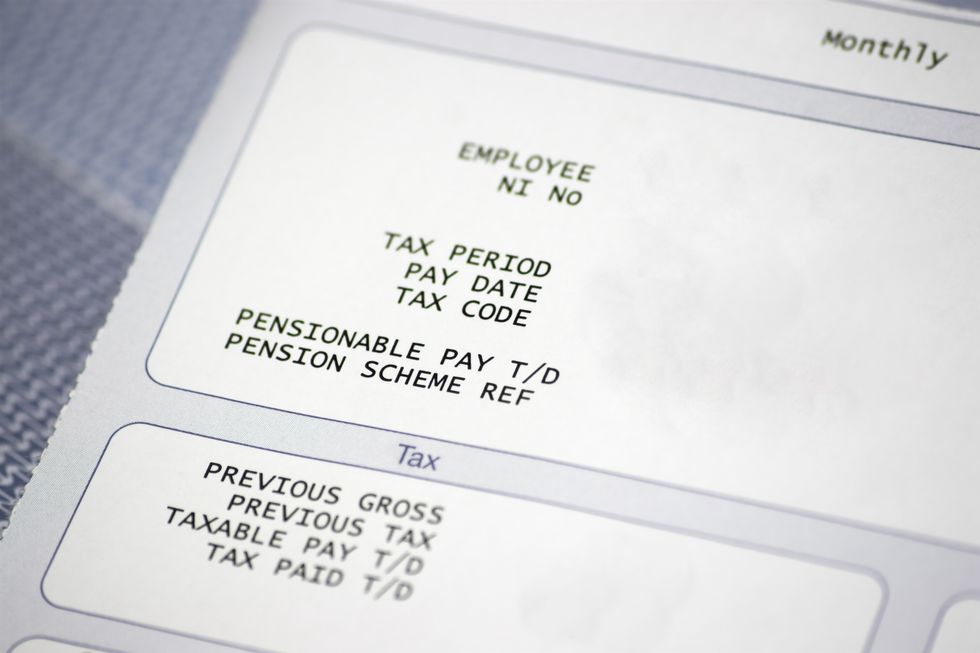

Tax thresholds are something the government has control over, the TaxPayers’ Alliance chief executive pointed out

|GETTY

But unlike price rises or interest rates, tax thresholds are something the government has control over.

They ultimately decide when people start paying tax, or start paying higher rates of tax.

This government won’t get another fiscal event to right these wrongs.

But whoever is in charge after July 4 should give taxpayers the relief they richly deserve by raising thresholds in line with inflation.