Santander to overhaul mortgage products in win for homebuyers - list of changes

EJ Antoni warns Bank of England 'should be worried' over exit of gold to US |

GB NEWS

Britons have been forced to contend with high mortgage costs but lenders, including Santander, are offering competitive deals

Don't Miss

Most Read

Latest

Santander has unveiled the latest overhaul to its line of mortgage products with dozens of new offerings set to be available to the bank's customers.

These latest changes from the lender will come into effect from tomorrow (May 2) in a win for prospective homebuyers navigating the property market.

Among the new products are 43 new build specific mortgages with a range of 60 per cent to 95 per cent LTV, two and five-year fixed rates, as well as two-year tracker rates.

Furthermore, cashback of £250 is also being rolled out for new build products from 85 per cent LTV up to 90 per cent LTV for first-time buyers and 95 per cent LTV for home movers.

Santander is launching new mortgage products

| GETTY/PAOn top of this, Santander is launching three-year fixed rate products and slashing interest rates across existing mortgage products, including its home mover, first-time buyer, remortgage, buy-to-let and large loans range.

Graham Sellar, the bank's head of Intermediaries, said: "There's a renewed focus on the new build market spurred on by the Government's ambition to create 1.5 million new homes, in part through new towns.

"We’re pleased to bolster our new build offering, alongside new three-year fixes and broad-reaching rate reductions, to support our brokers and customers access more options to help them on their homeownership journey."Research conducted by the lender found that nearly three-quarters of potential first-time buyers (FTB) and more than half (57 per cent) of next-time buyers would consider moving to a new build property in one of the proposed new town sites.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are concerned about rising mortgage costs

| GETTYAs well as this, more than four-fifths (83 per cent) of mortgage brokers believe that the new towns initiative will transform the homeownership market in the next year.

Here is a list of some of the new Santander mortgage products being rolled out tomorrow:

New build, new products - fixed

Home movers

- 60 per cent LTV two-year fixed rate, £999 fee, 3.89 per cent

- 60 per cent LTV five-year fixed rate, £999 fee, 3.92 per cent

- 85 per cent LTV five-year fixed rate, £999 fee, £250 cashback, 4.28 per cent

- 95 per cent LTV five-year fixed rate, £0 fee, £250 cashback, 4.90 per cent.

First-time buyers

- 60 per cent LTV two-year fixed rate, £999 fee, 3.94 per cent

- 85 per cent LTV two-year fixed rate, £999 fee, £250 cashback, 4.29 per cent

- 95 per cent LTV five-year fixed rate, £0 fee, £250 cashback, 4.99 per cent.

New build – new products – trackers

Home movers

- 60 per cent LTV two-year tracker rate, £999 fee, 4.64 per cent

- 75 per cent LTV two-year tracker rate, £999 fee, 4.90 per cent

- 90 per cent LTV two-year tracker rate, £0 fee, 5.54 per cent.

First-time buyers

- 60 per cent LTV two-year tracker rate, £999 fee, 4.69 per cent

- 75 per cent LTV two-year tracker rate, £999 fee, 4.95 per cent

- 90 per cent LTV two-year tracker rate, £0 fee, 5.59 per cent.

LATEST DEVELOPMENTS:

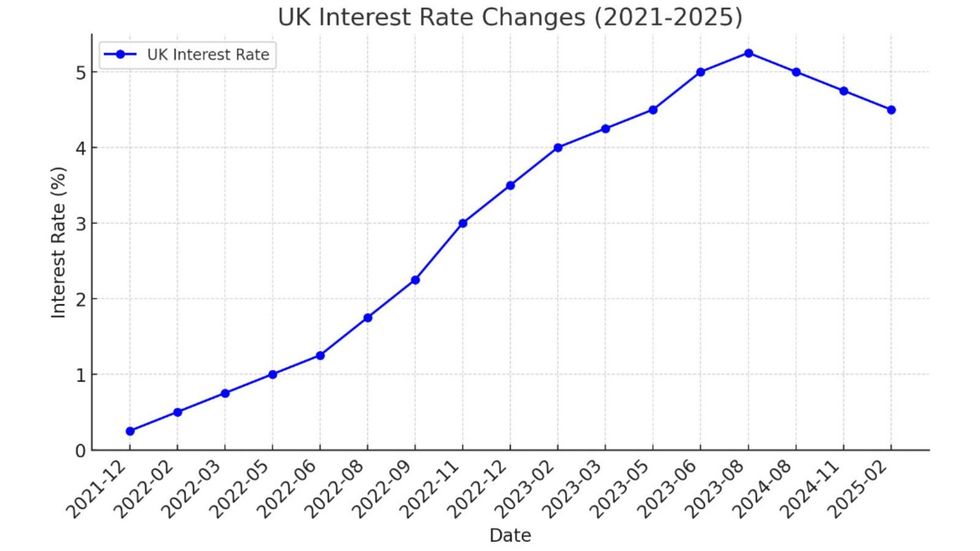

The Bank of England has made multiple changes to the base rate in recent years | CHAT GPT

The Bank of England has made multiple changes to the base rate in recent years | CHAT GPT Three year-fixed – new products

Home movers

- 85 per cent LTV three-year fixed rate with a £999 fee, £250 cashback, 4.49 per cent

- 90 per cent LTV three-year fixed rate, £999 fee, £250 cashback, 4.75 per cent

- 95 per cent LTV three-year fixed rate, £0 fee, £250 cashback, 5.23 per cent.

First-time buyers

- 85 per cent LTV three-year fixed rate, £999 fee, £250 cashback, 4.49 per cent

- 90 per cent LTV three-year fixed rate, £999 fee, £250 cashback, 4.75 per cent

- 95 per cent LTV three-year fixed rate, £0 fee, £250 cashback, 5.23 per cent.