Net zero ‘madness’ blamed as eye-watering inflation remains stubbornly high - ‘So thick!’

Richard Tice has slammed the Net Zero drive

|Parliament / GB News

The Bank of England is expected to raise the base rate for the 13th time in a row

Don't Miss

Most Read

Interest rates remaining stubbornly high has been attributed to the “mad” push for Net Zero by Reform UK leader Richard Tice.

On Thursday, the Bank of England is expected to raise the base rate for the 13th time in a row, having already increased it from 0.1 per cent in December 2021 to 4.5 per cent, where it currently stands.

Inflation in Britain continues to soar, as revealed by new figures released by the Office for National Statistics (ONS) on Wednesday.

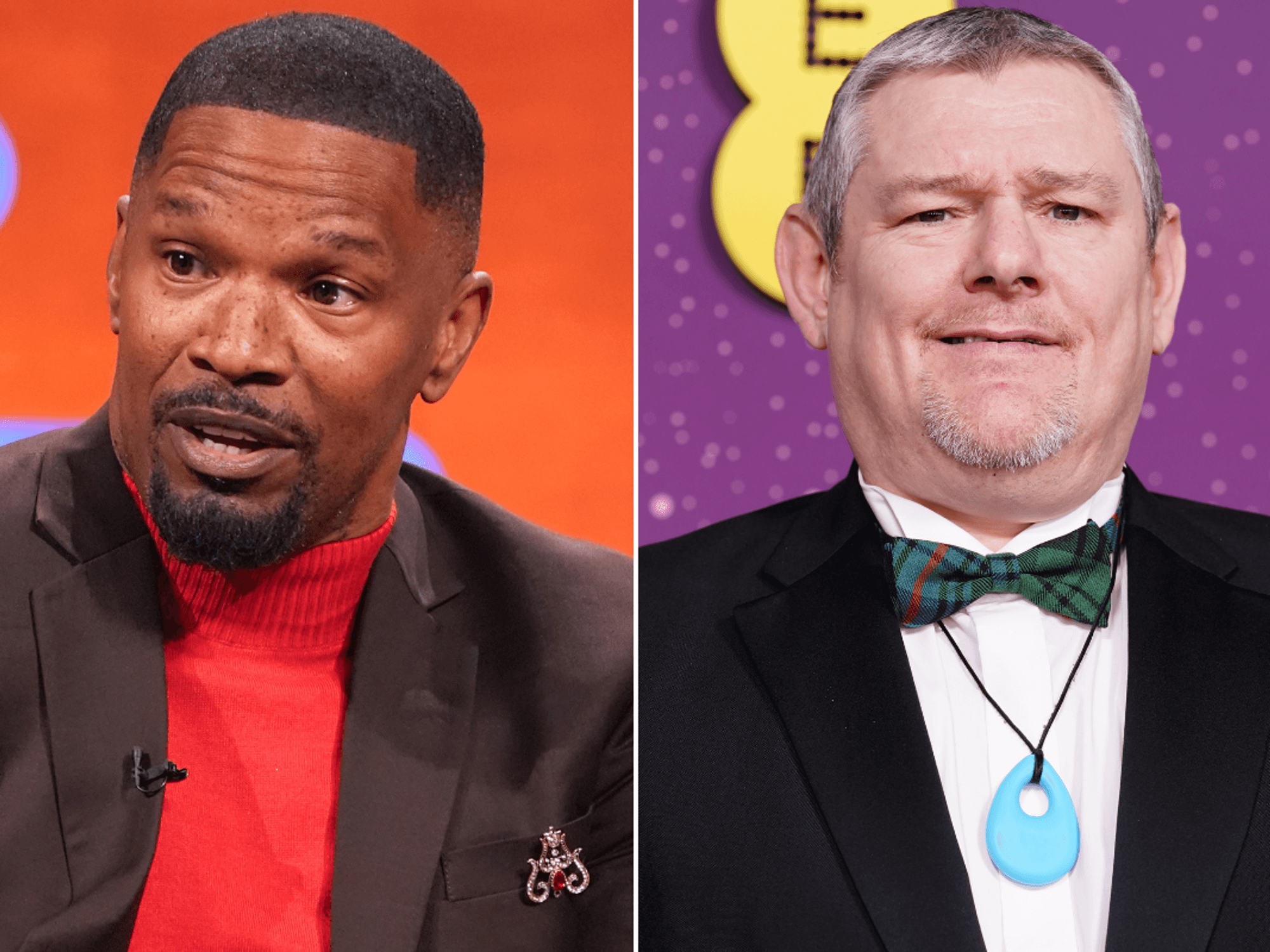

Speaking on GB News, Reform Party leader Richard Tice says he expects Brexit to shoulder the blame for the perilous situation, but feels the leading contributor is the Government’s drive for Net Zero.

He told Bev Turner and Andrew Pierce: “This was not a shock to me. We have the highest energy costs, the highest electricity costs in the Western world.

“This is the price of Net Zero, be under no illusions whatsoever.

“Those energy prices are going through everybody’s bills including businesses who will therefore have to raise the price of food and so on and on.

“We are uncompetitive. What does the Government and the Bank of England think? It’s the definition of madness to keep doing the same thing and expect a different answer.

“Why would you keep raising interest rates when it’s making not a jot of difference?

“They are so stupid. They are so thick. It absolutely infuriates me.

“What is the Governor of the Bank of England still doing in his job? He has failed, he should resign, or be fired.”

Andrew Pierce pointed out that the Governor of the Bank of England must be deemed “mentally incapacitated”.

The Bank of England | PA

The Bank of England | PATice responded: “Frankly, I think we’re pretty close to that.

“This is unbelievable and there is nothing that is going to change this. We have the highest percentage of renewable and offshore wind in the world.

“Gas prices are back to 2021 levels, electricity prices are still where they were.

“This is the reason, and it’s about time this country wakes up to what is going on.”

A report by the IFS said that, in March 2022, households with a mortgage were spending an average of £670 per month on mortgage payments, £230 of which was interest.

On average, those in mortgage-holding households face paying nearly £280 more each month, with 30 to 39-year-olds paying nearly £360 more, the IFS said.

The report continued: “This will be a significant hit to mortgagors’ disposable incomes (incomes after mortgage payments) at a time that families are already under strain – on average disposable incomes will fall by 8.3%, with those aged 30-39 again seeing the biggest hit (almost 11%).

“For some the rise will be substantially larger: almost 1.4 million – 690,000 of whom are under 40 – will see their disposable incomes fall by over 20%.”

Those in London will face the largest hits, with mortgage payments rising by around 12% of disposable income on average, the IFS said.

Mortgagors in Northern Ireland are the least exposed, losing around 5.3% of disposable income typically, according to the IFS.