Child Benefit alert: HMRC payments to stop for thousands of parents next month - are you affected?

Stella Creasey says cutting benefits will not 'magically' create jobs for unemployed |

GB NEWS

Millions of households claim Child Benefit but thousands are in line to lose their payments in May

Don't Miss

Most Read

Thousands of parents across the UK are set to see their Child Benefit payments stop at the end of this month. The upcoming May 31 cut-off date will affect families whose children are leaving approved education or training.

Over seven million families currently claim Child Benefit, which provides crucial financial support for those responsible for children. Child Benefit is currently valued at £26.05 per week for the first child, with £17.25 paid for each subsequent child.

The benefit can be claimed by anyone responsible for a child under 16, or under 20 if they remain in approved education or training, and is administered by HM Revenue and Customs (HMRC).

When a child leaves their approved education or training, payments will terminate at specific cut-off dates throughout the year - the end of February, May 31, August 31 or November 30, whichever comes first.

Households are being reminded of a looming Child Benefit deadline

|GETTY

The next deadline for Child Benefit payments to stop is May 31. To be eligible for Child Benefit, the child typically needs to live with you. Alternatively, you must contribute at least the same amount as Child Benefit towards their upkeep.

There's no limit to how many children you can claim Child Benefit for. However, if two people are caring for a child, only one person can claim the benefit.

Foster parents can claim Child Benefit, provided the local council isn't contributing towards the child's accommodation or maintenance.

Adoptive parents are also eligible to receive these payments. Those caring for a friend's or relative's child may qualify for Child Benefit too, offering support to various family arrangements.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

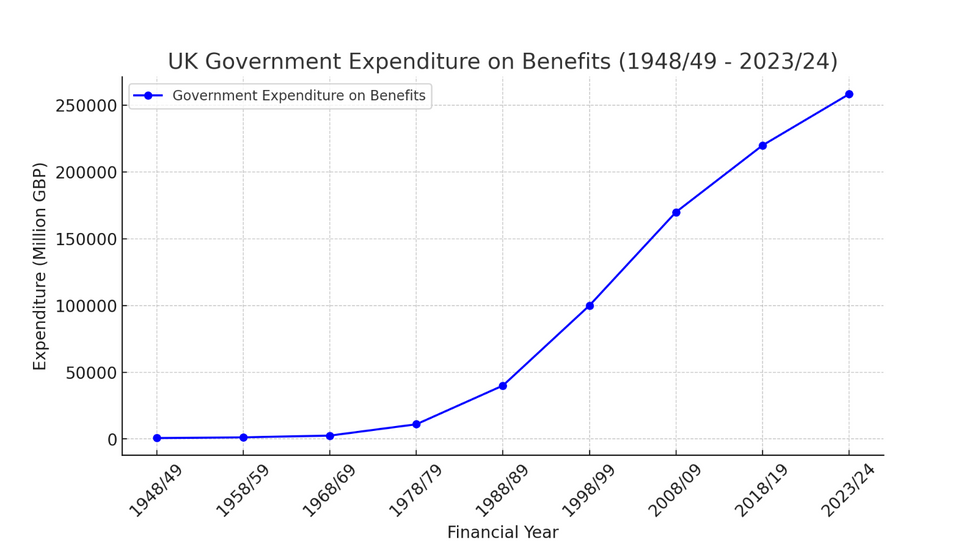

The UK government's expenditure on benefits has also increased over time, with the largest increase in 2020/21 due to the COVID-19 pandemic | ChatGPT

The UK government's expenditure on benefits has also increased over time, with the largest increase in 2020/21 due to the COVID-19 pandemic | ChatGPT Higher earners may need to repay some of their Child Benefit through the High Income Child Benefit Charge. The threshold for this charge was recently increased from £50,000 to £60,000 in April 2024.

HMRC highlighted this change on social media, tweeting: "Opted out of Child Benefit payments and earn under £80k? You may be missing out on support."

The charge requires repayment of one per cent of Child Benefit for every £200 earned above the £60,000 threshold. Once income exceeds £80,000, the entire amount of Child Benefit must be repaid.

This charge is typically settled annually through a self-assessment tax return, requiring careful financial planning for higher-earning families.

Changes are on the horizon for how families can manage this charge. A new digital service is expected to launch in summer 2025.

This will allow families to pay the High Income Child Benefit Charge through their PAYE tax code rather than solely through self-assessment.

LATEST DEVELOPMENTS:

Parents are being urged to check their Child Benefit eligibility

| GETTYAccording to the Government, the change aims to simplify the process for working parents.

For those wanting to avoid the charge yet still secure important state pension benefits, it's possible to claim Child Benefit without actually receiving the payments.

This option allows parents to accrue National Insurance credits which contribute towards their state pension.

HMRC has been actively encouraging eligible parents to consider this option, particularly those earning between £60,000 and £80,000.