State pension crisis as thousands of Britons have 'concerning awareness gap' over major change next year

Keir Starmer quizzed by Christopher Hope on whether pensioners will receive an apology for his winter fuel allowance cuts. |

GB NEWS

The state pension age is changed regularly due to various factors, including life expectancy data

Don't Miss

Most Read

New research from the Institute of Fiscal Studies (IFS) has revealed that more than 130,000 people approaching retirement have incorrect knowledge about when they can claim their state pension.

The think tank's analysis found that 22 per cent of those surveyed either underestimate their state pension age or are completely unaware of when they become eligible.

As it stands, Britons are able to access the state pension once they turn 66 years old, but this is expected to jump to 67 next year.

The research, based on data from the English Longitudinal Study of Ageing, examined responses from people born between 1955 and 1965 who were interviewed between 2021 and 2023.

Britons are being reminded of an upcoming change to the state pension in 2026

|GETTY

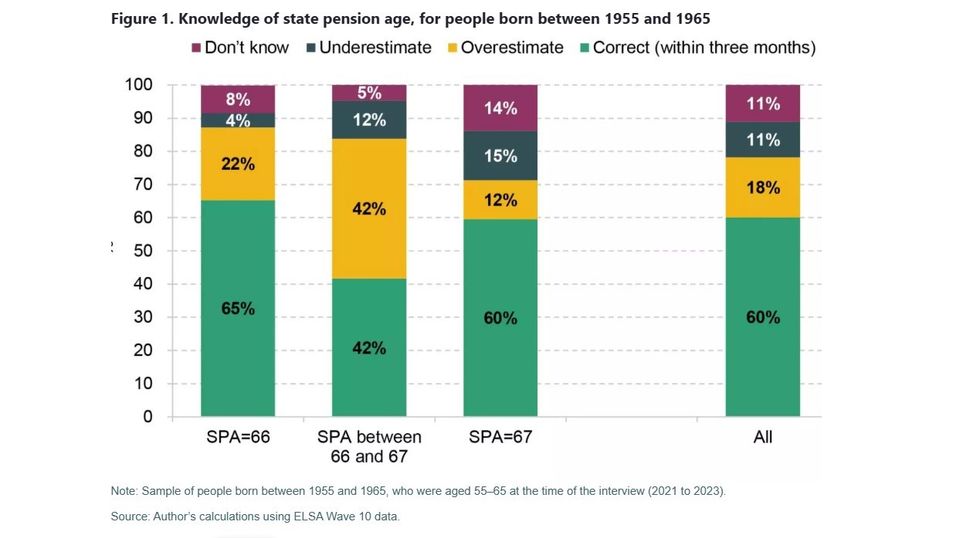

The IFS analysis showed that whilst approximately 60 per cent of respondents correctly identified their state pension age within three months, significant knowledge gaps remain.

Among those surveyed, 18 per cent overestimated their pension age, believing it to be higher than it actually is.

The research found that 11 per cent had no knowledge of their state pension age whatsoever, whilst another 11 per cent underestimated when they could claim.

Those with a state pension age between 66 and 67 demonstrated particularly poor awareness, with only 42 per cent correctly reporting their eligibility date.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The IFS's research into the state pension age suggests thousands of Britons lack essential knowledge of looming changes

|IFS

Heidi Karjalainen, a senior research economist from the Institute of Fiscal Studies, warned about the serious implications of these knowledge gaps.

"This gap in awareness is concerning because it can lead to financial risks," the economist explained.

"Many people in their late 50s and early 60s make consequential decisions around when to retire, how much to save, and how and when to draw down on their wealth.

"Some of those people may therefore be making these critical decisions based on incorrect assumptions about when they can start claiming the state pension.

"And for most, the state pension will represent a large part of their retirement resources."

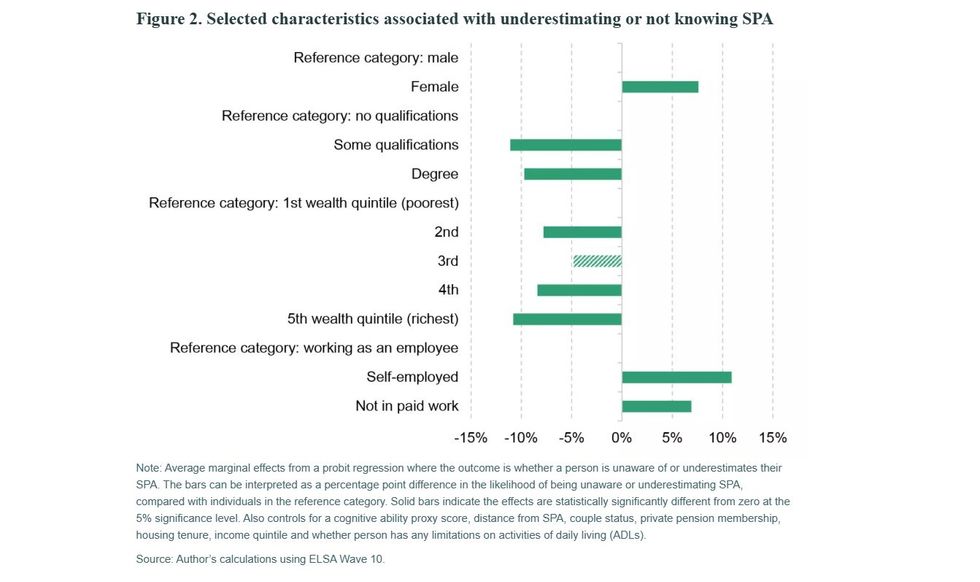

The research identified particularly vulnerable groups who are more likely to have incorrect knowledge about their state pension age.

LATEST DEVELOPMENTS:

Certain demographics are more aware of state pension changes than others, according to datea

|IFS

Women, individuals with lower educational qualifications, those with less wealth, self-employed workers and people not in paid employment face higher risks of misunderstanding their eligibility date.

The wealth divide proved especially stark, with those in the highest wealth bracket being 11 percentage points less likely to be unaware or underestimate their state pension age compared to those in the lowest wealth bracket.

People not in paid employment were seven percentage points more likely to have incorrect knowledge than those working as employees.

The state pension age in the UK is rising to 67 between April 2026 and April 2028, impacting those born on or after April 6, 1960.

More From GB News