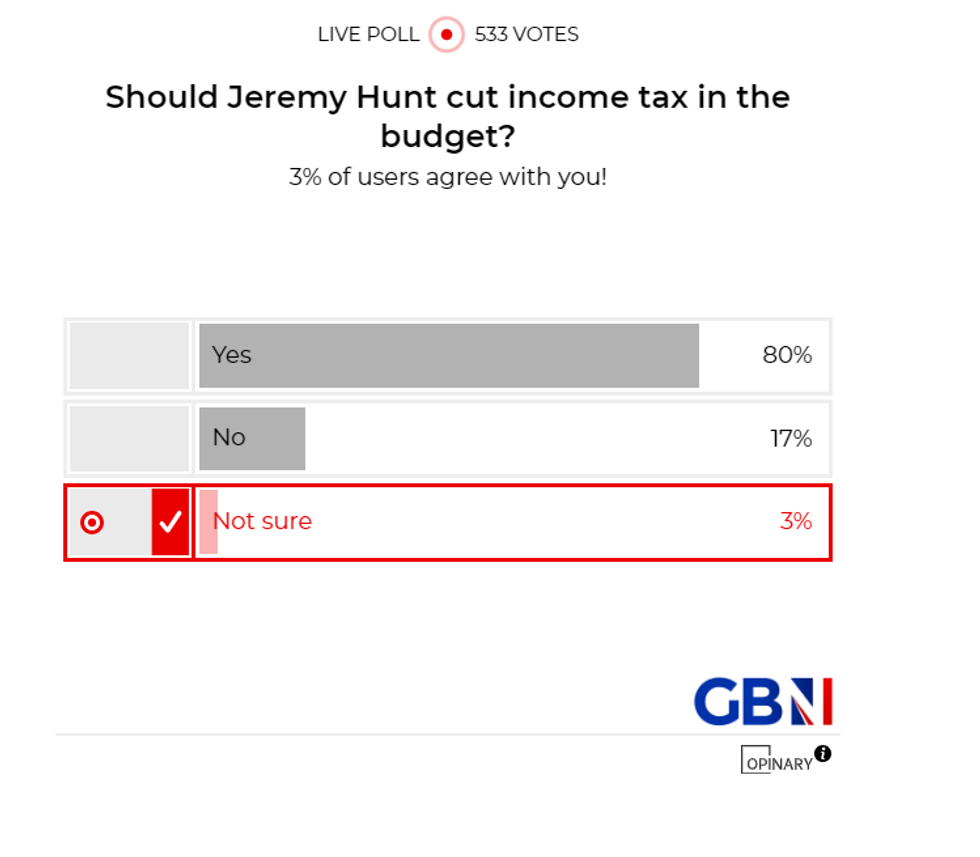

POLL OF THE DAY: Should Jeremy Hunt cut income tax in the budget? - YOUR VERDICT

Jeremy Hunt is expected to announce a reduction in the main rate of National Insurance | PA

GB News membership readers were asked whether they think that Jeremy Hunt should cut income tax in the budget

Don't Miss

Most Read

Latest

Jeremy Hunt is set to announce the Spring Budget later today, in what could be the final budget before the general election.

The Chancellor is expected to announce that the National Insurance rate will be reduced by a further two percentage points.

The Times claims Mr Hunt will suggest the rate reduction is worth a total of £900 for the average worker.

This figure takes into account the two percentage point cut that was announced in the Chancellor’s Autumn Budget last year.

POLL OF THE DAY: Should Jeremy Hunt cut income tax in the budget? - YOUR VERDICT

|GB News

Analysis carried out by HW Fisher found that a reduction in the main rate of National Insurance would mean a saving of £448.60 next year for someone earning £35,000.

However, due to tax thresholds being frozen until 2028, taxpayers are set to see their tax burden increase.

Reports suggest this rumoured change to National Insurance means an income tax cut is off the table.

Sam Dewes, a tax partner at the accountancy firm, suggested that Jeremy Hunt has few options available to him ahead of the Budget.

He explained: “It appears the Chancellor has limited room for broader tax giveaways, potentially viewing National Insurance cuts as a more affordable option for the Government by targeting workers, rather than cutting income tax instead.

“However, any benefits of a two per cent National Insurance cut will be capped at £754 per year for workers above £50,270 unless adjustments are made to the upper National Insurance rate."

80 per cent of GB News membership readers who voted in the poll agreed with the statement that Jeremy Hunt should cut income tax in the budget, while 17 per cent disagreed.