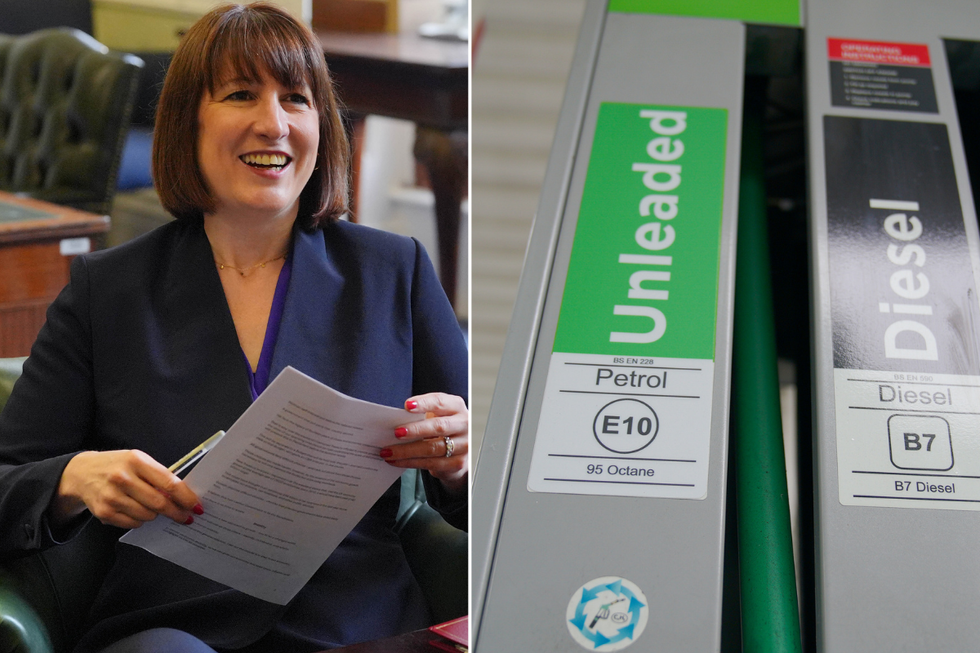

Rachel Reeves could hike fuel duty next year to help push millions onto electric vehicles

Fuel duty will remain frozen at 5p until March 2026

Don't Miss

Most Read

Latest

Drivers have been warned that Chancellor Rachel Reeves could increase fuel duty in March 2026 when the current 5p per litre benefit runs out as Labour looks to encourage more drivers to switch to electric vehicles.

The temporary reduction, which was extended in the Autumn Budget last year, has contributed to declining fuel duty revenues, with the Government now needing to plug the gap.

Experts have suggested that one way to ensure fuel duty remains a key revenue stream would be to increase it after the extension period finishes in March next year.

This could help support the Government's ambitious Zero Emission Vehicle mandate, which requires all new car sales to be electric by 2030.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The fuel duty freeze will expire in March next year | PA

The fuel duty freeze will expire in March next year | PAAccording to reports, the current fuel duty rate is the lowest in cash terms since March 2009, following an 11-year freeze before the cut was introduced under the Conservative Government in 2022.

While beneficial for the cost of living crisis, the low rate has not helped encourage the transition to low and zero emission vehicles, according to industry specialists.

The latest figures from HMRC have revealed that fuel duty receipts for the financial year April 2024 to March 2025 totalled £24.7billion a drop of £200million compared to the same period last year.

The declining tax take comes despite overall HMRC tax receipts increasing by £28.1billion across all revenue streams during the same period.

In percentage terms, fuel duties saw a one per cent reduction year-on-year, according to the monthly tax bulletin, with the downward trend attributed partly to the temporary 5p per litre reduction as well as changing consumer behaviour.

Sheena McGuinness, co-head of Energy and Natural Resources at RSM UK, said: "While this helps with the cost-of-living, it is not encouraging drivers to make the switch to low and no-emission vehicles.

"It is expected that, come March 2026, this will increase to motivate consumers to shift to electric vehicles and support the government's ambitious targets to reduce the number of petrol and diesel vehicles by 2030."

She queried how, as declining fuel duty revenues continue, "what form of alternative funding mechanism will replace the fuel duty to maintain the current tax take?"

McGuinness did note that the Government has ruled out introducing road pricing but stressed that "industry and consumers alike need a long-term strategy and some certainty on the future cost of motoring to support the transition to electric vehicles".

Electric vehicle adoption across the UK has been growing, but experts have warned that in order to meet the new 2030 ZEV mandate, more support will be needed to encourage drivers to switch.

Industry analysts suggest that as electric vehicle adoption increases, the Government faces a funding challenge with diminishing fuel duty revenues.

The current low fuel duty rate has provided relief to motorists during a period of economic pressure, but experts warn this comes at the cost of slowing the transition to greener transport options.

LATEST DEVELOPMENTS:

Drivers could see fuel duty rates rise in the October Budget | PA

Drivers could see fuel duty rates rise in the October Budget | PAHMRC shared: "As announced at Autumn Budget 2024, this measure extends the temporary cut in the rates of fuel duty first introduced at Spring Statement in March 2022 for a further 12 months.

"This 5 pence per litre cut will end on 22 March 2026. In addition, the planned increase in line with inflation for 2025 to 2026 will not take place.

"Taken together, this will maintain fuel duty rates at current levels for another year and represents a reduction of around 7 ppl for main petrol and diesel rates in comparison to previous plans."