Yorkshire Building Society increases interest rates on savings accounts

Yorkshire Building Society has said interest rates on variable rate savings accounts will rise

|PA

Yorkshire Building Society's interest rate boost marks the eleventh time it has passed rises on to savers since February last year.

Don't Miss

Most Read

Yorkshire Building Society will automatically add up to 0.25 per cent to all its variable rate savings accounts following Thursday's Bank of England base rate rise.

The changes will come into force automatically by Thursday, August 10.

Chris Irwin, director of savings at Yorkshire Building Society, said: “With the Bank rate continuing to rise, we’re sure it will be welcome news to our savers to hear we’re increasing the interest rate on our accounts yet again.

“Our decision to pass on this latest Bank rate rise maintains our commitment to delivering value to our members. Increasing rates across all of our variable rate savings - including our member loyalty savings accounts - continues to reflect our purpose of supporting our savers.”

The Rainy Day Saver Issue 2 will have a new rate of 4.55 per cent on balances up to £5,000 and 3.9 per cent above this level, under the changes.

The Regular Saver rate will also increase, rising to 5.25 per cent.

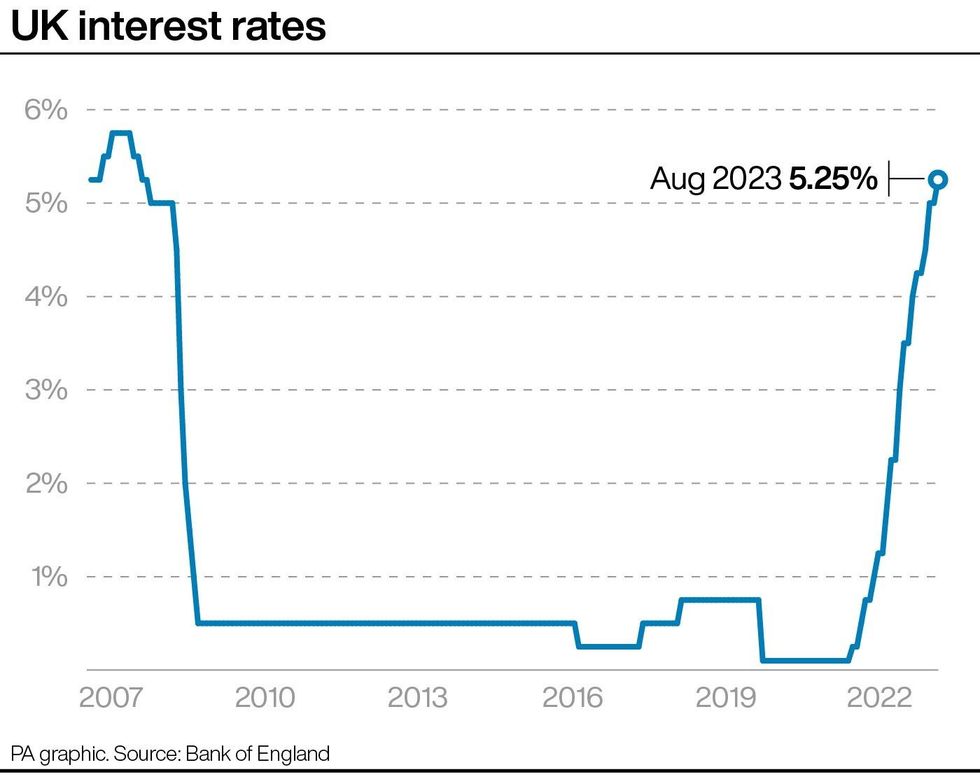

The announcement came after the Bank of England increased the base rate by 0.25 percentage points to 5.25 per cent, as it continues to try to put the brakes on inflation.

The Bank of England base rate rise has been a further blow for homeowners with a mortgage

|PA

Commenting on the central bank’s decision, Myron Jobson, senior personal finance analyst at interactive investor, said: “While an uptick in interest rates means that borrowing is more expensive, the silver lining is savings rates are likely to tick higher.

“There might be a bit more urgency among banks and building societies to pass on the base rate rise to their savings products this time around as the Financial Conduct Authority has recently gained new powers to take robust actions against those offering unjustifiably low rates.

“The city watchdog has wasted no time in exercising its new powers, gained under the Consumer Duty, by setting out a 14-point plan to make sure that interest rate rises are passed on to savers appropriately.”

Rising interest rates should in theory mean savings become more attractive, however, inflation remains higher than most rates offered to savers.

Mr Jobson warned: “It is important to bear in mind that buying power of cash saving continues to be eroded by inflation which, at 7.9 per cent, far outstrips the market leading savings rates.

“Those who can afford to put money away for five years or more should consider investing for the potential of long-term inflation-beating returns that far outstrip savings rates.”

Following the base rate decision, savers are being urged to check if they are benefitting from competitive savings rates.

Rachel Springall, finance expert at Moneyfactscompare.co.uk, said: “The savings market has benefitted from consecutive base rate rises and an injection of much-welcomed competition, particularly from challenger banks looking to raise funds for their future lending.

“It is imperative savers take time to review their existing accounts and not presume any base rate rise will be passed onto them, as this is never guaranteed.

“Those savers who have their cash sitting in an easy access account for convenience may find their loyalty is not being repaid, indeed, savers are earning just 1.50 per cent from the Everyday Saver from Barclays Bank, but the top easy access accounts pay more than four per cent.”

LATEST DEVELOPMENTS:

The Bank of England has increased the base rate taking it to the highest level since 2008

|PA

The savings expert suggested savers consider looking at alternative brands, such as building societies and challenger banks, offering “attractive returns”.

Becky O’Connor, Director of Public Affairs at PensionBee, said the rate rises would be welcomed by savers who see it passed on.

She said: “For people with savings accounts, a large proportion of whom are retirees who keep some or all of their life savings in cash, the rate rises are very welcome - provided their money is in an account that passes them on.

“Sadly, many will be missing out on the benefit of rate rises for savings by keeping their cash with a provider that is not passing on rises.”