Nationwide Building Society increases interest rates on 10 savings accounts

Nationwide Building Society has increased interest rates on a range of savings accounts

|PA

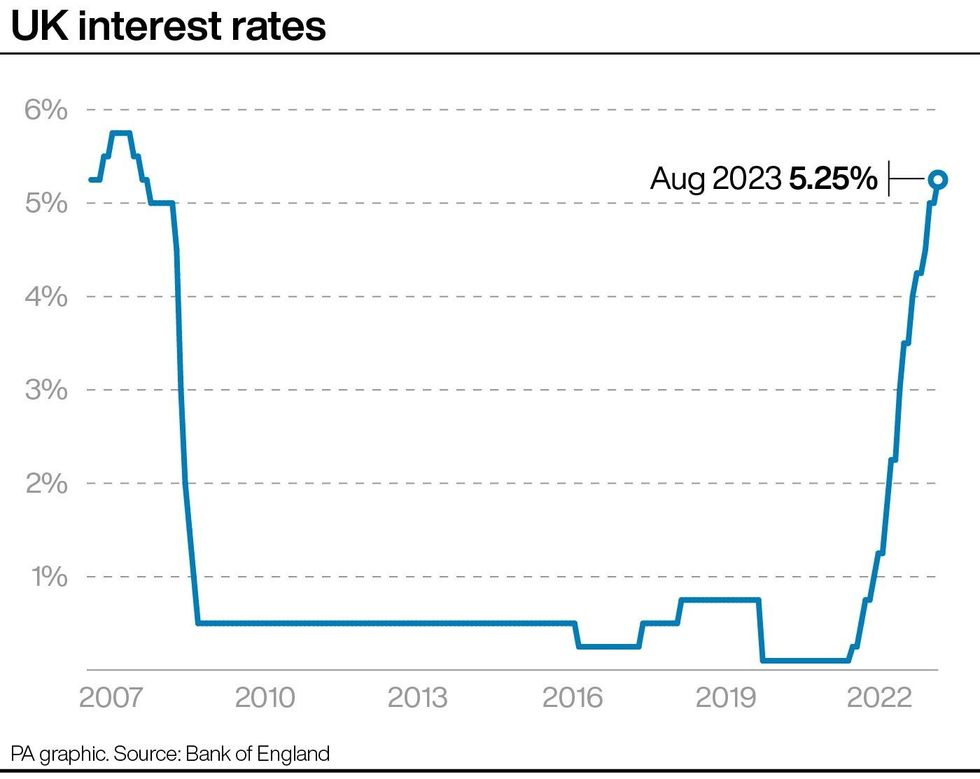

Nationwide’s interest rate rises come shortly after the Bank of England increased the base rate for the 14th consecutive time.

Don't Miss

Most Read

Nationwide Building Society is increasing interest rates by up to 0.75 percentage points across a range of savings accounts.

It is the fifth time this year that the building society has raised interest rates for existing members following the changes to the Bank of England base rate.

Tom Riley, director of retail products at Nationwide Building Society, said: “As a mutual, we are always keen to support savers and pay the best rates we can sustainably afford, which is why we are increasing rates on our most popular variable rate accounts.

"As a result of these changes, the vast majority of savers will see an increase in their rate.”

Nationwide Building Society has increased interest rates for existing members five times this year following Bank Rate changes

|PA

The Triple Access Online Saver account will pay 4.25 per cent, up from 3.5 per cent, from August 16.

From the same date, current account holders who save in the Flex Instant Saver 2 will get 3.25 per cent, previously three per cent.

Further changes will take effect from September 1. These are:

- The Triple Access Online ISA will increase from 3.5 per cent to 4.25 per cent

- Existing customers saving in Loyalty Saver, Loyalty ISA and Loyalty Single Access accounts will see rates increase from 3.5 per cent to 3.75 per cent

- Rates on all instant access accounts, including the Instant Access Saver, Instant ISA Saver and Cashbuilder, will rise to either 2.25 per cent, 2.30 per cent or 2.35 per cent, depending on the amount saved.

Nationwide also said the Instant Access Saver – Issue 10 will increase from 2.30 per cent to 2.40 per cent.

Yorkshire Building Society has also announced it will increase interest rates following today's base rate rise.

The building society will be upping the interest rates offered on its variable savings accounts "soon".

Money experts are urging savers to make sure they are taking advantage of the most attractive interest rates being offered on savings.

LATEST DEVELOPMENTS:

The Bank of England base rate has increased again

|PA

Rachel Springall, finance expert at Moneyfactscompare.co.uk, said: “The savings market has benefitted from consecutive base rate rises and an injection of much-welcomed competition, particularly from challenger banks looking to raise funds for their future lending.

“It is imperative savers take time to review their existing accounts and not presume any base rate rise will be passed onto them, as this is never guaranteed."

Myron Jobson, senior personal finance analyst at interactive investor, said the "silver lining" of today's rise is savings rates are "likely to tick higher".

He added: “There might be a bit more urgency among banks and building societies to pass on the base rate rise to their savings products this time around as the Financial Conduct Authority has recently gained new powers to take robust actions against those offering unjustifiably low rates."