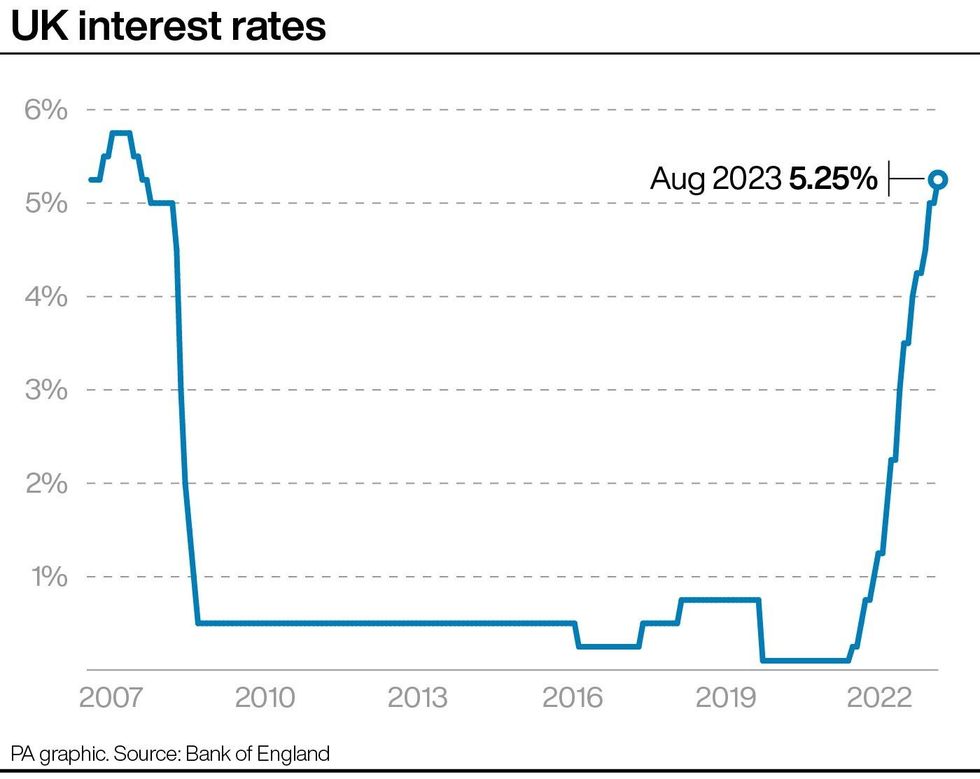

Bank of England increases interest rates to 5.25 per cent - highest since 2008

Digi Liam Halligan interest rates rise britai |

The Bank of England base rate rise marks the 14th consecutive increase in interest rates.

Don't Miss

Most Read

Latest

The Bank of England has increased the base rate by 25 basis points to 5.25 per cent, the highest it’s been since 2008.

The move is a further blow for millions of homeowners facing rising mortgage rates.

Rachel Springall, finance expert at Moneyfactscompare.co.uk, said the latest base rate rise would be “disappointing news” to borrowers worried about rising mortgage payments.

She added: “Those who still have a low-rate fixed mortgage would be wise to overpay where they can, with the aim of reducing their loan and the term of their mortgage.

The Bank of England has tried to ease inflation by increasing interest rates

|PA

“Interest rates on mortgages are much higher than some may realise, so borrowers will need to ensure they have surplus funds to meet higher repayments when they come off a lower rate deal.

“Consumers struggling with their outgoings amid the cost of living crisis, or who have become a ‘mortgage prisoner’, would be wise to seek independent advice to review their situation.”

Greg Marsh, CEO and founder of household money-saving tool Nous.co, said: “Another Bank of England rate rise means acute pain for the millions of mortgage holders who will be refinancing before the end of 2024."

Mr Marsh warned a household with a typical £200,000 mortgage who fixed two years ago and is moving to a new deal today could expect monthly payments to increase by £490 a month. This equates to an extra £5,880 a year.

Victor Trokoudes, founder and CEO and smart money app Plum, said: “A base rate of 5.25 per cent is still not great news for anyone with a mortgage, but it is less painful than a higher increase which looked likely only a few weeks ago.”

The central bank predicted that Consumer Prices Index (CPI) inflation will fall to 4.9 per cent in the final quarter of 2023, and remain above two per cent until mid-2025.

CPI rose by 7.9 per cent in the 12 months to June 2023, down from 8.7 per cent in May.

Six members of the nine-strong Monetary Policy Committee chose to increase the base rate by 0.25 percentage points, with two voting for a half-point increase, while one preferred to keep the rate at five per cent.

Chancellor of the Exchequer, Jeremy Hunt said: “If we stick to the plan, the Bank forecasts inflation will be below three per cent in a year's time without the economy falling into a recession.

“But that doesn't mean it's easy for families facing higher mortgage bills so we will continue to do what we can to help households."

Myron Jobson, senior personal finance analyst at interactive investor explained that while the Bank of England doesn’t set mortgage rates, the bank's decisions influence how rates move.

He said: “Lenders have already anticipated a hike in interest rates, meaning much of this is already priced into fixed rate deals.

“But the 2.2 million homeowners on variable rate mortgages, which are tied to the Bank of England’s base rate, will continue to feel the full brunt of the expected increase in interest rates as part of the UK’s central bank’s efforts to drag inflation closer to its two per cent target.”

Mortgage rates have started to edge higher, with the typical two-year fixed mortgage rate now 6.85 per cent, and 6.37 per cent for five-year fixes, according to new figures by Moneyfacts this week.

LATEST DEVELOPMENTS:

The Bank of England base rate has been increased to 5.25 percent

|PA

Mr Jobson added: “The fact remains that we’ll need to see a significant and sustained fall in inflation before mortgage rates move meaningfully lower."

Lyn Weston, director of church engagement at Christians Against Poverty, told GB News this morning: “Our clients are already struggling with debt... What this means is people just can’t afford the basics – rent, mortgage, food.”

She warned an interest rate rise “is going to cause even more anxiety”, adding: “It’s heartbreaking to see what’s happening.”

Property expert Jonathan Rolande urged borrowers to check they’re on the best possible deal they can be on.

He added: “Then it’s a case of getting all outgoings down as low as possible and income up as high as possible.”

Addressing prospective buyers, the property expert said he echoes Rightmove’s motto of “there’s never a perfect time to buy, only the right time”.

“If you’ve just got engaged or just want to buy a house with a partner, how much longer do you want to wait?

“What are the alternatives – staying with mum and dad, or renting? That’s not ideal for lots of people.”