Savers urged to 'keep an eye on ISA allowances' as Rachel Reeves could launch tax raid

Britons are able to save up to £20,000 annually tax-free into ISA products

Don't Miss

Most Read

Savers are being urged to "keep an eye" out for a potential stealth tax raid as reports circulate that Chancellor Rachel Reeves may reduce the £20,000 Cash ISA allowance in the upcoming Autumn Budget.

The concerns follow Wednesday's Spending Review, which has left the personal finance landscape "in a state of flux", according to Myron Jobson, senior personal finance analyst at interactive investor.

In this year's Spending Review, the Chancellor pledged to bolster public funding health, energy and infrastructure but analysts are warning a likely tax raid in this year's Autumn Budget looms.

With Reeves ruling out hiking taxes on "working people", experts believe HM Revenue and Customs (HMRC) could target pensions, inheritance and savings.

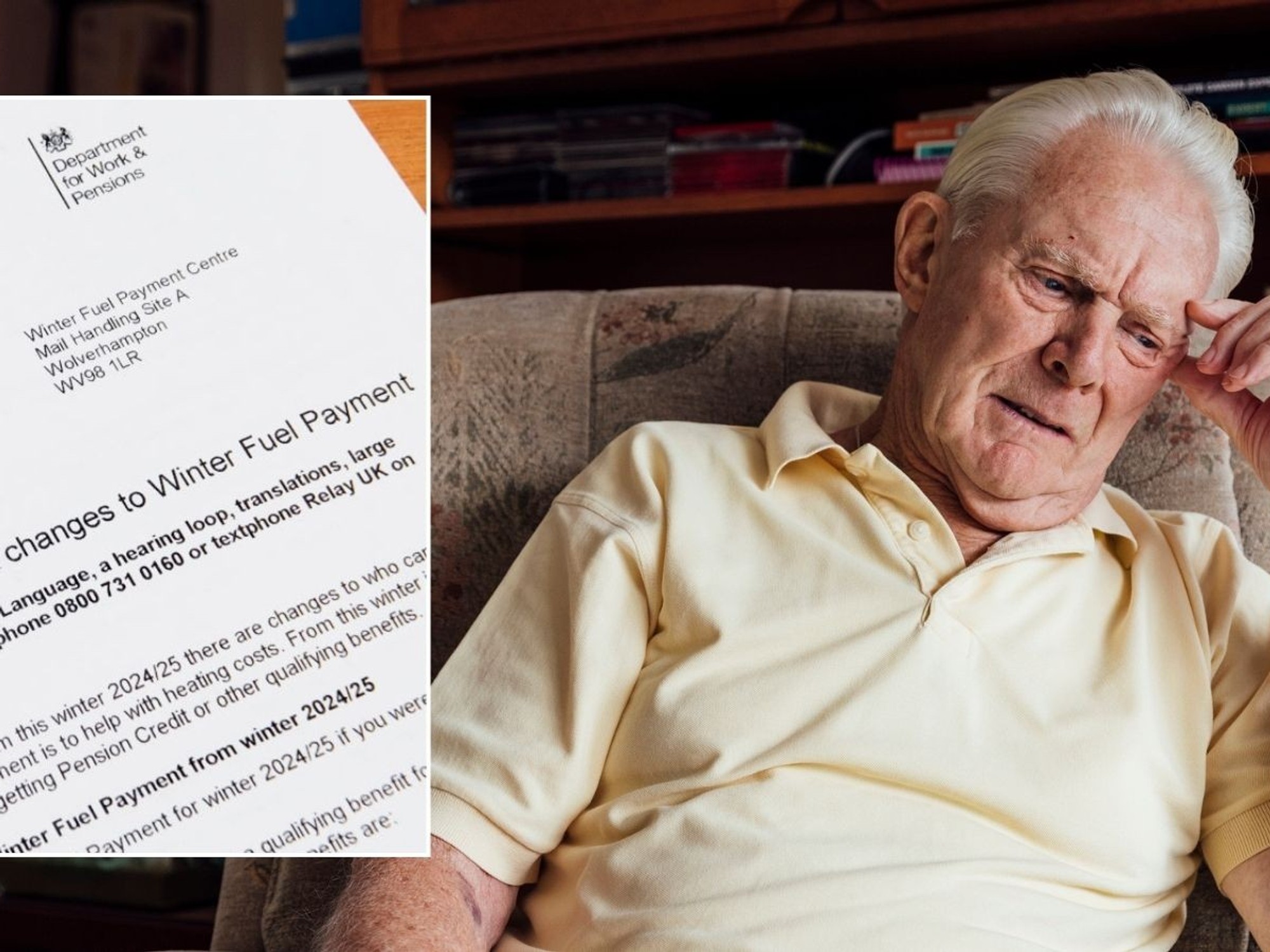

Savers are being urged to "keep an eye on ISA allowances" as the Chancellor could launch a tax raid

GETTY

Ronan Donohue, the founder of Q4 Capital Advisors, suggested the Chancellor should "keep an eye on ISA limits and allowances", noting that "restricting tax-free investments could be delivered with the tiresome reference to 'those with the broadest shoulders'".

While Reeves confirmed earlier this year that the Government has no plans to cut the ISA allowance, she indicated that changes to how ISAs function may still be on the cards.

Jobson urged savers to "stay nimble but not reactionary", emphasising that "making full use of available tax wrappers, such as ISAs and pensions, remains one of the most effective ways to protect and grow your wealth".

However, he cautioned against hasty decisions, warning: "But it's equally important to avoid knee-jerk decisions based on speculation that could have long-lasting financial consequences.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

"A measured approach is the best defence against the uncertainty that continues to define the current personal finance landscape."

The analyst noted that changes to the ISA regime, inheritance tax, and pension rules "are all in the pipeline", whilst the U-turn on cuts to the winter fuel payment signals "the piecemeal nature of support measures".

Treasury officials are reportedly considering reforms particularly targeting Cash ISAs, which enable savers to earn interest without paying tax.

The £20,000 ISA allowance has remained unchanged since 2017. Currently, the Government aims to channel more capital into UK markets through Stocks and Shares ISAs and pensions.

Additionally, every pound held in a cash ISA represents lost tax revenue on interest income. With higher interest rates, this limits the government's ability to collect taxes.

In a BBC interview in May, Reeves stated: "I'm not going to reduce the limit of what people can put into an ISA, but I do want people to get better returns on their savings, whether that's in a pension or in their day-to-day savings."

LATEST DEVELOPMENTS:

Rachel Reeves delivers her Government's spending review to MPs in the House of CommonsPA

Rachel Reeves delivers her Government's spending review to MPs in the House of CommonsPAAccording to HMRC statistics, approximately 12.4 million Adult ISA accounts were subscribed to in 2022 to 2023, up from 11.8 million the previous year but significantly lower than the 15 million seen in 2011. Around two-thirds of subscriptions went into cash ISAs.

Only 16 per cent of UK adults hold a Stocks and Shares ISA, despite average long-term returns of five to seven per cent annually for diversified investment portfolios.

Many savers leave cash in standard accounts earning less than two per cent interest. Until any official changes are announced, the £20,000 ISA allowance remains available for the current tax year.

The UK household savings ratio reached significant levels by the end of 2024, according to the ONS, yet much of this sits in low-yielding accounts. Less than a third of UK adults have a cash ISA.