Inflation expected to have risen in blow for Sunak as wage rises ‘not falling in line’ with target

Economists are warning that the CPI inflation rate could have risen again in the year to January 2024 despite recent easing

Don't Miss

Most Read

Inflation in the UK is expected to have increased for the second month in a row, based on forecasts from economists.

Ahead of the Office for National Stastics (ONS) publishing the data tomorrow, experts today predicted CPI inflation jumped from four per cent in December 2023 to 4.2 per cent last month.

This will be a Valentine’s Day blow to Prime Minister Rishi Sunak and Chancellor Jeremy Hunt as such as development would damage the Government’s argument that it is making inroads in addressing the cost of living crisis.

However, Pantheon Macroeconomics chief economist Samuel Tombs believes inflation will only rise to 4.1 per cent in the year to January, before dropping considerably to 3.4 per cent for this month.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Inflation is expected to rise as high as 4.2 per cent tomorrow

|GETTY

Economists will be anxiously looking to see what tomorrow’s data will mean for the Bank of England base rate.

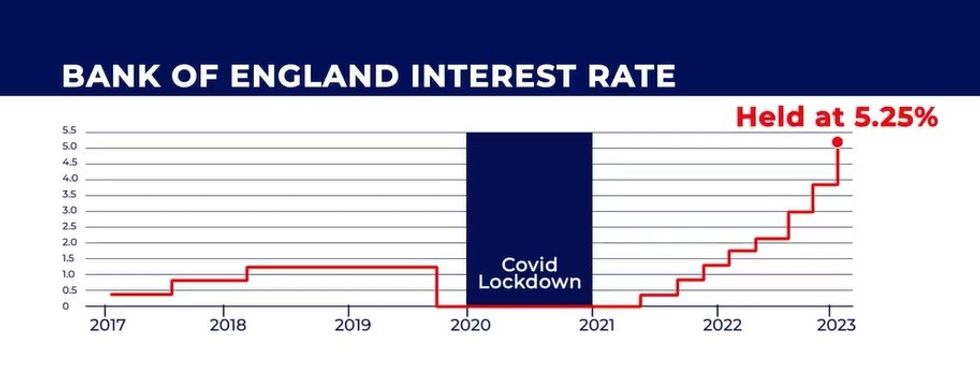

The central bank hiked interest rates 14 consecutive times before holding at a 15-year high to try to ease inflation. The central bank’s target level of inflation is two per cent.

Today’s higher-than-expected wage rise figures have also reignited concerns over how long inflation will remain above target.

Wage growth eased in the UK job market for the last three months of 2023 but it still outpaces pace rises, the ONS reports.

Pay, not including bonuses, jumped by 6.2 per cent over the period compared with the same period a year before, according to the ONS. When taking pay rises into account, wages went up by 1.9 per cent.

Rob Morgan, Charles Stanley’s chief investment analyst, highlighted the factors which are contributing to the country’s rate of inflation.

He explained: “Today’s wage rises contribute to tomorrow’s spending power, impacting demand and influencing inflation, so the Bank will be keenly monitoring average earnings growth in particular.

“Resilient wages have been a driver of sticky consumer price inflation, and they are not falling back into line as fast as the BoE would like as it looks to return inflation to the two per cent target.

“What’s more, a further inflationary impulse could lie in wait in the form of an increase to the national minimum wage of almost 10 per cent from April, which stands to simultaneously increase costs for employers and bolster household spending power, potentially exerting further upward pressure on prices.”

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent | GB NEWS

The Bank of England has held the base rate at 5.25 per cent | GB NEWSMartin Beck, the chief economic adviser to the EY Item Club, added: “On balance, the EY Item Club thinks the latest pay data should further calm the MPC’s concerns about the threat posed by a tight labour market to achieving low inflation on a sustainable basis.

“The committee will likely want to assess the impact of April’s sizeable rise in the national living wage before it’s sufficiently reassured on that subject.

“But the EY Item Club continues to think the MPC will start cutting interest rates in May, with a series of further reductions in bank rate following over the course of this year.”