Budget tax cuts could raise mortgage rates, senior economist warns Jeremy Hunt

Income Tax should be cut by 1p in Budget, says Jonathan Gullis … |

GB NEWS

The Chancellor has previously cited his desire to introduce more tax cuts but this has raised eyebrows from economists

Don't Miss

Most Read

Latest

Introducing further tax cuts in the upcoming Spring Budget could raise mortgage rates, economists have warned.

Experts from Bloomberg Economics are sounding the alarm that further tax cutting measures could reverse the recent trend of reductions in mortgage rates and contribute to inflation.

Chancellor Jeremy Hunt and Prime Minister Rishi Sunak have previously pledged to ease the “tax burden” being placed on households across the country ahead of the Budget on March 6.

However, Mr Hunt has asserted he will only do so if the tax cuts are compatible with the Government’s fiscal rules.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

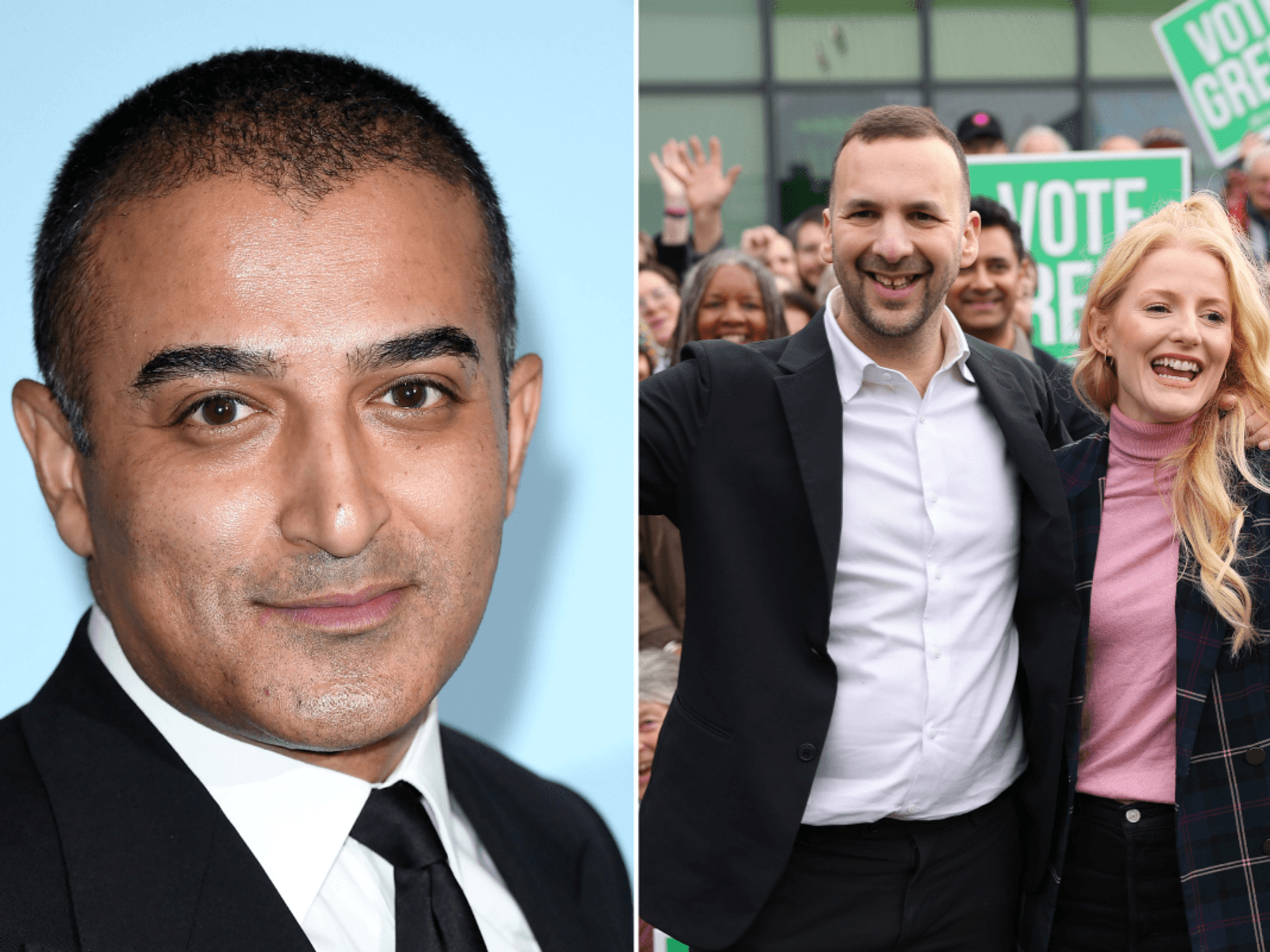

The Chancellor is being warned against introducing further tax cuts in the upcoming Budget

|GETTY

Bloomberg’s senior economist Dan Hanson has urged Jeremy Hunt to be careful of not undermining the Bank of England’s efforts to rein in inflation.

He said: “The more immediate challenge will be to deliver sweeteners for voters that don’t cause the Bank of England to rethink the merits or reducing interest rates.

“A policy package that ends up lifting mortgage rates is the last thing Hunt will want with an election looming”.

The central bank’s Monetary Policy Committee (MPC) raised the base rate 14 consecutive times to 5.25 per cent, and has held it at that level since August 2023.

For the 12 months to December 2023, the Consumer Price Index (CPI) rate of inflation rose slightly to four per cent which is higher than the Bank’s two per cent target.

Rishi Sunak’s Conservative Government are desperately looking for fiscal policies that will attract voters and lessen the 20-point polling gap between Keir Starmer’s Labour Party ahead of the next General Election.

In December, the Bank of England warned that five million households are at risk of seeing their annual mortgage repayments rise by £2,900 as many roll off existing deals between June 2023 and 2026.

In recent weeks, lenders such as Santander have slashed mortgage rates slightly in a sign of optimism within the market.

LATEST DEVELOPMENTS:

Mr Hunt and the Prime Minister have previously pledged to ease the 'tax burden' on Britons

| GETTYRecently, Jeremy Hunt downplayed expectations of further tax cuts.

Last month, he said: “It doesn’t look to me like we will have the same scope for cutting taxes in the Spring Budget that we had in the Autumn Budget”.

Last Autumn, Mr Hunt’s Budget had £31billion in headroom of which he spent around £18billion.

The Chancellor will announce any potential tax changes during the Spring Budget on March 6.