UK economy in crisis as Bank of England warns of borrowing shock amid pension fund retreat

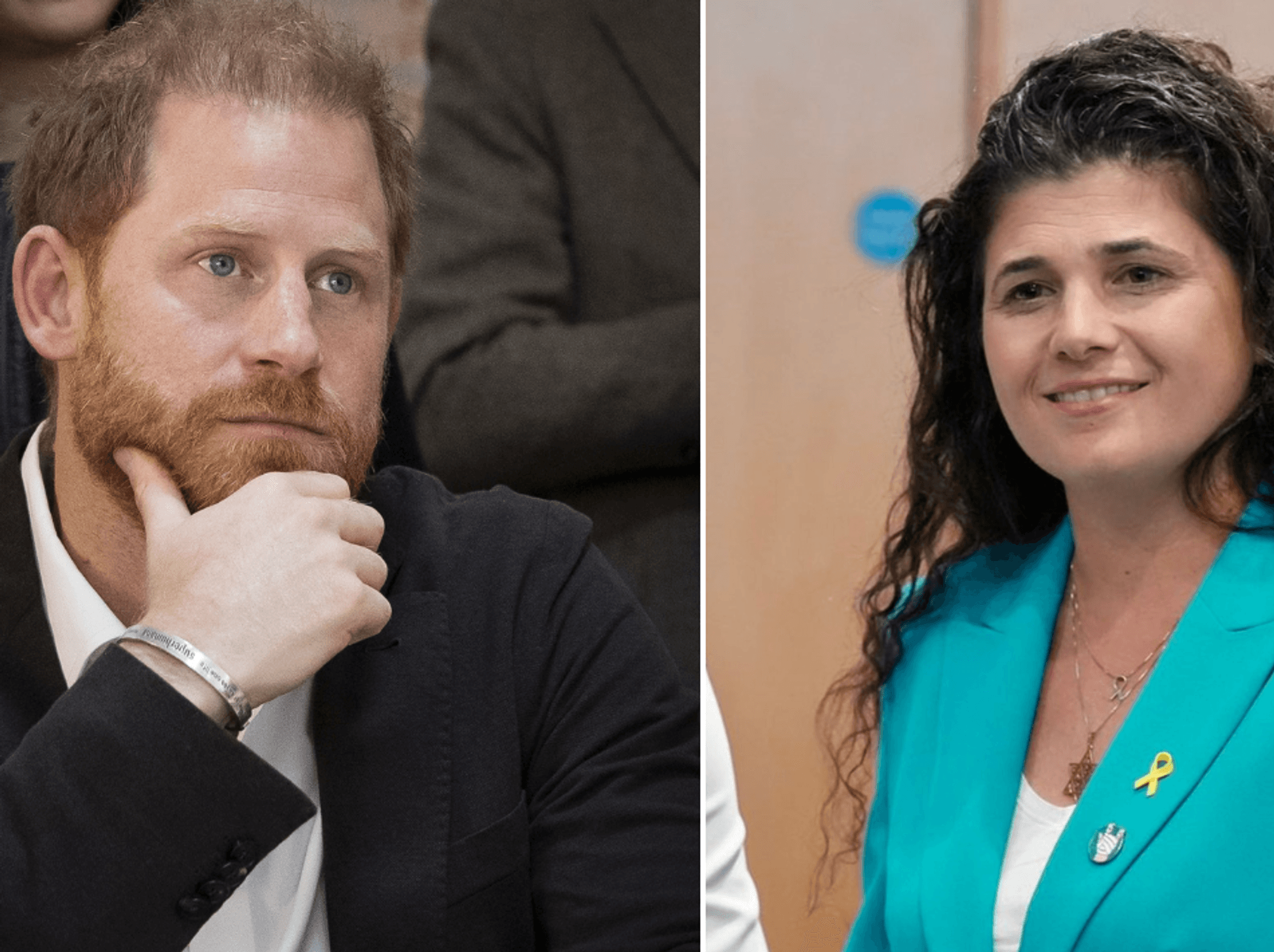

Chancellor Rachel Reeves is grilled on her handling of the economy |

GBNEWS

The warning piles pressure on the Chancellor as the UK grapples with rising debt costs

Don't Miss

Most Read

Britain could be heading for fresh financial turbulence, the Bank of England has warned, raising alarm over growing risks to the economy. Policymakers cautioned that markets are increasingly fragile and vulnerable to shocks that could drive up Government borrowing costs.

Pension crisis looms | GETTY

Pension crisis looms | GETTY

The Financial Policy Committee, led by Governor Andrew Bailey, pointed to the sharp rise in bond yields earlier this year after Donald Trump’s “liberation day” tariffs unsettled global markets.

The warning comes as Chancellor Rachel Reeves faces mounting pressure to balance the nation’s books. Economists estimate that the recent rise in borrowing costs has already wiped out around half of her £9.9 billion fiscal headroom, leaving her with little room for error.

Adding to the pressure, the Office for Budget Responsibility has warned that weaker demand from pension funds for long-term government debt could create a further £22bn hole in the public finances.

UK economy in crisis as Bank of England warns of borrowing shock

| GETTYThis retreat by pension funds from the gilt market represents a significant shift in the UK's borrowing landscape. Richard Hughes, chairman of the OBR, warned that Britain was becoming increasingly dependent on "fickle and flighty" overseas investors as domestic pension fund appetite for UK bonds diminishes.

Reeves must now contend with both rising borrowing costs and a shrinking pool of reliable domestic investors for Government debt.

The Bank of England’s Financial Policy Committee (FPC) warned that UK government borrowing costs, known as gilt yields, have climbed alongside rising US borrowing costs.

Officials said the situation could have spiralled into a full-blown financial crisis if President Trump had not announced a 90-day pause on his planned tariffs.

The Bank highlighted how stress in one market can quickly spread to others because of the deep interconnectedness of global financial systems

| PAIn its latest Financial Stability Report, the Bank highlighted how stress in one market can quickly spread to others because of the deep interconnectedness of global financial systems.

The FPC also raised the alarm over the risk of sharp drops in asset prices, sudden shifts in investor behaviour, and a longer-term breakdown in market stability, warning that Trump’s trade war could destabilise the global financial order.

Meanwhile, Britain’s long-term borrowing costs have kept rising as economic uncertainty deepens. The situation worsened when yields on 30-year Government debt surged after Sir Keir Starmer refused to publicly support Reeves in Parliament, prompting fears among traders that her successor could unleash a fresh wave of borrowing.

The Bank warned that whilst investors had not engaged in mass gilt dumping during the recent volatility sparked by steep tariffs, "conditions might have become more strained had the episode of volatility lasted longer".

The combination of rising yields and pension fund retreat has left Reeves with rapidly shrinking fiscal options.

Speculation is mounting that Reeves will implement another tax raid in the autumn, with Labour backbenchers and former party leader Lord Kinnock advocating for increased wealth taxes.

Pension crisis looms | GETTY

Pension crisis looms | GETTYThe FPC also highlighted that growing gilt holdings by hedge funds heightened the risk of a borrowing shock.

It warned that "a rapid unwind of leveraged positions by a few key players could amplify shocks during periods of high volatility", noting that 90 per cent of net borrowing on the repo market was concentrated amongst a small number of hedge funds.

Additionally, the Bank flagged energy price vulnerability, noting European gas storage levels were below typical seasonal levels, which "raises the probability of price volatility".

More From GB News