Is the cost of living crisis nearly over? Analysis by Olivia Utley

Jack Carson vox pops on inflation remaining the same.mp4 |

Inflation is generally going down - but from a very high peak of 11 per cent in October 2022

Don't Miss

Most Read

Latest

Is the cost of living crisis starting to subside? Inflation figures released this morning give cause for hope: economists predicted that core inflation would rise by 4.2 per cent in January, but in fact it stalled at 4 per cent.

For those of us with mortgages, that’s (quite) good news. The Bank of England raised interest rates in 2022 to mitigate against very high inflation, so logic follows that now inflation is on a downwards trajectory it will eventually lower them again.

But the word eventually is doing a lot of heavy lifting there. Inflation is generally going down, but from a very high base – it reached a peak of 11 per cent in October 2022 – and it’s hardly tumbling at a rate of knots. Sure it didn’t rise last month, but it didn’t actually fall.

That poses a problem for the Conservatives. Of Rishi Sunak’s five pledges, to grow the economy, decrease national debt, halve inflation, cut NHS waiting lists and stop the boats, he can only really claim success on inflation. And it seems unlikely that he will see any electoral reward for it.

Is the cost of living crisis starting to subside?

|PA

Why? Firstly because of the lag effect. People whose mortgage terms ended in 2022 or 2023 will already have had to swallow the pill of high rates, and will most likely be stuck on their current deal for two years, or in some cases five.

But the bigger for the Conservatives is that even if interest rates start to drop, it is very unlikely that there will be an accompanying feel-good factor: although people may be better off than they would have been had inflation continued to rise, they will be worse off than they were a few years ago. And that’s all they’ll be thinking about.

Take the example of a young couple who took out a five-year fixed mortgage for the first time in 2019, when the Bank of England base rate was just 0.75 per cent. This couple, who grew up only knowing a world of low-interest rates, understandably borrowed as much as they possibly could – up to five times their joint salaries.

MORE CONTENT FOR GBN MEMBERS:

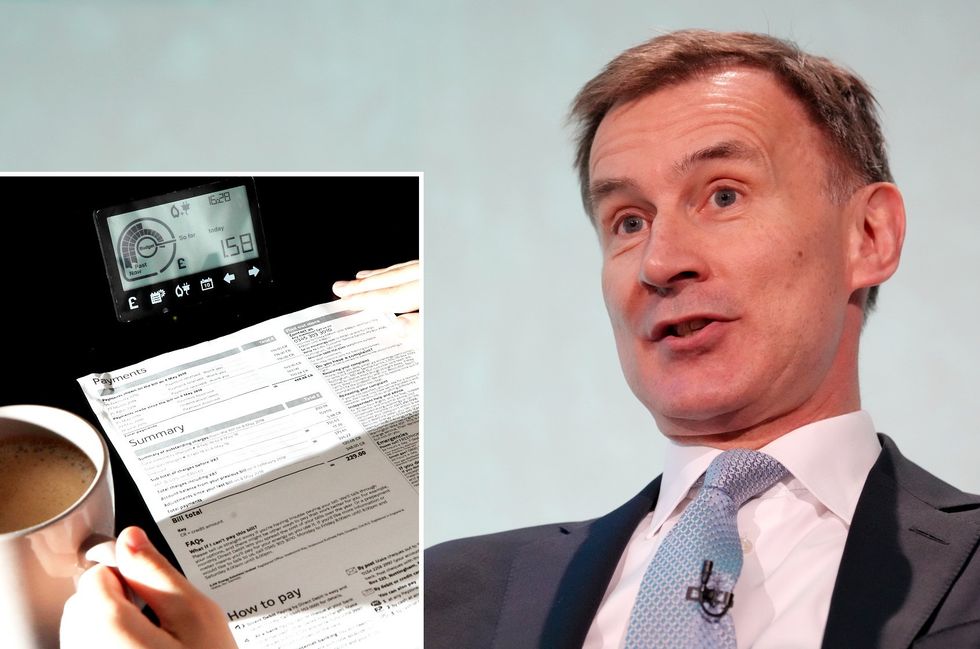

Jeremy Hunt

|PA

Luckily for our imaginary couple, their five year fixed rate meant that they were protected from the soaring interest rates of the last couple of years, and, if all goes according to plan, the base rate will be falling again by the time they have to remortgage later this year. The issue is that even if it falls relatively dramatically, it will still be far higher than it was in 2019. And that means that in the latter half of this year, this couple will be paying hundreds more each month in interest than they were in the first half.

The Conservatives would tell this couple, truthfully, that had Rishi Sunak and Jeremy Hunt failed to get inflation under control, interest rates would still be rising, and their mortgage would be going up thousands rather than hundreds.

But for a party trying to win an election on the economy, “you’re poorer but you’re not quite as poor as you might have been had we messed things up more” is hardly a killer slogan.

In short, it is true that the peak of the cost of living crisis is now probably in the past. But voters sitting at home with less money in their pockets than they had three years ago are unlikely to see that as a reason to flock to the ballot boxes in blue rosettes.