BUDGET POLL: Did Jeremy Hunt's Budget deliver for you? - YOUR VERDICT

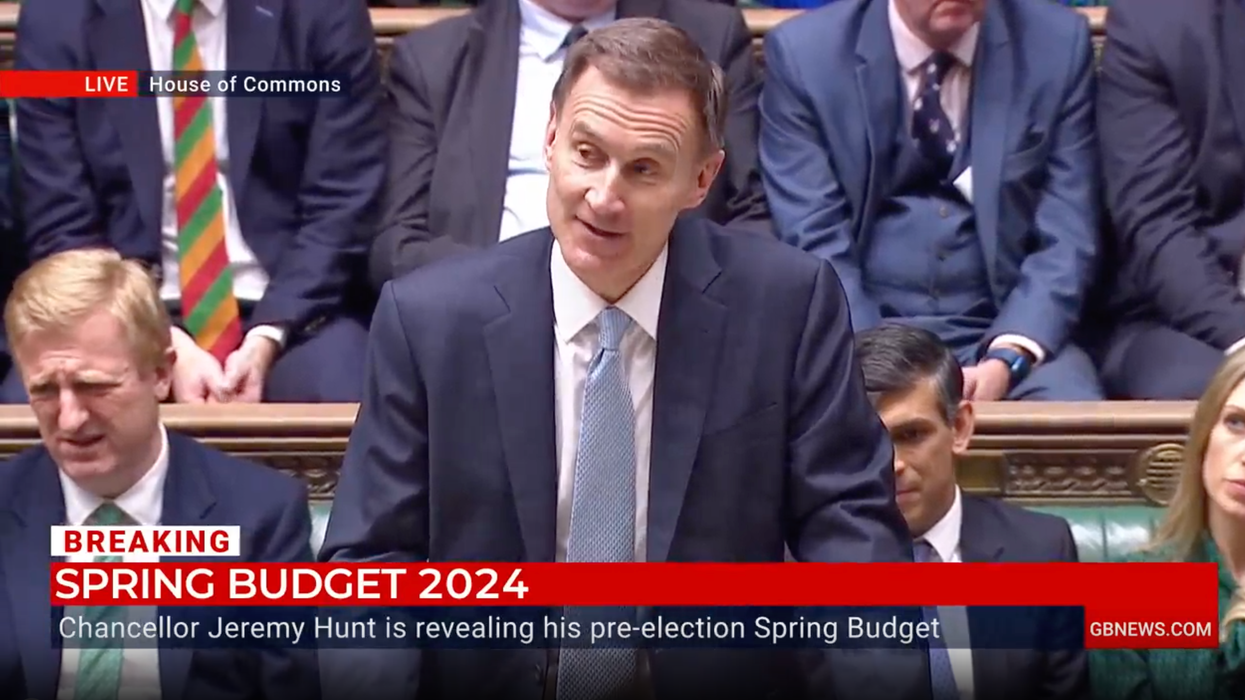

Jeremy Hunt unveiled his Spring Budget in the House of Commons

|GB News

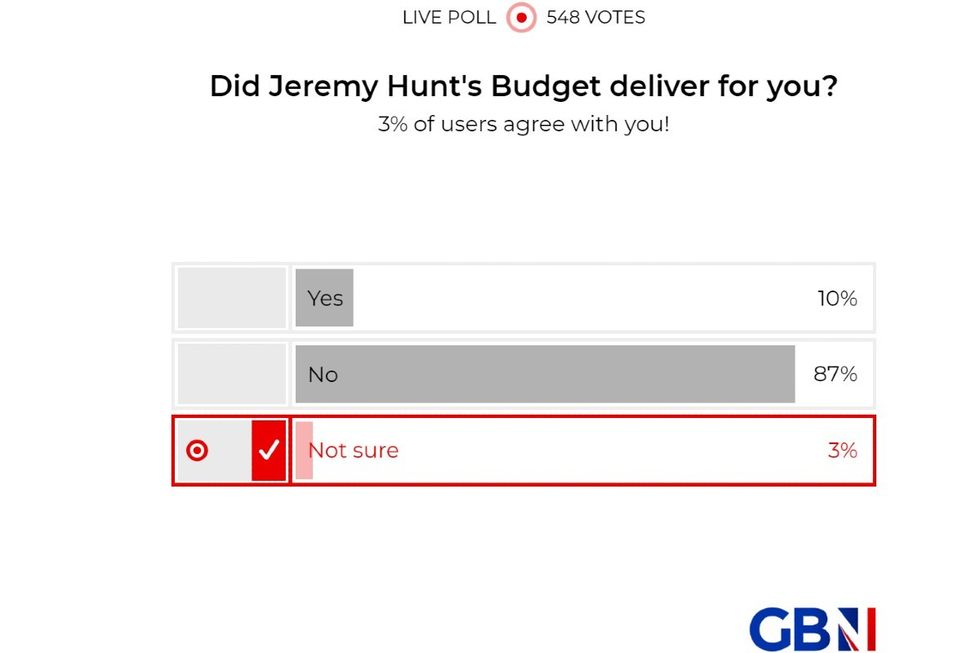

GB News membership readers have been asked whether they feel like Jeremy Hunt's Budget delivered for them

Don't Miss

Most Read

Latest

Jeremy Hunt delivered his Spring Budget earlier this afternoon.

The biggest policy included in the Budget was the slashing of the National Insurance (NI) contributions by 2p, which will save an extra £450 for the average employee.

At the same time however, the Chancellor left income tax untouched.

He said the Treasury was able to introduce the changes "because of the progress we have made in bringing down inflation, because of the additional investment that is flowing into the economy, because we have a plan for better and more efficient public services and because we have asked those with the broadest shoulders to pay a bit more."

BUDGET POLL: Did Jeremy Hunt's Budget deliver for you? - YOUR VERDICT

|GB News

The VAT registration threshold will be increased from £85,000 to £90,000 from the start of April, Hunt confirmed.

He said the move will help “tens of thousands of businesses.”

In an exclusive poll for GB News membership readers, an overwhelming majority (87 per cent) of the 548 voters thought Hunt's Budget did not deliver for them, while just 10 per cent thought the Budget did deliver. Three per cent said they did not know.

Hunt has also announced that he will extend the alcohol duty freeze until February 2025, a move that he said will benefit 38,000 pubs across the UK with the aim of “backing the great British pub”.

The Chancellor said he will maintain the 5p cut and freeze fuel duty for a further 12 months, a move that would save the average driver £50 next year and bring total savings since the 5p cut was introduced to around £250.

The National Insurance cut dominated Hunt's Budget

| PAThe Treasury has announced it will abolish the £90 debt relief order to help people who take out loans.

Hunt said he wanted to focus on people falling into debt, saying: “Nearly one million households on Universal Credit take out budgeting advance loans to pay for more expensive emergencies like boiler repairs or help getting a job.

He also announced the introduction of the "British ISA", which will allow an additional £5,000 annually for investments in UK equity.

The Chancellor has announced a tax on vapes from October 2026 in order to discourage non-smokers from taking up vaping. He also announced a one-off increase in tobacco duty, in order to maintain the financial incentive of switching to vaping from smoking.

The Chancellor announced that tax reliefs for orchestras, museums, galleries and theatres - introduced during the pandemic - will be made permanent.

Hunt announced he would abolish the current tax system for non-doms and "get rid of the outdated status of non-domicile". He said the Government will replace the non-dom regime with a "modern, simpler and fairer residency-based system" from April 2025.

People who move to the UK will be exempt from paying tax on income they earn abroad for the first four years.

Jeremy Hunt extended child benefit to hundreds of thousands of middle-income families, increasing the threshold high-income child benefit charge threshold from £50,000 to £60,000. The taper will extend up to £80,000.