Social Security Retirement Age rise 'is inevitable' but there must be 'significant notice'

Social Security Retirement Age increases are needed as people live longer, a US money manager has said

Don't Miss

Most Read

The US Retirement Age will need to rise to pay for Social Security as seniors live longer and those who would be affected must be given a "significant" warning, a money manager has told GBN America.

David Bahnsen, managing partner of the wealth management firm Bahnsen Group, said: "I don’t think there’s any question that the age will end up having to rise.

"What I’m vehemently opposed to is springing it on people.

"If right now people are expecting it to be 65, I don’t think we should tell 61-year-olds that we’re going to move it higher for them."

Mr Bahnsen, author of the new book Full Time: Work and the Meaning of Life, suggested a notice period of at least ten to 15 years, to give people time to prepare and make any changes to their retirement plan.

He said: "If we take people under 55 or under 50 and give them 15-20 years of preparation that it might need to move a few years higher based on the blessing of longer mortality and just the sheer economic necessity, I think that would be a very good policy solution."

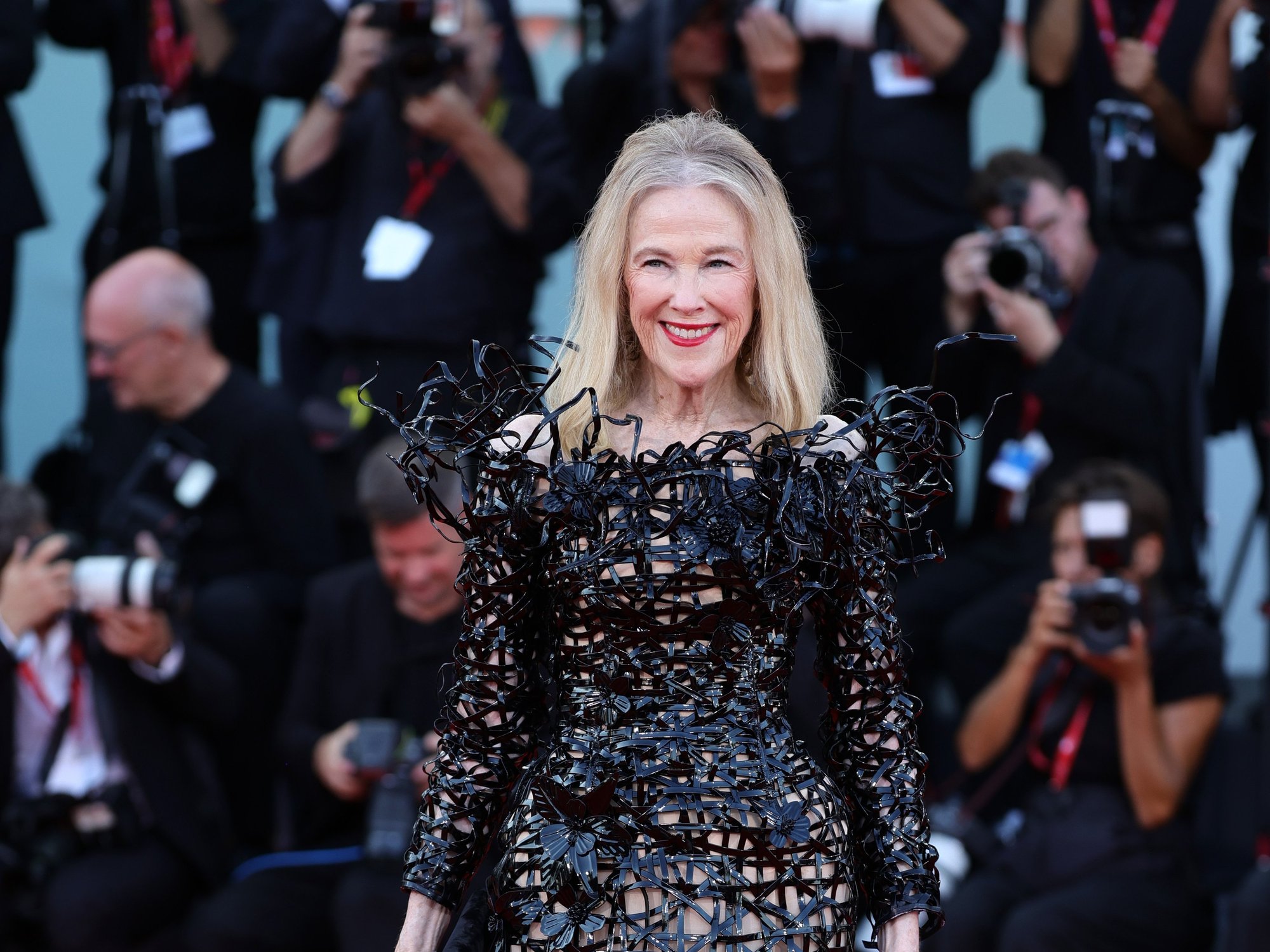

David Bahnsen was asked about potential hikes to the Social Security Retirement Age

|GETTY | GB NEWS

Mr Bahnsen warned that while the idea of raising the retirement age may not be popular now, he thinks it's important to take action before there's greater pressure.

He said: "It’s not politically popular right now, and unfortunately, I think it will become very politically popular when we get to an emergency.

"I’d rather get in front of it. But moving the retirement age higher, with giving people significant notice ahead of time, I think is not only a good policy, it’s inevitable."

While it would depend on what the details were, according to the financial expert, giving Americans 15 years to plan is "reasonable".

Mr Bahnsen said: "Right now, people can get a partial payment at age 62, they can get a full payment in between 65 and 66 and they can get an enhanced benefit if they wait until they’re 70.

"Let’s say that the number is going to move up to 68, three years later, I think somebody who is aged 50 has probably not thought whatsoever about what it means at 65.

"And to have now 15 years, going to 18 years, to prepare, strikes me as a perfectly reasonable solution.

"The older the person is that they start this for, the more savings to the system but the less politically doable it is.

"I’d suggest it be the age 50, because I think that’s, politically, almost harmless.

"I turn 50 this year, I can’t imagine anybody my age even caring about the difference between 65 and 68 right now.

"For someone who is 55, they’re probably a little closer to it, so I think giving that 10 to 15 years of preparation is a very good idea."

Mr Bahnsen hopes to make a "plea" for a "higher, more elevated view" of work with his new book, Full Time: Work and the Meaning of Life.

LATEST DEVELOPMENTS:

"There is a lot of existential, psychological, sociological benefit that comes from people being productive and active.

"I don't think that's very controversial. I think that's rather universally accepted.

"The case I'm making in the book is that we're getting away from that through this implicit belief that work is laying layers of stress and anxiety on people, taking away from other things in their lives, and that that's a net negative.

"What I'm suggesting is the things that are upsetting people, that take them away from the joy and fulfillment they want to have in their lives, that those things need to be rooted to a view of productive and useful work."