50,000 more Britons are being dragged into paying death levy

Pexels

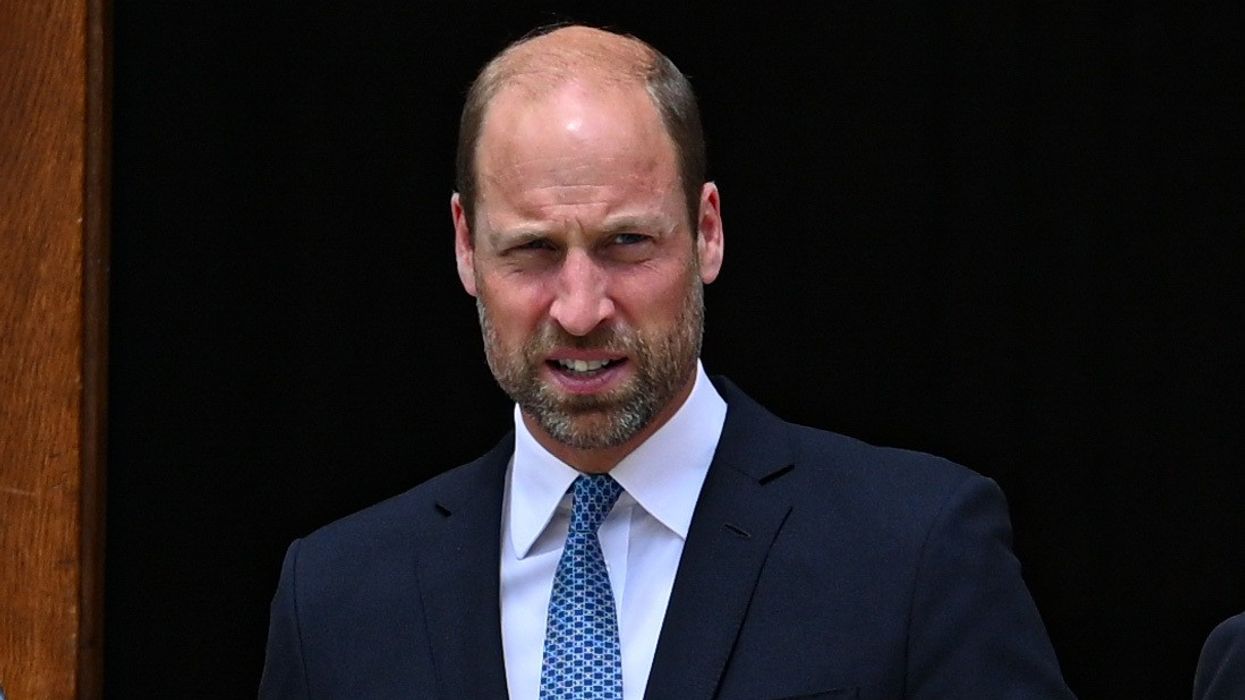

Jeremy Hunt decided to freeze the death levy threshold until April 2028

Don't Miss

Most Read

An extra 50,000 Britons have been dragged into paying inheritance tax, a report has revealed.

The figure is four times more than previously predicted and comes after the Government opted to freeze the threshold for another five years.

It was estimated the decision would bring 13,400 extra estates into the fold.

However, The Telegraph obtained internal forecasts showing higher-than-expected inflation as a key reason behind 49,400 more families being slapped with the levy.

Inheritance tax is the most unpopular levy in the UK PA

Inheritance tax is the most unpopular levy in the UK PAMore than 280,000 households across the United Kingdom will likely pay more in inheritance tax bills by the end of the 2027/28 due to the seven-year threshold freeze.

A 40 per cent tax is imposed on anything above the basic allowance of £325,000 plus an extra £175,000 for property.

Thresholds tended to increase in line with inflation but the figure remains equal to its 2021 level.

Rising house prices, growth in value of assets and increased strength of savings means thousands have almost inevitably been forced to cover the costs.

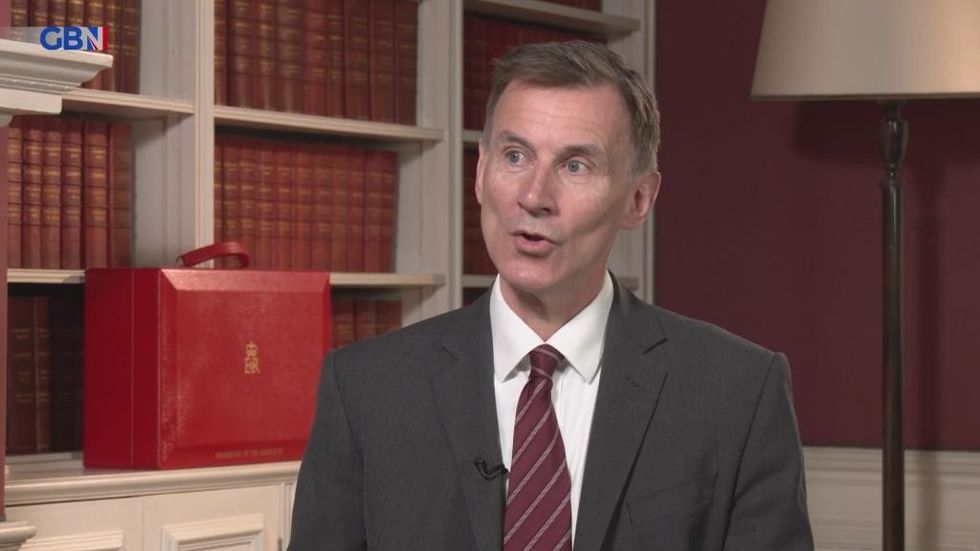

LATEST DEVELOPMENTS: Jeremy Hunt extended the freeze on income tax thresholdsGB News

Jeremy Hunt extended the freeze on income tax thresholdsGB NewsThere will be a 63 per cent increase in the number of estates paying inheritance tax during the 2021-28 freeze period compared to the preceding seven-years.

An estimate from November revealed receipts will also boom from £7.1billion last year to £8.4billion by 2027/28.

His Majesty’s Revenue & Customs said: “You will note that the numbers have increased since the last time this information was published.

“This is because of the large upward revision to both the actual and forecast CPI inflation series, which is used to index the inheritance tax thresholds in the years where they are not maintained at their current levels.”

Coins in an old person's hands

PARishi Sunak is reportedly considering whether to scrap the loathed-levy ahead of the next general election.

The Prime Minister is discussing whether to make abolishing inheritance tax a key manifesto commitment in an attempt to woo wavering Blue Wall voters, a report in The Times recently claimed.

Conservative MPs have also put pressure on Number 11 to shift its stance on inheritance tax.

Ex-Business Secretary Jacob Rees-Mogg told The Telegraph: “Fiscal drag could be the younger brother of the Grim Reaper as the two of them work together to increase taxation on death.

Rishi SunakPA

Rishi SunakPA“This most iniquitous tax ought to be abolished as it raises little and distorts the allocation of capital, making us all poorer by lowering economic growth.”

Despite opinion polls showing British opposition to the death levy, the Treasury stresses a majority of people will not face the charge.

A Treasury spokesman said: “This vast majority of estates do not pay inheritance tax – more than 93 per cent of estates are forecast to have zero inheritance tax liability in the coming years.

“However, the tax raises more than £7billion a year to help fund public services millions of us rely on daily.”