Inheritance tax could be SCRAPPED if Tories win next election - 'Gamechanger!'

Rishi Sunak is considering scrapping inheritance tax if he wins the next election

| PAConservatives plotting to spend £7billion abolishing ‘most despised’ tax in UK

Don't Miss

Most Read

Inheritance tax could be scrapped within two years with Downing Street drawing up secret plans to abolish the hated levy.

There are ‘live discussions’ under way to permanently ditch IHT as the Tories - who are 18% behind Labour in the polls - look to shore up votes in southern England ahead of the next election.

Supporters claim a manifesto pledge to end inheritance tax, which would cost the Treasury £7billion, would be a “gamechanger”, especially in constituencies vulnerable to gains from the Liberal Democrats.

Neither Downing Street nor the Treasury denied discussions were taking place over the plans, which would cost far less than a previously proposed cut to income tax.

A source told the Times: “It’s about being an aspirational country. You work hard, play hard and pass on your wealth. It’s a live discussion.”

Senior Conservatives are increasingly alarmed about the risk to blue wall” seats in the Home Counties in 2025, with the Lib Dems polling at 11% according to YouGov, just 14% behind the Tories.

IHT is routinely cited by Conservative voters as the least popular tax and pledging to scrap it would put clear blue water between the Tories and both major opposition parties.

Tory chiefs have identified 32 critical seats that they said must be fought by Thatcherite candidates at the next election, to avoid an “existential crisis” for the party.

A No 10 source said: “The PM has repeatedly said that he wants to cut taxes for people.“As Conservatives that is obvious, we want people to keep more of their own money."

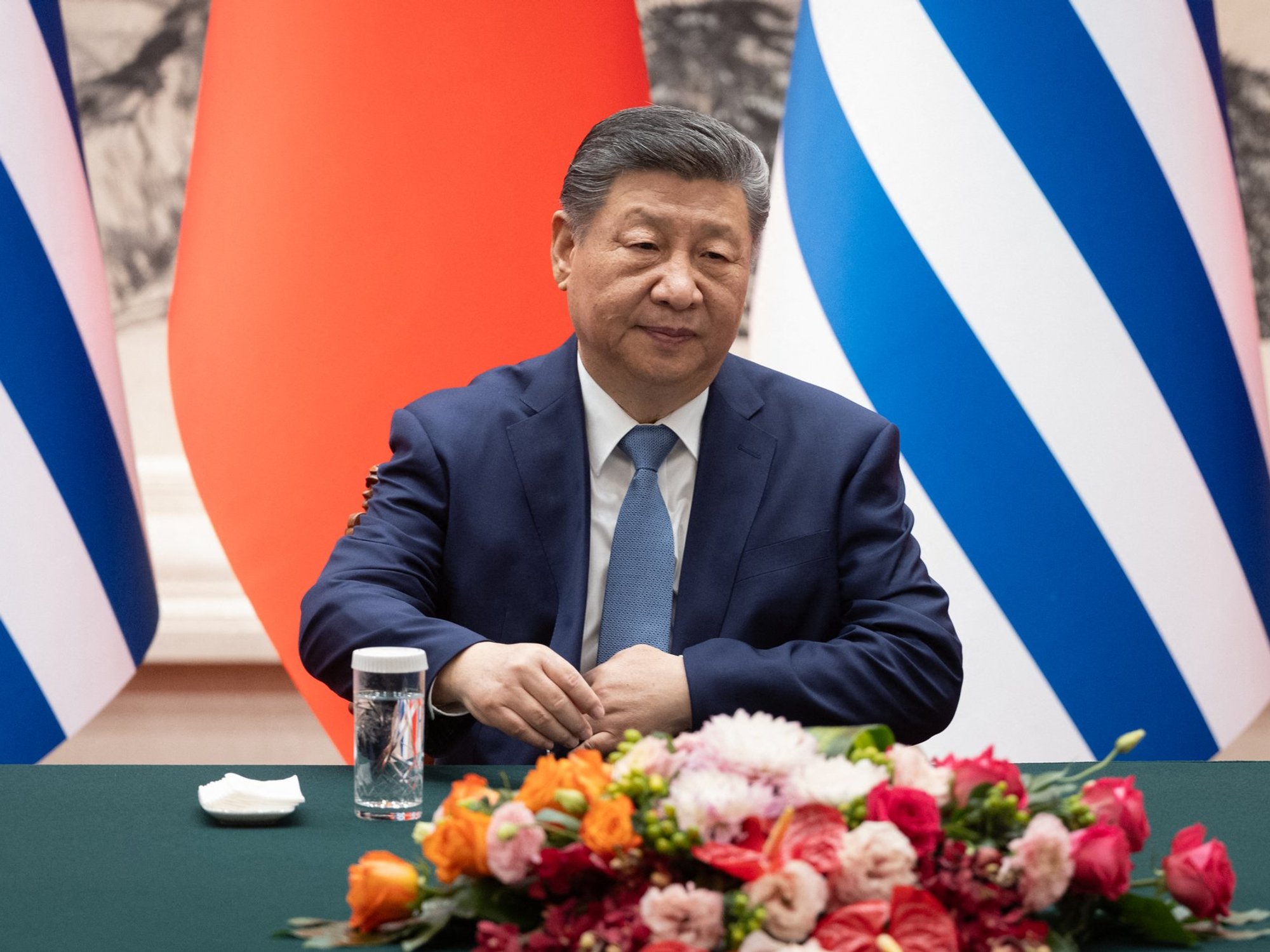

Kier Starmer's Labour Party are 18 points ahead in the polls

| PARishi Sunak made halving inflation by the end of the year one of the five key ambitions for his leadership, and Jeremy Hunt has previously signalled this target will be prioritised over tax cuts.

The wider economic challenge facing the Chancellor and Prime Minister was illustrated by official figures showing the UK economy contracted in May.

Abolishing inheritance tax is being considered as a manifesto pledge, rather than a policy to be implemented next year.

The rate of inheritance tax is currently 40% for estates worth more than £325,000, which is only charged on the portion that is above the threshold.

But estates of spouses and civil partners can pass on up to £1 million without any inheritance tax liability.

Inheritance tax is the most unpopular levy in the UK

| PAThose rates - which have been frozen for many years - are rapidly catching more and more families out, with inflation running at 8.7%. One in 20 UK deaths now results in an inheritance tax bill.

The No 10 source added: "The current economic situation means that Government is completely focused on halving inflation – to help people have more in their pockets at the end of each month.

“This kind of future-scoping speculation just isn’t on his mind at the moment and requires a different kind of economic environment to the one we are operating in.”

It comes amid increasing calls for the death tax to be scrapped.Last week, the Centre for Policy Studies, a think tank co-founded by Margaret Thatcher joined more than 50 Conservative MPs who have called for it to be abolished.

The levy is “tortuously complicated”, unfair and economically damaging, it said.