HMRC crackdown sees thousands of holiday home owners investigated

In some places around the UK, more than one in 10 properties are holiday lets

|GETTY

In some places around the UK, more than one in 10 properties are holiday lets

Don't Miss

Most Read

Latest

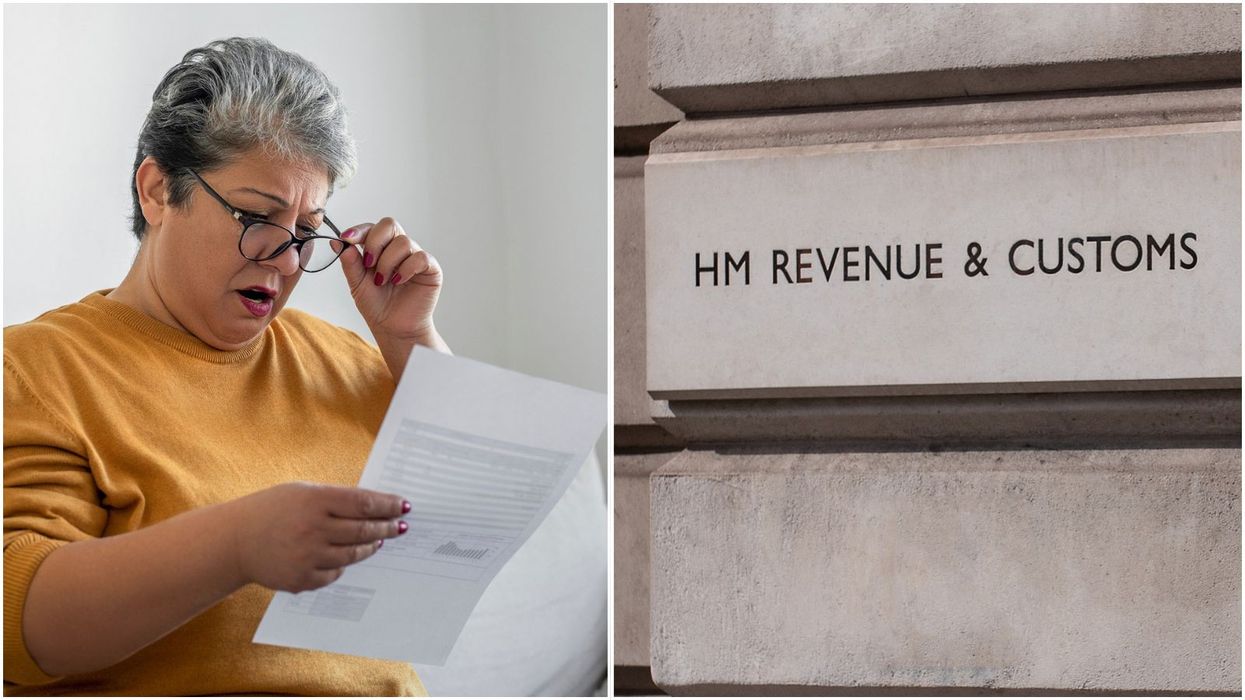

Holiday homeowners are being targeted in an HMRC crackdown following a boom in staycation bookings.

HM Revenue & Customs (HMRC) launched nearly 2,000 holiday let enquiries in 2023-24.

This is an increase from 375 the prior year and just 95 the year before that, according to official data.

Michael Foote, founder of the financial comparison website, Quotegoat.com, told GB News: “It’s no surprise HMRC is focusing on holiday lets given the staycation boom during the pandemic.

“With more than one in 10 addresses in some regions now holiday rentals, the sector has grown a lot.

"While the increase in investigations might seem tough on property owners, it’s necessary for fair competition.”

HM Revenue & Customs (HMRC) launched nearly 2,000 holiday let enquiries in 2023-24

|GETTY

The rise in holiday lets shows a 20-fold increase in investigations between 2021-22 and 2023-24, the Telegraph reported.

There are around 70,000 holiday homes in the UK, according to the latest Census data.

The investigations into these properties were prompted by suspicion that the owners were failing to declare income following a post-pandemic boom in staycations.

Although there is no excuse for tax evasion, Foote explained that the complex rules could make it hard for people to understand. In cases like this people are urged to seek professional advice.

He continued: “Many owners might not be intentionally avoiding taxes but could be unaware of their obligations.

“Property owners should stay informed and get professional advice from an accountant to navigate the rules.”

Foote explained that some people will live in their Airbnb property, rent out another room and earn less than £7,500 a year from hosting. “It's tax-free under the Rent-a-Room scheme”, he said.

Earnings over this amount need to be declared to HMRC. If people rent out a second property they don’t live in, they can earn up to £1,000 tax-free each year, but anything over that is subject to Income Tax.

The crackdown comes after the Government announced a £300million tax raid on short-term rentals.

During the Budget, Chancellor Jeremy Hunt announced the abolition of the Furnished Holiday Lettings regime (FHL).

He did this as part of a wider plan to discourage those who don’t live in these towns from purchasing a second home just because it is in a holiday hotspot.

With the rise in properties becoming buy to let, many locals argue they are being priced out of the property market within their areas because of all the competition.

He continued:" This crackdown also highlights a housing affordability crisis. With so many properties turned into holiday rentals, local residents are being priced out of the area they grew up in.

“This surge in holiday lets has reduced the number of affordable homes for locals, worsening the housing crisis.

“Ensuring tax compliance in the holiday let market is crucial for fairness and will also help to address these housing issues. Policymakers need to balance tourism and local housing needs to support sustainable communities.”

The abolition of tax breaks on holiday lets threatens to leave investors nearly £3,000 worse off a year from April, according to calculations by wealth manager Quilter.

Councils will soon be able to double council tax bills for owners of second homes that have been left empty for more than a year, under enhanced powers. These rules are already in place in Scotland.

A HMRC spokesman said: “The short-term property rental market is growing fast and it’s our role to ensure owners pay the right tax, creating a level playing field for all. We have dedicated specific resource to opening enquiries where there is evidence that those renting out holiday lets have not declared income.”