Economy in crisis: UK teeters on edge of stagflation as services sector shrinks for first time in 18 months

UK’s services sector shrank last month for the first time since October 2023

Don't Miss

Most Read

Latest

Troubling signs are emerging for the UK economy as pressure builds on businesses at home and abroad.

New figures suggest confidence is wavering and conditions are becoming harder for key sectors.

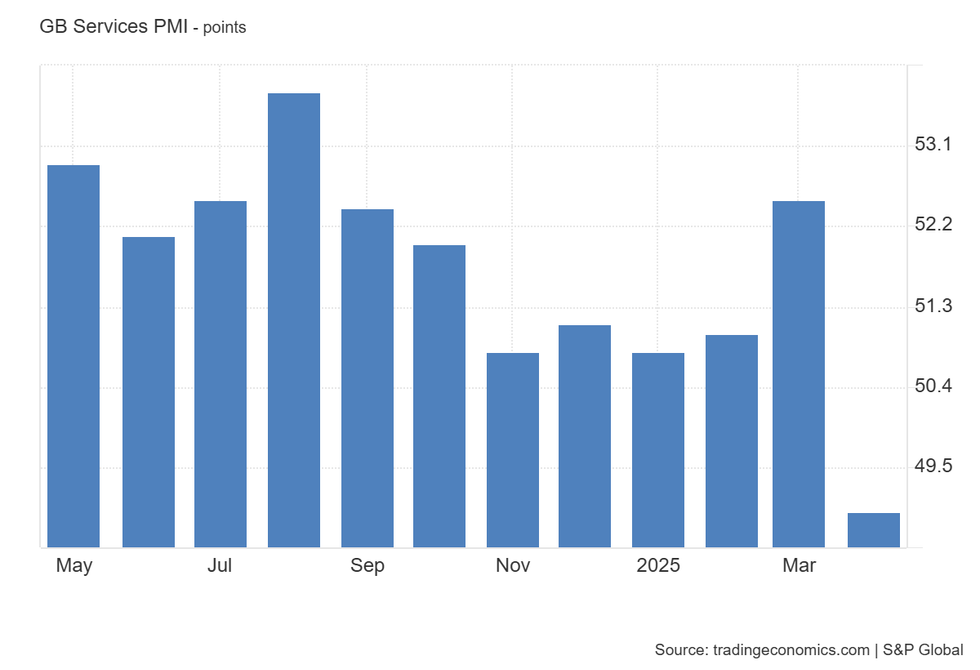

The UK’s services sector shrank last month for the first time since October 2023, according to the latest data from S&P Global.

The figures show overseas demand has dried up, with service firms reporting the weakest levels of new international business in over four years.

Analysts pointed to rising global tensions, particularly recent US tariff plans, as a major factor behind the slowdown.

The S&P Global UK services PMI fell to 49.0 in April, down from 52.5 in March. It’s the lowest reading in more than two years.

Any score below 50 means the sector is contracting. Economists had expected a decline but forecast a milder drop to 49.9.

The UK’s services sector shrank last month for the first time since October 2023, according to the latest data from S&P Global

|trading economics

Tim Moore, economics director at S&P Global Market Intelligence, said: "UK service sector output slipped into contraction for the first time in one-and-a-half years as heightened business uncertainty weighed on order books during April.

"Export conditions were particularly weak, with new business from abroad falling to the greatest extent since February 2021.

"Survey respondents often commented on the impact of global financial market turbulence in the wake of US tariff announcements."

Even sectors usually seen as resilient, like technology and financial services, showed signs of strain.

Moore added: "Businesses in the technology and financial service sector highlighted risk aversion and delayed spending decisions among clients."

Even sectors usually seen as resilient, like technology and financial services, showed signs of strain

| GETTYThe slowdown also led to more cautious hiring, with reduced workloads prompting firms to delay recruitment.

Wider concerns are now growing about stagflation, an economic situation where inflation stays high while growth slows or stalls.

Lindsay James, investment strategist at Quilter, said: "There is a cocktail of risks right now for the UK when it comes to inflation, and this is only adding to the ‘stagflationary’ fears.

"Economic growth is miniscule and risks going backwards, but should inflation continue to refuse to get back near the two per cent target, it is difficult to see what the Bank of England can do with interest rates.

"Not cutting or not doing it quick enough may be enough to tip the economy back into recession, but cutting too soon or to quickly and you risk adding fuel to the inflationary fire."

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: "The risks of stagflation are stark.

"Inflation remains above the Bank's two per cent target and price pressures are piling up, but the economy is stagnating, and business confidence has taken a knock."

With inflation still running above target and the UK’s largest sector now in reverse, the data is expected to add pressure on the Bank of England ahead of its next interest rate decision.

Following the latest data showing a decline in services activity, many now fear that any recovery may already be starting to fade

| PAWhile high inflation has kept interest rates elevated, signs of a slowdown may push policymakers to rethink their approach.

The UK economy grew by 0.5 per cent in February 2025—better than expected—with a three-month average of 0.6 per cent.

But experts still view this as modest growth, and many expect the pace to slow later in the year due to rising costs and the impact of new trade barriers.

In April, the EY ITEM Club downgraded its forecast for UK growth in 2025 from one per cent to just 0.8 per cent.

It also warned that growth could be delayed for another two years unless confidence improves.

Using the Treasury’s own economic model, the group said the biggest threats include Donald Trump’s new tariffs, stubbornly high inflation, and rising uncertainty.

According to their analysis, the most damaging factor could be falling confidence among both households and businesses, as global instability continues to cloud the outlook.

Following the latest data showing a decline in services activity, many now fear that any recovery may already be starting to fade.