Rishi’s 1% mortgage deposit plan stinks – here’s what he can do to win votes and sort the housing crisis, writes Patrick O’Donnell

The Conservative Party under Prime Minister Rishi Sunak is on the brink of electoral decimation but tackling the housing crisis and mortgage costs could save the Tories and the country, writes Finance Reporter Patrick O’Donnell

Don't Miss

Most Read

Homeownership is a pipe dream for many young people, including myself, who can’t rely on the Bank of Mum and Dad to bail them out. If rumours are true, the Government is finally taking drastic action to address this country’s housing crisis.

Ahead of this year’s General Election, Rishi Sunak is reportedly floating the idea of one per cent deposit mortgages in a bid to lure younger voters from Keir Starmer’s Labour Party.

But, this mooted proposal could fuel the house price bubble and pull the property ladder up away from generations to come.

This potential plan has been praised by former housing ministers, including Robert Buckland MP, who described it as a “bold idea” and “very welcome”. Others, including myself, believe it stinks.

Rishi Sunak's Government is reportedly considering introducing one per cent mortgage deposits to entice new voters

|GETTY

It could be announced in the upcoming Spring Budget but I think it’s more of a “Get Out Of Jail Free” card by a Government which has refused to address this issue in a fiscally responsible and honest way.

Yes: one per cent deposit or 99 percent loan-to-value (LTV) mortgages could remove the financial barrier posed by high deposits but they will likely come with a greater cost down the road.

In reality, this new deal for prospective homebuyers would likely push costs up further for “Generation Rent” who have sleepwalked from financial crisis to financial crisis in recent years.

If one per cent mortgage deposits were introduced, interest rates could rise once again and the property market may overheat, pushing housing prices up even further. Quite simply, it kicks the can down the road, it is unsustainable and does not address the issue at its core: there is too little supply to address so much demand.

More importantly, it goes against everything the Conservatives are supposed to represents when it comes to fiscal responsibility. The Government would have borrow substantially to fund this promise or severely guarantee mortgage lenders for the extra risk.

I may not have faith in Labour to address the housing crisis sufficiently but I do think they will know what not to do after watching the Tories.

Through recent schemes, such as Help to Buy and the mortgage guarantee scheme, the Government has attempted to ease the financial burden of homeownership for younger generations but it is not enough.

Building more houses to financially empower younger Britons could be a gamechanger in the next election. Only 10 per cent of under 50s intend to vote Tory at the next election, according to the latest polls. The Conservative Party’s polling woes could be reversed if they choose to invest in housing.

LATEST DEVELOPMENTS:

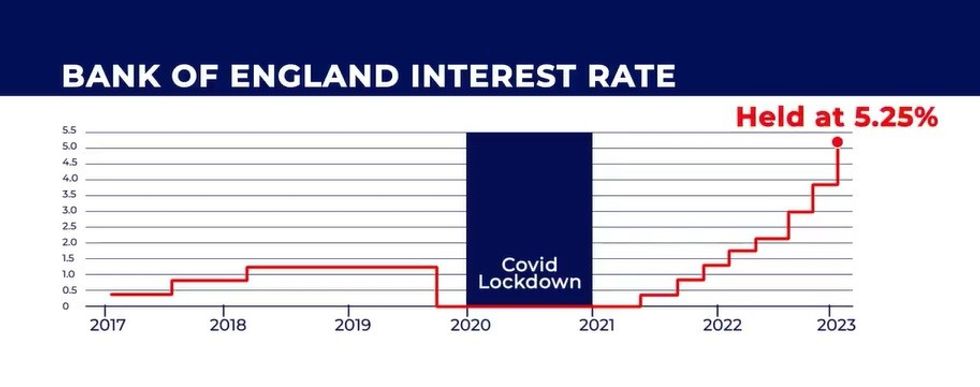

The Bank of England base rate has been held at 5.25 per cent in recent months

| GB NEWSMore houses means more supply. More supply means lower costs. It relieves the pressure put on parents and guardians to fork over a small fortune in deposits and gives young people an affordable goal to save towards.

Last year, the Pensions Policy Institute (PPI) warned that the increase in private renting could jeopardise the UK’s pension system and younger generations ability to save. Millennials, Generation Z and even some Gen X Brits face a future of worse financial security than their parents thanks to years of consistent inaction from the two main parties.

While it is easy to dismiss the demands of the youth, damning future generations to a subpar retirement will put the country on the path to ruin. There has been backlash to the growing YIMBY (Yes In My Back Yard) movement which lobbies for increasing housing supply but this campaign has been born out of necessity and won’t go away quietly.

The average house price in the UK dropped slightly to £288,000 in the 12 months to October 2023, properties costs on average £228,000 which is hardly affordable for many.

According to Moneyfactscompare, the average two-year fixed residential mortgage rate stands at 5.58 per cent, while an equivalent five-year deal comes to 5.20 per cent as of today.

The era of low interest rates that the UK has enjoyed prior to the pandemic is likely not going to return for the foreseeable future; if ever. There is only option left to bring mortgage costs down: build more houses.

Patrick O’Donnell is a Digital Finance Reporter for GB News