Car tax changes set to roll out next year ‘send mixed messages’ to British drivers amid switch to EVs

WATCH: MAJOR car tax changes scrapped in huge U-turn amid driver fears

|GB NEWS

The new car tax changes will be rolled out next April

Don't Miss

Most Read

In reaction to the Budget, experts have criticised the Government for failing to address issues within the system of vehicle taxation ahead of major changes set to be introduced next year.

Drivers have frequently highlighted how such Government policies could hold other motorists back from wanting to switch to an electric vehicle with fewer incentives to ditch petrol and diesel.

Electric cars are due to start paying Vehicle Excise Duty from 2025, despite many calling for the new rule to be scrapped to ensure people continue to choose EVs.

Matthew Walters, head of consultancy services and customer value at ALD Automotive | LeasePlan UK, lamented the lack of changes in the Budget.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Experts have said the Government missed the chance to introduce new measures

|GETTY

He said British drivers and the wider industry would have welcomed new changes to the system of car tax if they had been introduced.

The expert added that it was inevitable that electric vehicles would be forced to pay Vehicle Excise Duty, also known as road tax, after it was announced in the Autumn Statement in 2022.

Speaking at the time, Chancellor Jeremy Hunt said this was a necessary measure to ensure the system of taxation is fair for all motorists.

Walters said that has introduced unnecessary penalties compared to some petrol and diesel models.

He added: “From April 2025, VED rates will be equalised across all cars, while new registrations priced over £40,000 will also qualify for the expensive car supplement – a £410 charge, applied to the first five annual renewals.

“In some cases, this will mean drivers are paying three times more tax than they would for an equivalent petrol or diesel car, adding over £1,000 to a three-year lease contract.

“It sends mixed messages to drivers at a time when the Government is trying to encourage them to switch to battery power.”

Data from the Government suggests that the Treasury will benefit massively from the new changes that will be implemented from April next year.

In the 2025-26 tax year, the Treasury projects earnings of £515million, £985million in 2026-27 and a staggering £1.595billion in the 2027-2028 tax year.

There were also calls from industry voices to slash the rate of VAT on public charging stations from 20 per cent to five per cent - the same level as home charging.

While the number of public chargers is growing, there are fears that rates of chargers are not yet at sufficient levels to fulfil the demand for the number of EVs on the road.

It is hoped that 300,000 chargers will be installed by 2030, according to Government predictions, although some experts have stated that installation rates may fall short.

LATEST DEVELOPMENTS:

- Calls for fresh parking laws to ban 'dangerous' vehicles from stopping on pavements amid campaigner demands

- Driving age limits could be slashed to just 13 as petition for younger licence holders gains support

- Electric car driver sees brakes fail in 'terrifying' ordeal as his Jaguar EV had 'no way of stopping'

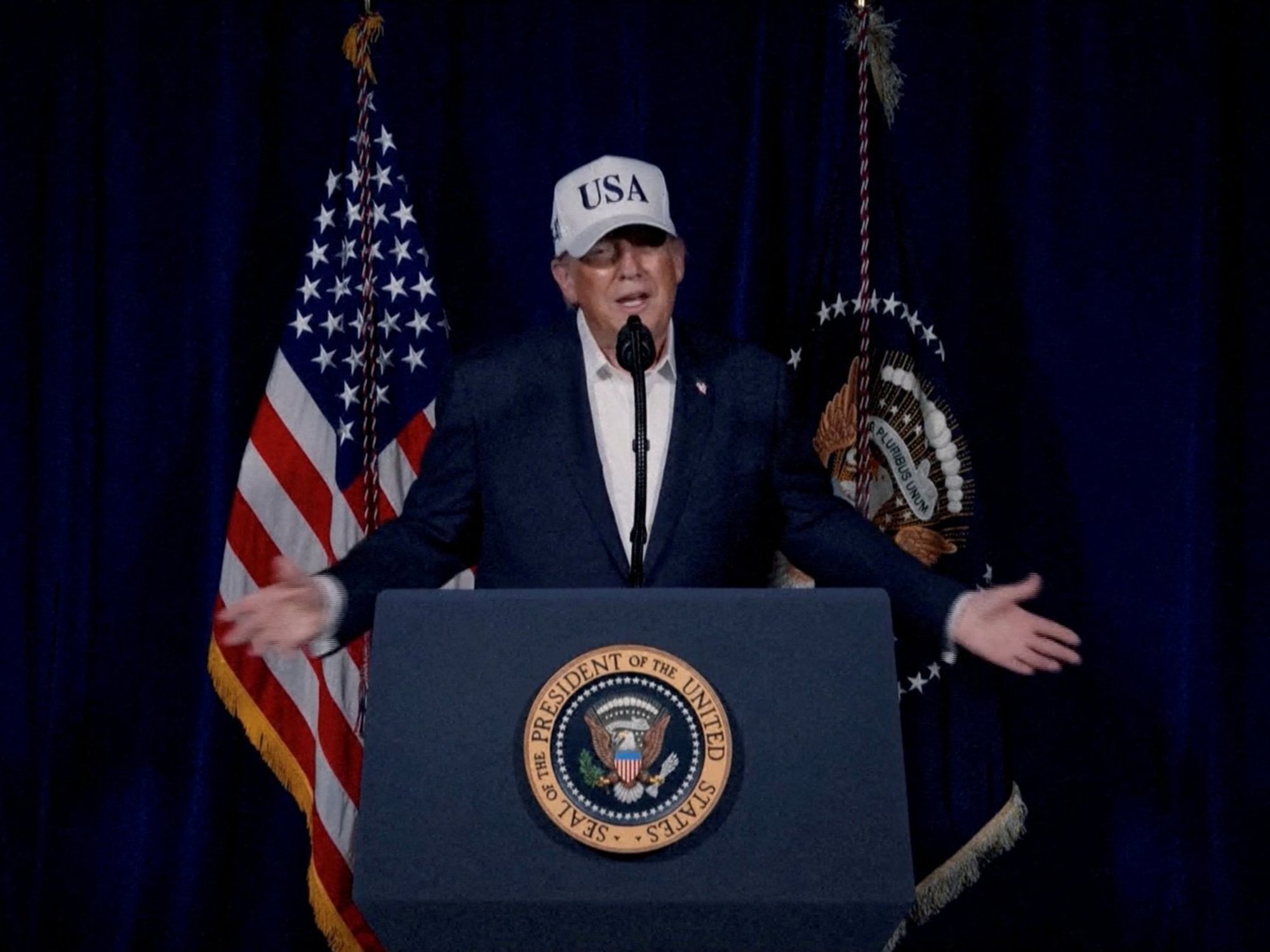

Jeremy Hunt delivered the Spring Budget earlier this week

|PA

Some experts also called on the Government to reintroduce the Plug-in Grant to allow drivers to access thousands of pounds off the retail price of a new electric vehicle.