Exposed: How Jeremy Hunt's Budget actually leaves you WORSE OFF this year

The Chancellor unveiled the budget to the House of Commons yesterday, announcing a further 2p cut to national insurance

Don't Miss

Most Read

The Conservatives will preside over the first parliament in modern history to oversee a fall in living standards, a report from the Resolution foundation has warned.

The thinktank published analysis of yesterday's Spring Budget which showed that real disposable income will drop by 0.9 per cent by next year.

It also dubbed £19 billion of cuts to public services a "fiscal fiction" and warned that the next Government will be facing a "huge" task ahead of them.

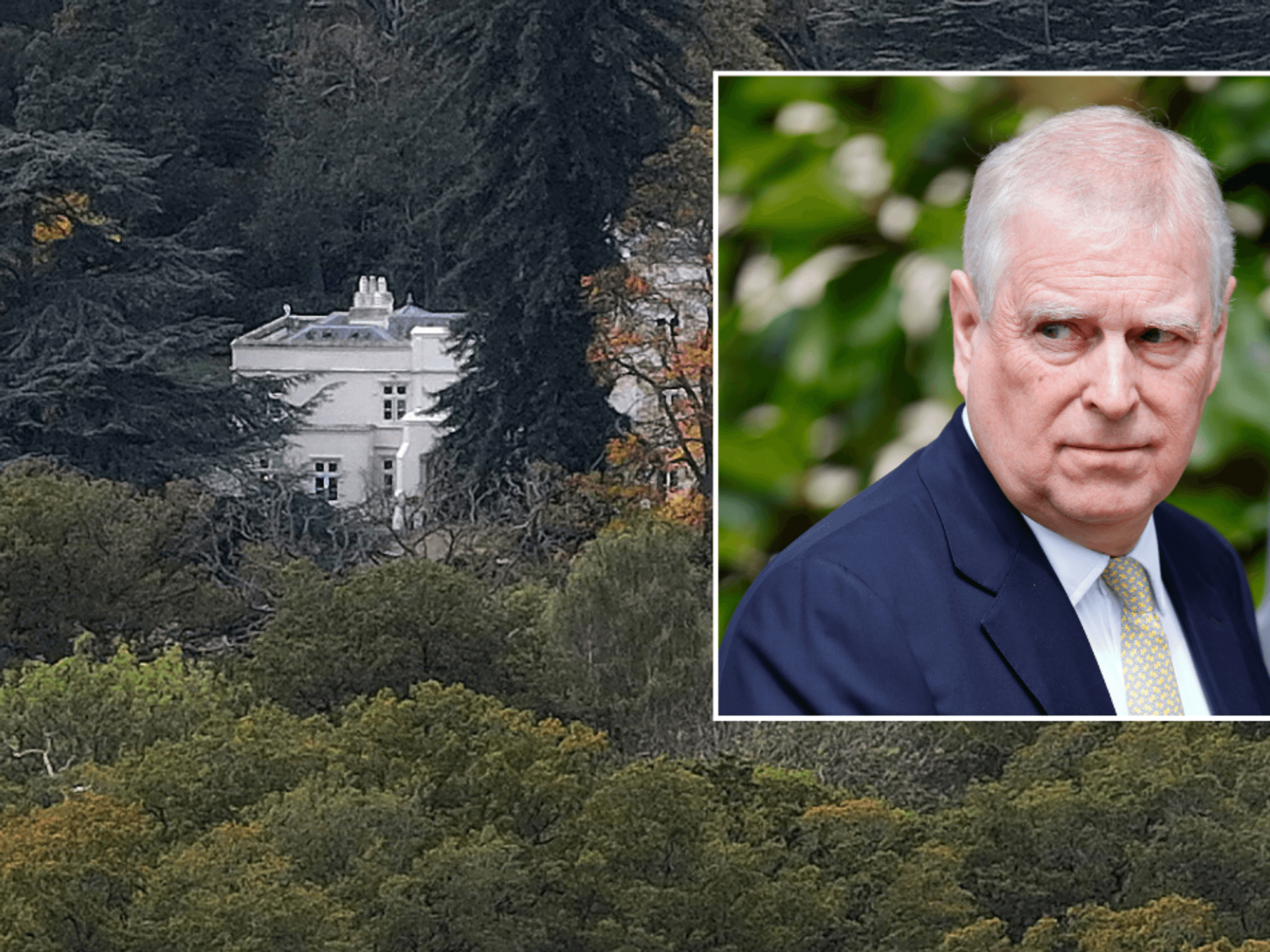

Jeremy Hunt unveiled the budget to the House of Commons yesterday, announcing a further 2p cut to national insurance.

Jeremy Hunt unveiled the budget to the House of Commons yesterday, announcing a further 2p cut to national insurance

|PA

Leaving income tax untouched, Hunt was keen to stress the benefits of the combined NI cuts announced over the last two budgets - saying it will amount to a £900 saving for the average employee.

The Chancellor also suggested National Insurance payments could be scrapped entirely, describing the levy as "particularly unfair". He said his "long-term ambition" is to end the system of double taxation.

Hunt also froze both alcohol and fuel duty until 2025, along with the creation of a "British ISA" which will allow an additional £5,000 annual investment in UK equity.

The Chancellor allocated £3.4 billion in investment aimed at improving NHS productivity, something he said will "unlock £35 billion of savings". He announced plans to get rid of the "outdated" non-dom status, instead replacing the regime with a "modern, simpler and fairer residency-based system" from April 2025.

Hunt also extended child benefits to hundreds of thousands of middle-income families, increasing the high-income child benefit charge threshold from £50,000 to £60,000.

However, Tory MPs have been ambivalent about the measures, calling for him to go further at the Autumn Statement.

MP for Mansfield Ben Bradley told GB News it had "some small positive steps", but added: "I hope that - assuming we'll have an autumn statement now - there will be something more radical to come before a [General Election]".

LATEST DEVELOPMENTS:

Another equally unenthusiastic MP added: "It went as far as the O.B.R. would allow."

Former cabinet minister Jacob Rees-Mogg accused the Chancellor of simply "tinkering" with the country's finances

He told GB News: "My test for today's budget was could it have been delivered by Rachel Reeves? Was there really going to be an important difference between what a brave, bold conservative Chancellor would do and what a cautious, Brownite socialist Chancellor would do?

“And yes, there was one important difference; that was the cut in national insurance, the two percent off, reducing it to eight percent and with the implication that it may be abolished altogether, which is a really very important implication and would be a fundamental change and improvement in our tax system.

“But overall, the budget was constrained by the way we now construct economic policy.”

He added: "Now, the tax burden is best applied if it's applied sensibly and uniformly and what I don't like about this budget is the endless tinkering: the little bit here and a little bit.'

"So yes, I was pleased that capital gains tax on property, from which I may marginally benefit myself just so that you know, went down and that the Treasury and the OBR had agreed that there was a Laffer effect and that it would raise more money.

“But why not take it down to 20 per cent so you only have one rate of CGT? Why carry on with this muddling?"